The Fed cut rates in September for the first time this year, ending a prolonged pause since December 2024. The move reflects a more balanced risk outlook from the Fed and the growing risk posed by the softening labor market. For equity investors, cutting cycles have delivered mixed results over time, with a key variable being the economic trajectory that followed the initial cut.

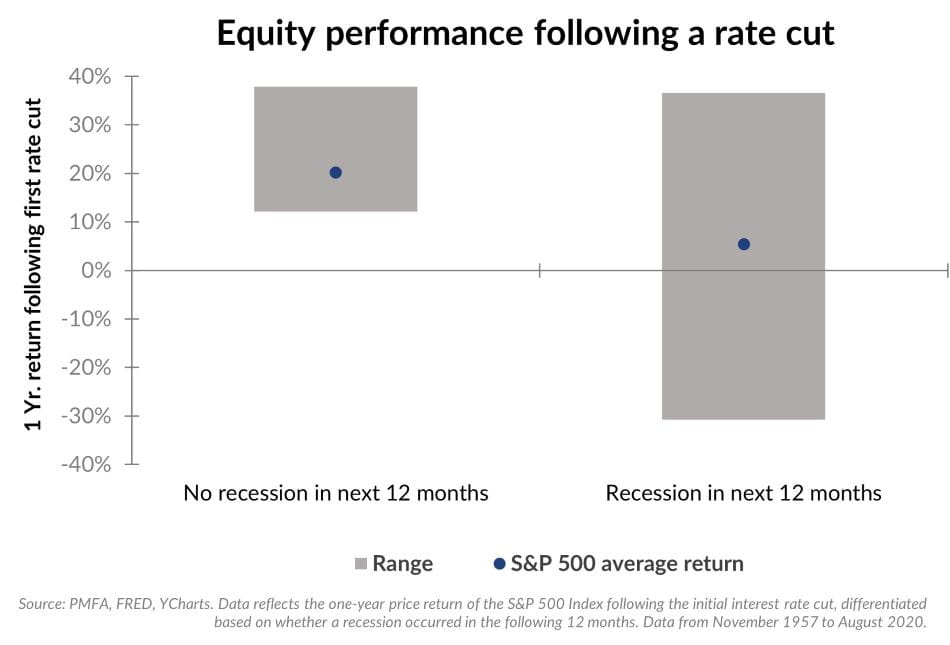

In the chart above, we dissect equity performance following rate cuts based on the accompanying economic outcomes; the distinction between the two is clear. When the economy expanded post-cut (i.e., no recession), equity markets tended to perform well. In those seven instances since 1957, the S&P 500 delivered an average return of 20% in the year that followed. Meanwhile, in the 12 periods in which the economy slid into recession as the Fed was cutting, the S&P delivered a far more muted average return of just 5%. Around that modest average was a very wide range of outcomes — from -30.8% to 36.6% return for the S&P 500 in the year that followed.

Rate cuts are typically intended to support growth, but over many decades, the Fed has often hiked rates too much or cut too late to avoid a downturn. By reducing borrowing costs, the Fed aims to stimulate investment and spending, helping to extend economic expansions. Though, a soft landing can be difficult to navigate as Fed Chair Powell reiterated in September — there’s no risk-free path.

For now, it appears this latest cut may align with a cyclical upswing — supported by a positive fiscal impulse and brisk AI investment, which may present a favorable backdrop for stocks. However, risks certainly remain — slowing global demand, sticky inflation, a potential policy misstep, and geopolitical tensions. In light of these uncertainties, we continue to emphasize the importance of maintaining broad-based diversification for investors.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.

© 2025 YCharts, Inc. All rights reserved, The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided “AS IS” with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.