Introduction

As traditional exit routes in private equity remain constrained and the continued growth of private markets fuels a robust pipeline of future deal flow, secondaries have gained popularity particularly in the last few years, with several structural elements that make it a strong ballast to a private market portfolio. The secondary market developed in response to the needs of investors seeking early liquidity from their long-term, largely illiquid private equity investments.

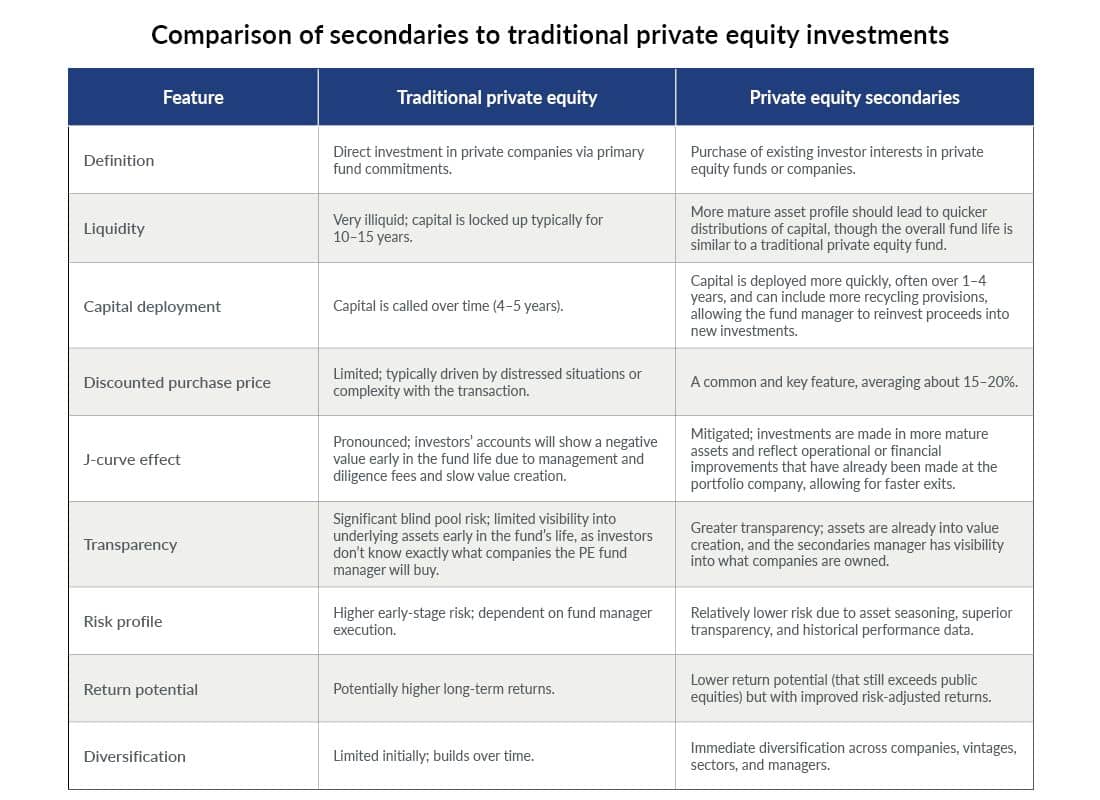

When an individual or an institution invests in a private equity fund, they make a legal commitment to fund that investment over a period of four to five years, as well as retain an interest in the future cash flows — distributions — that come out of the fund over the subsequent several years. In recent years, a growing number of funds have been specifically created to purchase the commitments or stakes investors have previously made to private equity funds, typically at a discount to their most recent valuations. Buyers of these assets benefit from exposure to mature assets with improved visibility into their underlying fundamentals, future prospects, and terminal performance. These assets are also closer to an exit opportunity.

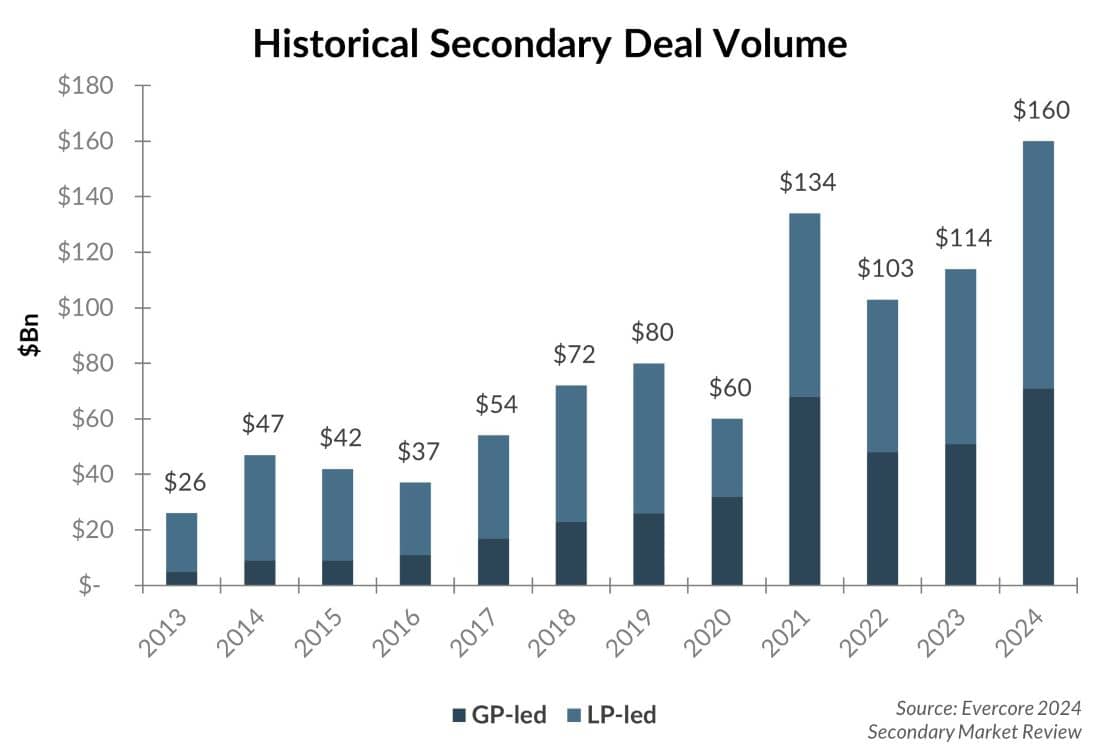

Because existing investors, also known as limited partners (LPs), are typically the ones seeking release from their commitments, these transactions are known as “LP-led secondaries.” With the exception of 2020, these have represented the majority of secondary transactions completed each year. GP-led secondaries, which we touch on briefly below, have seen the most significant growth in the secondary market over the last five years, but typically target a different return profile, have a different set of associated risks, and are not the focus of this article.

In its early years, secondaries began as a niche liquidity tool; today, the secondaries market has evolved into a sophisticated and essential component of the private equity ecosystem — offering investors access to mature, diversified assets at typically discounted valuations. Beyond LP deals, the market also includes direct or “GP-led” secondaries, where buyers can acquire stakes in underlying portfolio companies of private equity funds; continuation vehicles are the most common example of this type of transaction. We’ve previously highlighted that private equity’s long-term return potential makes it a powerful tool for enhancing portfolio performance and a valuable diversifier to public equities despite its inherent illiquidity and risk. For investors navigating a world of higher interest rates, delayed distributions, and shifting portfolio allocations, the ability to participate in the purchase of secondaries elevate that value proposition through faster capital deployment, improved transparency from reduced “blind pool” risk, and the potential to capitalize on market dislocations.

Sellers and their motivations

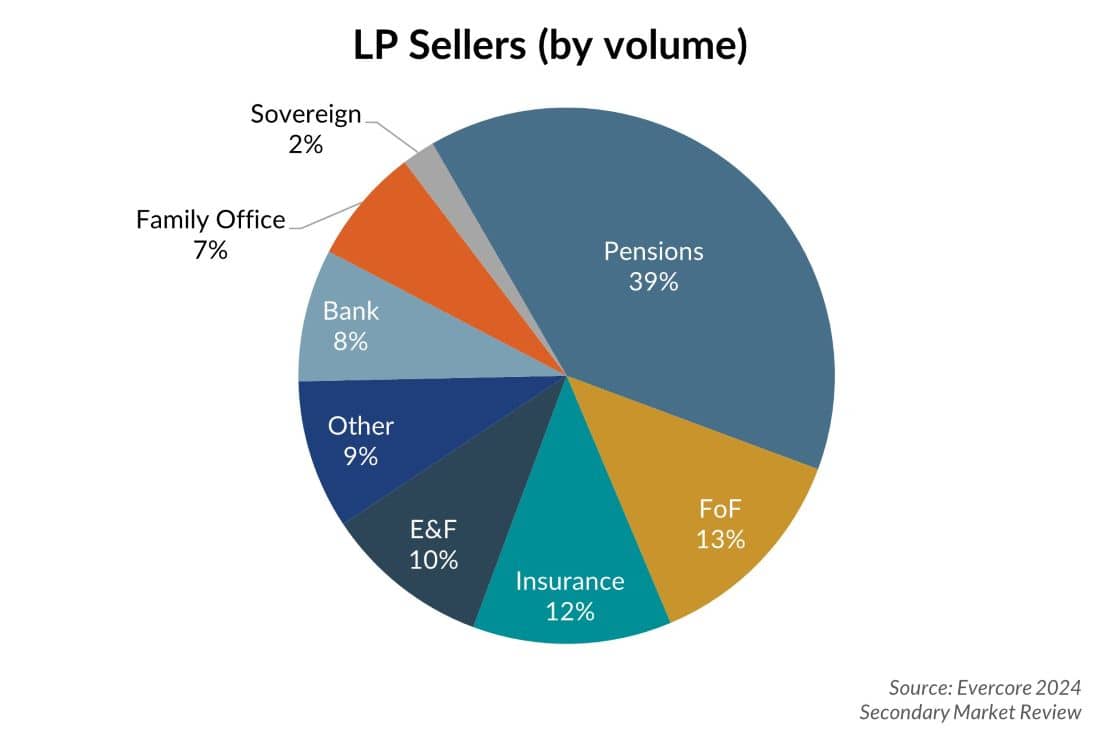

Secondaries have been increasingly in the headlines recently with endowments, foundations, and other institutional investors selling due to potential changes in tax treatment and a challenged liquidity environment. CalSTRS is a very large pension fund that’s regularly active in the secondaries market, while Yale, a college endowment, was a first-time seller in the market this year. Both were the subject of headlines for their high-profile decisions to sell illiquid portfolio holdings into the secondary market. Institutions may sell their interests to rebalance portfolios, manage liquidity, or comply with allocation targets or regulatory capital requirements. The motivations of the seller can provide valuable insight into the negotiation process.

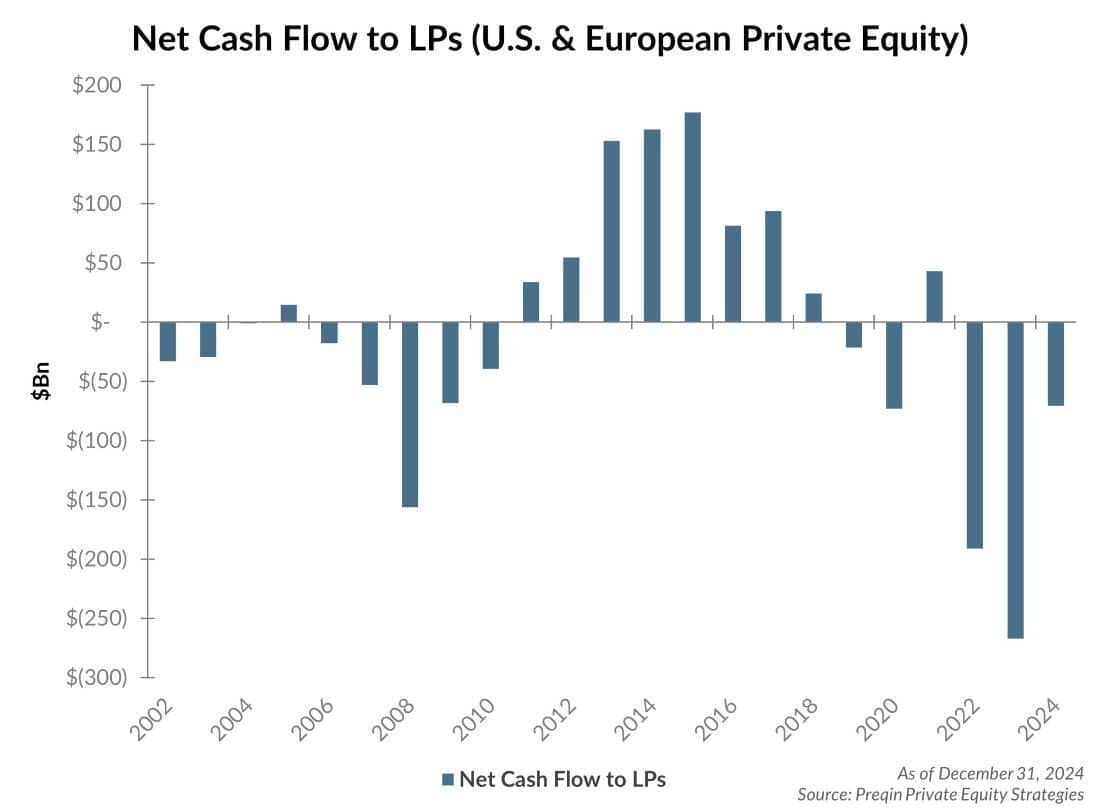

- The denominator effect occurs when a market downturn causes the public portion of an investor’s portfolio to decline, while the private portion of the portfolio remains more stable as it experiences less mark-to-market pricing volatility. The result is a smaller total portfolio value and a private equity allocation that grows relative to public equities, exceeding its target. This dynamic was most apparent in two distinct periods in particular: the Global Financial Crisis and the bear market of 2022. In the more recent episode, it was further exacerbated by active private equity funds continuing to call capital, causing institutions to have to generate liquidity while also further increasing the value of an already outsized private equity allocation. In response, many institutions sold fund investments on the secondary market to trim their exposure to private equity but also to generate cash to roll into new opportunities and rebalance their portfolios into traditional equities.

- Slowing distributions: The last couple of years have been characterized by higher interest rates and moderating valuations from their peak in 2021, causing deal activity in primary private equity funds to slow significantly. As a result, distributions have also slowed, putting additional pressure on some LPs’ ability to meet capital calls for previous investments and make new commitments. In response, some strategically sold interests on the secondary market to generate needed liquidity.

- Idiosyncratic/portfolio construction: The above two rationales for selling are market-based and can impact any LP. In some situations, LPs will sell their interests in a fund for more idiosyncratic reasons such as changes in regulation for the LP’s industry (e.g., insurance, banking). In other cases, it’s an institutional investor’s portfolio manager or investment officer who’s motivated to utilize a secondary transaction to streamline portfolio holdings, exit a space, reduce portfolio monitoring costs, and/or free up capital to make new commitments. The pie chart below illustrates what types of investors brought portfolios to market in 2024.

Why are secondaries an attractive addition or ballast to a private market portfolio?

- J-curve mitigation: Secondary funds buy seasoned assets and deploy capital quickly. This helps avoid the typical J-curve, which describes when management fees and diligence costs drive negative performance for the first two to three years in traditional private equity before the expected positive performance starts to accrue from fund investments.

- Reduction in blind pool risk: Secondary funds target well-established portfolios, and buyers can evaluate existing assets: They can assess if the GP’s value creation plan, already well into execution phase, has the potential to generate sufficient upside for the fund and can also consider whether the economic landscape has changed favorably or unfavorably since investments were initially made. When making a direct commitment to a private fund, a year or more could pass before the fund begins to deploy capital and make investment selections, a process that typically extends over multiple years. This introduces blind-pool risk, where the LP has no visibility to the investments in the portfolio at entry.

- Acquiring assets at a discount: Because secondary transactions are complex (large number of line items, information asymmetry, consents/restrictions, legal/admin hurdles, limited buyer pool, etc.), buyers can often negotiate discounts with the seller. Transaction pricing is typically quoted as a percentage of net asset value (NAV), with a range around 65–95%. Discounts tend to go up during periods of market distress or when liquidity becomes challenged, but pricing between asset classes can be influenced by a unique set of factors, and won’t always move in tandem. Venture capital company portfolios usually transact at a larger discount due to greater pricing uncertainty, longer holding periods, and limited buyers.

- Potential access to high quality assets: Specifically for GP-led transactions, portfolio companies that are put into continuation vehicles are often marketed as the “crown jewels” of a private equity fund. The GP could sell to a strategic or other financial acquirer but doesn’t want to miss out on the potential upside. Investments are often past key inflection points, which can reduce the band of potential outcomes.

- Diversification: Traditional secondary fund transactions often include dozens of individual private equity funds managed by different GPs. A single transaction could result in exposure to thousands of underlying portfolio companies ranging in size, industry, geography, and maturity. A large secondary fund can resemble something like a cross-section of the entire private equity landscape, creating broad, market-like exposure to private markets. According to Coller’s 2025 PE Barometer, 45% of LPs surveyed consider secondaries to be a core pillar of their alternative investment program1.

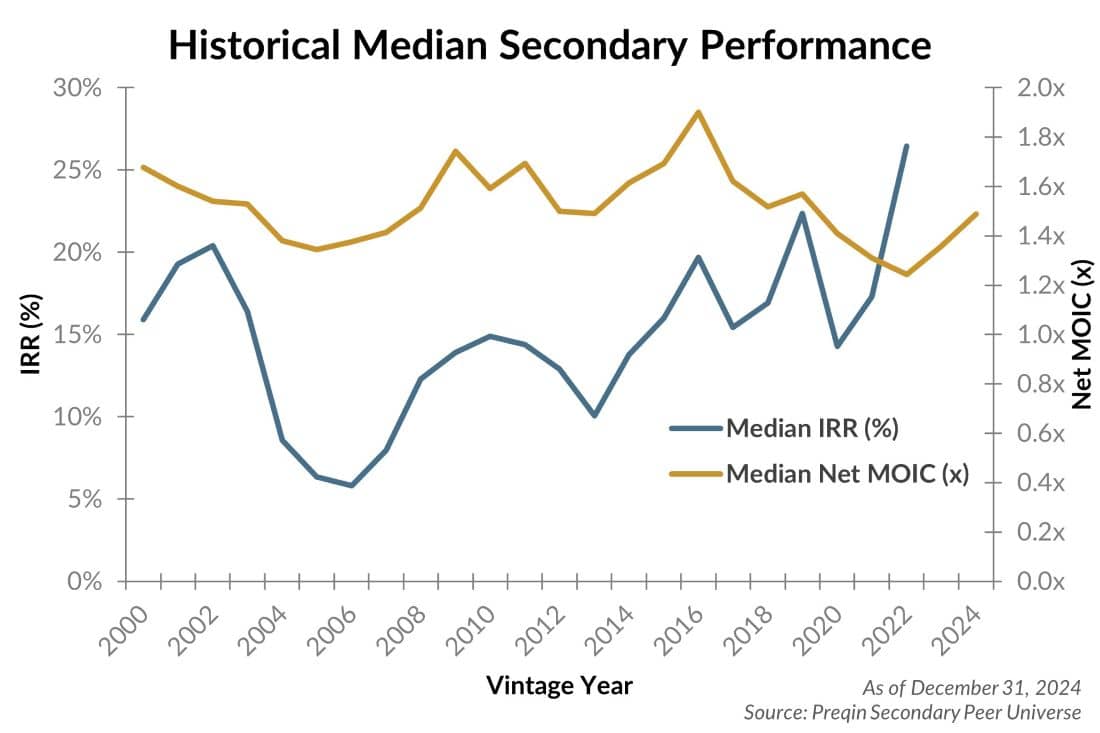

- Performance: Because of the above reasons, the band of potential returns in secondaries is often compressed relative to traditional private equity. While there’s less upside when compared to traditional private equity, there’s also less downside risk, resulting in the steadier, attractive overall risk-return profile illustrated in this chart. Over the prior 20 years, the median multiple on invested capital hasn’t fallen below 1.24x and has averaged 1.52x.

Opportunity set in secondaries

In 2024, secondary transactions totaled $160 billion2, and based on activity in the first half of 2025, that number could reach $200 billion before year-end, making it another record year for the asset class. There are several reasons we expect the opportunity to remain attractive.

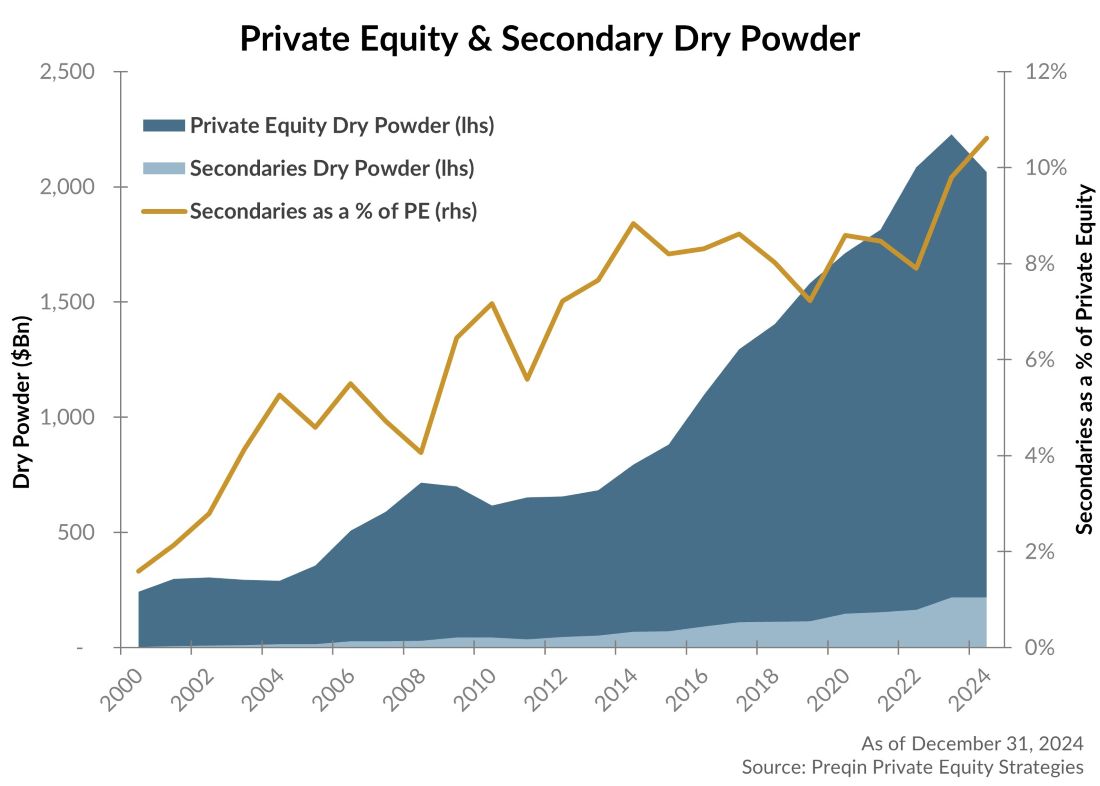

- Private equity assets under management continue to grow, and capital raised for dedicated secondary funds still represents a very small percentage (less than 10%) of those assets. If even 10% of those private equity assets make their way to the secondary market, it would drive significant additional need for secondary capital.

- For a variety of reasons, companies are staying private for longer. Consequently, private equity sponsors are finding that an initial public offering (IPO) might be a less reliable or timely route for exiting their investments. GPs are also seeking to extend ownership of high-performing assets.

- Private markets have continued to develop, become more creative in product development and investor accessibility, broaden their investor base, and accept unique structures. Secondaries represent another tool in the tool-belt for LPs and GPs alike. Additionally, new fund products and intermediaries are making the asset class more accessible to individual investors that historically had no means to access the asset class. The “democratization” of private asset investing opens the door to a secular period of growth and capital flows into the space.

Risks & considerations

One of the primary risks for secondaries is limited liquidity — even though they’re generally more liquid than primary private equity investments, they’re still considerably less liquid than public markets. Valuation uncertainty is another concern; NAV inputs and discounts may be outdated or unadjusted for current market conditions or company-specific developments. Secondary funds often have layered fee structures, including both the original fund’s fees and any fees charged by the secondary buyer or intermediary. Finally, manager selection is a critical aspect as performance varies by manager skill, resources, and access to deal flow. Working with an advisor that provides unbiased due diligence on these managers is critical.

Conclusion

Given the challenges in highly illiquid private markets, secondary private equity can be a compelling addition to a private market portfolio, particularly one in the early build-out phase. Investing in secondaries accelerates getting capital in the ground, mitigates blind pool risk, and provides enhanced visibility and potential discounts, often lowering overall risk and return dispersion. For individuals with a long-term investment horizon seeking attractive, risk-adjusted return, secondaries can serve as a strong ballast for a private market portfolio.

1: Global Private Capital Barometer 42nd Edition, Summer 2025 | Coller Capital

2: Evercore Full Year 2024 Secondary Market Survey Results

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.