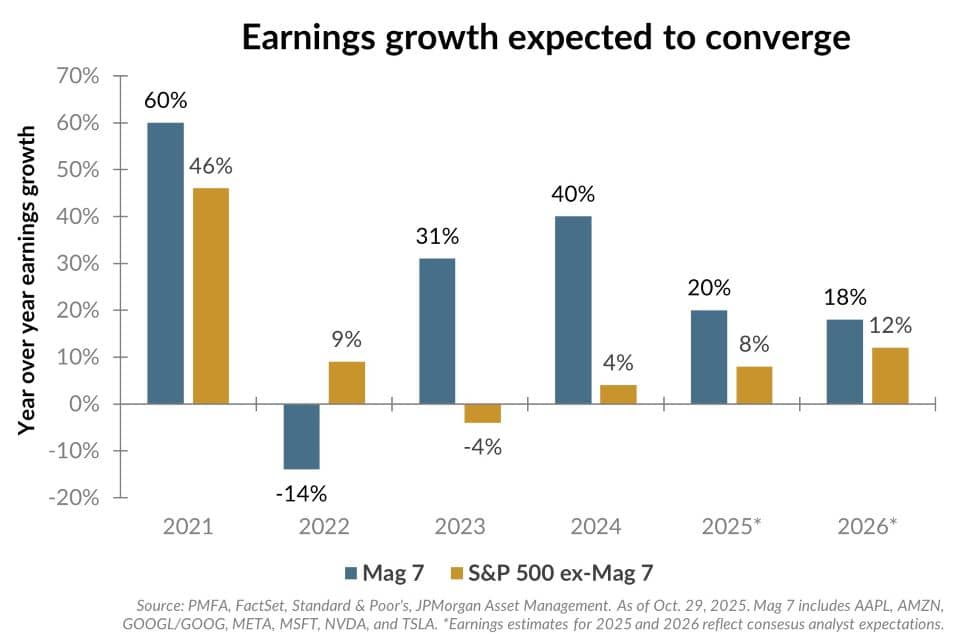

Fueled by dominant positions in technology, innovation, and AI capital spending, the Mag 7 mega-cap tech firms are expected to post average earnings growth of about 20% this year, compared to an average 8% pace expected for the other constituents in the S&P 500 index. Among their strengths are their sizeable economic moat that allows them to protect market share and profitability. Investors have embraced that narrative with a fervor that has continued to drive exceptional returns and — as discussed in our accompanying piece — priced in a notable, although variable, premium into their P/E multiple. That premium shows that investors have been content to pay up for growth.

However, the magnitude of the current earnings growth gap between the two groups may not last. Consensus estimates for 2026 suggest earnings growth may converge, as summarized above. Broader adoption of AI across the economy, easing cost pressures, and a more balanced macroeconomic backdrop could support stronger performance across all sectors.

While the Mag 7 continues to drive earnings growth, the rest of the S&P 500 appears poised to narrow the gap. Whether that results in valuation multiples for those higher-premium stocks compressing toward the rest of the market or via an additional boost to P/E multiples for the broad market remains to be seen. Both are plausible.

As demonstrated by the recent volatility in higher-octane stocks, diversification remains beneficial; every asset class will eventually have its proverbial day in the sun. Aligning your portfolio with your long-term goals and objectives — rather than chasing the most recent winners — remains an important underpinning to long-term financial success.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.