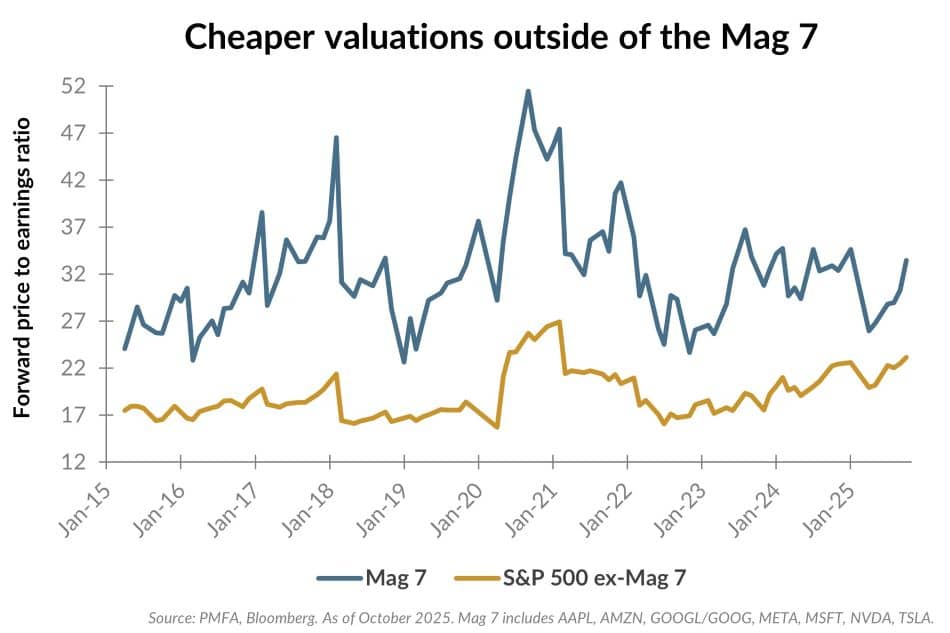

The “Magnificent 7” (Mag 7) stocks continue to trade at elevated forward price-to-earnings (P/E) multiples, driven by robust earnings growth, innovation, and investor enthusiasm for the artificial intelligence story. These companies represent a large and growing portion of the overall S&P 500 index, amplifying their impact on both market-level performance and valuations.

As shown above, the forward P/E for the Mag 7 remains well above the multiple for the rest of the S&P 500 index, reflecting premium pricing for perceived leadership in mega-cap tech. In contrast, the S&P 500, excluding these top names, trades at a lower multiple, suggesting pockets of relative value across other sectors within the benchmark. While the valuation gap between the Mag 7 and the broader market is notable, it’s still far less extreme than at the peak of the dot-com bubble. It’s also partially explained by their stronger earnings growth trajectory. The key will be their ability to deliver earnings growth that meets or exceeds increasingly elevated investor expectations.

This divergence underscores the importance of diversification. While the Mag 7 have powered much of the index’s performance, the valuation gap illustrated above hints at the benefits of broader market participation — especially if earnings growth begins to converge across sectors as addressed in our accompanying article or if other factors shake investor confidence, leading to a re-rating of those higher-priced names.

Concentrated leadership has driven strong index performance, but elevated valuations in the Mag 7 warrant a balanced approach. Stretched valuations increase the downside risk if earnings growth slows or investor sentiment falters. As fundamentals improve across the rest of the index, diversified portfolios should allow investors to participate in long-term growth themes while managing portfolio risk and smoothing returns.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.