While hospitals have been pouring time, talent, and technology into optimizing federal 340B benefits, a quiet storm has been brewing. Medicaid inpatient volumes, once inflated by pandemic-era enrollment surges, have been steadily declining since the end of the COVID-19 public health emergency (PHE), cutting into hospitals’ eligibility margins and revenue. Now, with passage of the One, Big, Beautiful Bill (OBBB), that slow leak is about to become a torrent that will threaten many hospitals’ ability to survive.

To navigate the changes, so far, stemming from a wave of post-PHE redeterminations, safety net hospitals have pursued a variety of compensating tactics with common strategic goals: maintain Medicaid-eligible volume, protect 340B savings, and reinvest in patient care. During the PHE, many healthcare systems focused their activities on increasing benefits under the critical 340B Drug Pricing Program. Unfortunately, hospitals that have built their 340B strategies on assumptions of stable Medicaid inpatient ratios will soon find themselves overexposed and scrambling to preserve their shrinking 340B eligibility. Hospitals that rely on these programs should assess whether their current 340B strategy will be effective in the new landscape.

Changes mandated under the OBBB, passed in July 2025, will introduce stricter Medicaid eligibility rules, like more frequent redetermination checks. State budgets will also be impacted heavily by changes in State Directed Payment limits. These multidimensional modifications are expected to cause the disenrollment of up to 11 million individuals by 2034, according to Congressional Budget Office (CBO) estimates. It’s a further blow to hospitals that have been struggling with post-pandemic redetermination impacts to their Medicare Disproportionate Share Hospital (DSH) ratios.

Despite the enormous challenges, hospitals that act early and decisively to improve visibility into their own data will be better prepared to navigate the impending uncertainties of the OBBB. The goal is to develop data-based strategies to avoid surprises in DSH and 340B eligibility. It’s time to get clear insights into your Medicaid inpatient data before your 340B foundation starts to sink.

Understanding Medicare DSH

A hospital’s DSH Patient Percentage (DPP), as filed on its Medicare cost report, determines its eligibility for Medicare DSH and Uncompensated Care (UC) reimbursement. These two programs require a DPP above 15%, and hospitals with a large enough DPP can qualify for the 340B program with a DSH adjustment percentage of more than 11.75% (or 8% for certain hospitals). These programs are financial lifelines, especially for hospitals in rural or underserved areas. Without them, many may be forced to reduce services, lay off staff, or close altogether.

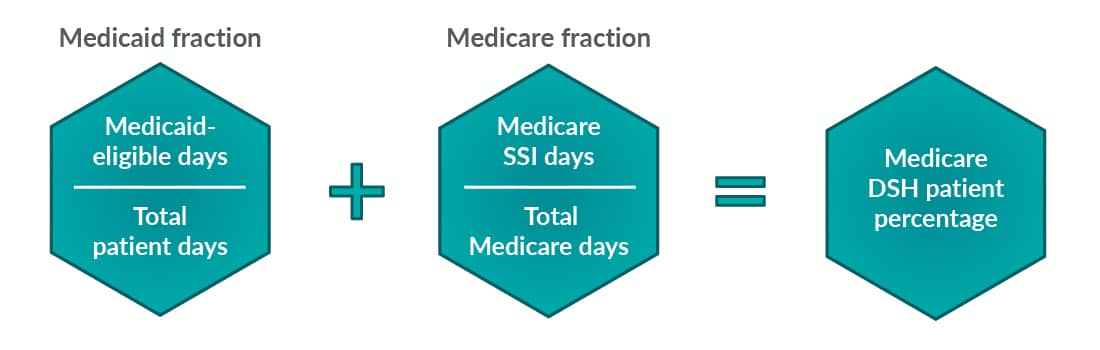

The DPP consists of two inpatient ratios: Medicaid-eligible inpatient days over total inpatient days (Medicaid ratio) plus Medicare Supplemental Security Income (SSI)-eligible patient days over total Medicare patient days (Medicare SSI ratio) for the applicable cost report period. During the pandemic, states were required to maintain continuous Medicaid enrollment for individuals in exchange for enhanced federal funding. The temporary suspension of annual eligibility checks, or redeterminations, led to a surge in enrollment that peaked at over 94 million individuals in April 2023, when the continuous coverage requirement expired, according to the Kaiser Family Foundation (KFF).

Since states resumed annual redeterminations, more than 15 million people have been disenrolled. KFF estimates that most disenrollments, 69%, are due to procedural reasons compared to those who have lost benefits due to criteria-based ineligibility. The mass disenrollment has caused the steady lowering of Medicaid inpatient days that are the basis for eligibility formulas, which has had a cascading effect on hospitals that rely on Medicaid patient volumes to meet federal program thresholds.

The unwinding process has played out differently in each state, and the combination of state rules and changes in Medicaid expansion status has created a mix of Medicaid patient types with varying criteria and restrictions, further complicating the task of managing eligibility metrics. Hospital leaders are growing concerned as their eligibility numbers are falling after years of stability. For many providers, the loss of just a few Medicaid inpatient days could push them below DSH or 340B thresholds to the point where they lose coverage altogether.

OBBB brings more challenges

With pressure mounting on the Medicaid ratio, the OBBB’s widely reported provisions (such as work requirements, increased redetermination checks, stricter documentation, shortened lookback period, and massive funding cuts) will further reduce Medicaid enrollment and increase administrative complexity.

The shifts are expected to accelerate the churn in Medicaid enrollment, further increasing the pressure on the Medicaid ratio, and a majority of patients who lose Medicaid eligibility will end up uninsured. KFF estimates that there will be 14.2 million newly uninsured Americans by 2034 because of the OBBB and the expiration of enhanced premium tax credits for marketplace plans.

A greater number of uninsured Americans means the Medicare UC Pool payments will continue to increase. The federal fiscal year 2026 UC Pool increased by 35% to $7.7 billion from the 2025 level. Providers that continue to qualify for this program will likely see future allotments increase. However, hospitals are in a very real situation where they could no longer qualify for those dollars due to lost Medicare DSH eligibility.

340B and your Medicaid ratio: What’s your strategy?

Organizations with an incomplete understanding of their inpatient data are at the greatest risk. As the pressure increases, many hospitals are also considering operational changes such as service line reductions. It’s critical that these decisions incorporate an understanding of Medicare DSH and 340B eligibility implications. For example, eliminating a service line with high Medicaid utilization, such as obstetrics, could inadvertently reduce a hospital’s Medicaid ratio, jeopardizing its qualification for Medicare DSH payments or 340B savings. Without strategic insight, hospitals may make the mistake of chasing short-term savings at the expense of long-term reimbursement stability.

Since 2023, hospitals have been gaining experience with redetermination processes, and many have adopted measures to shore up 340B eligibility, such as building in-house specialty pharmacies, repositioning outpatient infusion centers, deploying AI-driven patient registration tools, and optimizing contract pharmacy networks. Other general measures include patient outreach and eligibility support to help patients reenroll by helping with procedural issues like missed paperwork.

Unfortunately, for most hospitals, these steps won’t be enough to offset the combination of cuts under the OBBB. Hospitals will need to significantly build on their post-PHE strategies to adapt to the coming challenges. Strategic financial planning, real-time data insights, and advocating at the state level are no longer optional — they’re critical to survival.

Hospitals must focus on gaining a better understanding of their 340B strategy from a holistic point of view. For example, hospital leaders must understand such factors as what service lines drive their Medicaid ratio, what clinics provide the most 340B savings, and which drugs are subject to the orphan drug exclusion. Above all, they must be able to continuously track how much cushion the hospital has before it no longer qualifies for 340B or Medicare DSH.

For hospitals that are at risk of dropping below 340B thresholds, timing of program registration is also a key consideration, as filing incorrectly can cause unnecessary program gaps costing the hospital millions of dollars. In one example, a sole community hospital expected to drop below the 11.75% 340B threshold but could maintain 340B at the lower 8% threshold due to its special designation. While this caused a significant impact on their program savings, knowing this in advance allowed them to analyze the impacts and file their program registration documents at the appropriate time, thereby avoiding complete program coverage gaps.

Being able to obtain the right data at the right time and pull meaningful insights from it can make the difference between maintaining and losing millions of dollars. In another example, a regional Midwest healthcare network was facing the loss of 340B benefits at one of its hospitals. We helped leaders leverage real-time data to identify and analyze the different factors contributing to their 340B eligibility. With a new data-driven understanding, they were able to quickly devise a strategy that repositioned certain services within its system to maintain access to 340B benefits for crucial service lines.

Organizations should consider conducting their assessment of data adequacy alongside a review of available technology systems and capabilities. In all things data-related, it’s critical that providers take advantage of powerful digital tools and automation technologies that are available, and necessary, to manage huge volumes of patient data and analyze layers of interdependent eligibility criteria. Artificial intelligence and data analytics tools can help hospitals move from a reactive to a proactive financial strategy by helping to forecast risks and suggesting preventative actions.

A closer look at Medicaid ratio monitoring: Key tactics and process considerations

The key is to monitor the Medicaid ratio monthly, and hospitals can approach this in different ways. Dashboards and data summaries are often reviewed as part of the monthly close process, but how often are those items reconciled with the data reported on the Medicare cost report? Discrepancies between internal ratios and vendor-provided cost-report ratios are a common, even expected, part of the annual process, but how much time have you spent understanding what the differences mean? Differences between Medicaid secondary populations and recently disenrolled patients, for example, could create gaps in the estimates used in internal monthly processes. Often, by digging into the source of the monthly reports, a hospital can identify a skewed assumption or missing population — and thus, opportunities to improve inpatient numbers — when compared to the Medicaid-eligible days on the Medicare cost report after year-end.

Consider marrying your year-end processes to monthly monitoring by identifying a unified data source that combines the two. From there, streamlined processes for continuous repetition can be developed, reducing variability and creating a single source of truth for analysis. Instead of relying on static data, hospitals must develop a dynamic system that provides real-time visibility into their payer mix and patient populations.

To build a continuous monitoring strategy, hospitals should leverage prebuilt data sets from annual cost reporting cycles into ongoing reporting and dashboards. The idea is to identify the key processes done on an annual cost report cycle that can be built into a more frequent cadence while maintaining efficiency and accuracy. Some considerations include:

- Building out a two-source check. Combine discharge logs and revenue code reports to capture actual inpatient billed days.

- Understanding noncountable Medicaid plans. How prevalent are non-Title XIX plans in your Medicaid population? Are they accounted for in your assumptions?

- Total days review. Consider analytic fluctuations by department or service area while also avoiding overstatement of total days. How are observation days showing up in your report?

- Outside validation. Collaborate with outside vendors to review and validate your internal procedures. This can provide clarity into actual levels and comfort in your current processes.

- Strategy considerations. Understand what level of detail operations leaders look at when assessing service line viability and adapt your monitoring files accordingly.

- 340B benefit and timing. Review 340B benefit by location, understand key drugs for coverage, and determine reporting timing and gaps for reregistration.

Navigating the storm with strategy and resolve

While the OBBB casts a long shadow over Medicaid ratios and 340B eligibility, it also presents a clarifying moment for hospital leaders. Our healthcare experts have first-hand experience helping hospitals create processes to understand the factors behind falling Medicaid inpatient volumes and avoid unwelcome consequences. By investing in real-time insights, aligning cost report processes with monthly monitoring, and proactively addressing risk areas, organizations can not only weather the storm but emerge stronger. Those who act now will be best positioned to protect their mission, their margins, and most importantly, their patients. We can help you build strategies to better position your organization’s overall eligibility picture. Contact us today to get started.