The bottom line: Sticky inflation still edging lower

- The economy has endured multiple shocks in recent years, but none were severe enough to take the economic engine off the tracks since the post-lockdown recovery began in 2020. That doesn’t mean it’s been smooth sailing across the board, with sticky inflation being one of the most notable side effects that has yet to fully resolve.

- Inflation has been a source of frustration for Fed policymakers, and a political landmine for both parties to varying degrees in recent years.

- Progress toward the Fed’s 2% target has been slow, but meaningful. That’s a small solace for many households that continue to absorb the collective impact of surging prices since 2020.

- That reality goes a long way toward explaining subdued measures of the collective consumer mood in the absence of a recession. It’s the reality of a K-shaped economy in which inflation is a frustration for all, but particularly for lower-income households that have seen significant increases in the biggest components of their nondiscretionary spending.

- Today’s inflation data is positive at the margin, but it doesn’t likely change the narrative for the markets. For now, the pieces to the puzzle point to a Fed that’s more likely to hold than cut further in the near term.

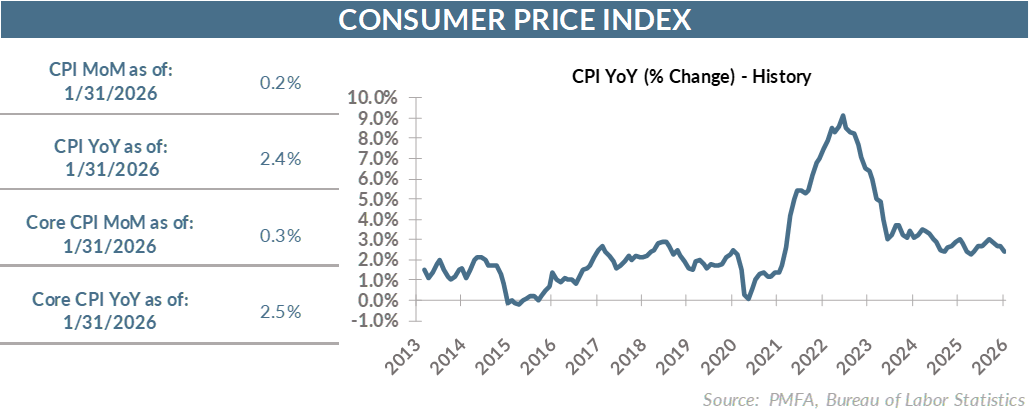

By the numbers: CPI still easing but also still elevated

- The Consumer Price Index rose 0.2% in January, modestly below with the consensus forecast for a 0.3% gain.

- Core CPI, which excludes food and energy, edged up by 0.3%, in line with expectations.

- On a year-over-year basis, headline CPI eased unexpectedly to 2.4% for the year ending in January, down from 2.7% for the 2025 calendar year. Economists had expected inflation to ease, but not to that degree.

- Core inflation is proving to be stickier than headline readings, but it still edged down from 2.6% to 2.5% over the past year.

The pocketed nature of rising prices contributes to the K-shaped economy

- The divergence in price pressure between services, food, and other goods remains apparent in the inflation data.

- While the Fed’s 2% inflation target isn’t irrefutable dogma, we’ve collectively anchored to it as a convenient threshold above which inflation is deemed elevated.

- Against that 2% target, goods inflation appears relatively benign, with food being the lone exception. Tariffs have artificially raised the cost for certain goods but haven’t offset the otherwise disinflationary trend in goods that has persisted for some time.

- The story for the service sector is quite different. Solid wage growth in recent years has had a greater impact on service sector prices and remains a key catalyst keeping inflation readings elevated.

- Shelter costs have also eased considerably but remain perhaps the greatest single factor keeping a floor under the consumer price index, having risen by 3% over the past year. Underinvestment in housing over an extended period plays a role, as has the surge in building commodities pricing and interest rates in recent years despite a notable weakening in demand. Its large presence in the index makes shelter a disproportionately significant cost that’s keeping inflation elevated.

- For low- and middle-income households, the one-two punch of elevated inflation for food and shelter can’t be overlooked. Spending on food and shelter represents a significant portion of monthly budgets for low-income households, and surging prices for both have had a disproportionately large impact on those consumers in particular. It’s not the only factor explaining the K-shaped economy, but it’s a meaningful one.

What does it mean for the Fed?

- The Fed’s recent cuts had much more to do with growing concerns about labor conditions and the potential that a sharp slowdown in hiring could slip further into net job losses.

- A few “insurance cuts” were just what the market ordered, providing a welcome source of fuel that carried stocks strongly into year-end.

- At the same time, the government shutdown cut off the flow of government economic data, obscuring the view of the overall state of the economy for a few months and raising concerns about the potential drag of a prolonged shutdown on growth.

- That’s changing. There are growing signs that labor conditions may be stabilizing, although weak demographic trends and a sharp reduction in immigration have curtailed labor force growth and put a practical limit on the pace of job creation. Further, employers have become much more discerning in their hiring practices, increasingly turning their attention to alternative means of increasing productivity without adding to head count.

- With inflation still above 2% and the potential stabilization of labor conditions, where does this leave the Fed?

- In the near term, the case for another cut looks flimsy, and the strong likelihood is that the Fed stands pat in March, barring a shock to the economy in the interim.

- Whether or not another cut comes in the following months remains to be seen but will likely require further progress in inflation’s decline to 2%.

- That could change if the pace of layoffs accelerated, or if job creation faltered meaningfully again in the coming months. For now, policymakers appear convinced that the three quarter-point cuts late last year were enough to reduce that risk sufficiently, allowing them to take a patient approach in assessing whether additional easing will be needed.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.