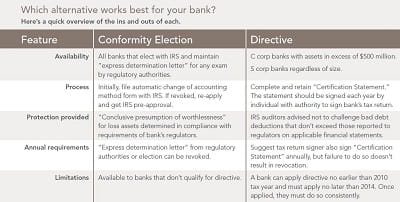

Conformity election

The fundamental idea behind the conformity election is that a presumption of worthlessness exists for tax purposes if a bank determines its charge-offs in accordance with the loan loss classification standards enforced by its regulator. A bank that wants to start using the conformity election must notify the IRS by filing an “Application for Change in Accounting Method” form. The change is automatic. In order to maintain the election, your bank needs to request an “express determination letter” from its regulatory authority prior to every exam and provide that letter to the IRS on audit.

One area where the conformity election doesn’t exactly conform is the inclusion of nonaccrual loan interest in taxable income. For financial statement purposes, these payments would typically be treated

as a reduction in principal on the loan. For tax purposes, they would be included in taxable income. The amount included would be the lesser of non-accrued interest or cash accrued in the year collected.

Once a conformity election has been made by filing the change in accounting method form with the IRS, it remains in place unless revoked by the IRS. If the election is revoked, the bank may apply to go back on the conformity method by filing another change in accounting method form. Unlike the first application, requests to return to the conformity method after an election has been revoked are no longer automatic. IRS pre-approval will be required.

IRS directive

The conformity election helped to reduce the conflict between tax and financial reporting rules for banks, but financial institutions continued to note concerns about the treatment of costs related to bad debts. In response, the IRS Large Business and International (LB&I) Division released a directive to its examiners in late 2014. The directive tells IRS examiners not to challenge bad debt deductions for banks using the specific charge-off method, as long as the deductions don’t exceed loan charge-offs and debt securities impairments reported to the bank’s regulators on applicable financial statements.

Because the directive applies to banks using the specific charge-off method, it’s not applicable to those eligible for the reserve method, specifically C corporation banks with less than $500 million in assets. In order to adopt the directive, qualifying financial institutions should complete and retain on file a “Certification Statement” (CS). It must be signed by an individual authorized to sign the bank’s tax returns, and it’s advisable to make sure that a new one is signed every year to protect against executive turnover.

The determination to apply the directive or the conformity election should be based on the specific facts and circumstances of each bank. Plante Moran’s financial institution specialists can help you determine which of these methods will provide the most effective protection against an IRS challenge of your bank’s bad debt deduction.