ASU No. 2016-01 - Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities

Overview

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities (ASU 2016-01), which primarily updates the standards on accounting for financial instruments to align with International Accounting Standards. One amendment in the ASU directly impacts employee benefit plans.

Specifically, ASU 2016-01 changed the applicability of some of the disclosure requirements for the fair value of financial instruments included in Accounting Standards Codification (ASC) Subtopic 825-10 to be only applicable to “public business entities.”

Prior to ASU 2016-01, accounting standards (specifically ASC 825-10-50) required all public entities (which includes any employee benefit plans that require an 11-K filing, regardless of the dollar value of net assets) or nonpublic entities (including any employee benefit plan) with over $100 million in assets to make certain disclosures related to the fair value of financial instruments not recorded at fair value on the statement of net assets available for benefits.

The disclosures, previously required under ASC 825-10-50, are typically related to the fair value of contributions receivable, accrued income, pending trades, and notes payable (for leveraged ESOPs). The typical disclosure was similar to the following:

- The Plan also holds other assets and liabilities not measured at fair value on a recurring basis, including employer contributions receivable, accrued income, accrued liabilities and unsettled trades. The fair value of these assets and liabilities approximates the carrying amounts in the accompanying financial statements due to the short maturity of the instruments. (For public entities only (including employee benefit plans that require an 11-K filing), the following sentence was also included) Under the fair value hierarchy, these financial instruments are valued primarily using level inputs.

What changed?

The one amendment in ASU 2016-01 that impacts benefit plan financial statements was the elimination of the requirements for employee benefit plans to make certain disclosures related to the fair value of financial instruments not recorded at fair value. This change resulted from the change of the applicability of the fair value of financial instruments disclosure (under ASC 825-10-50) to “public business entities” only. The definition of “public business entity” states that neither a not-for-profit entity nor an employee benefit plan is a business entity.

Given the change in definition, at the time of adoption of ASU 2016-01, all employee benefit plans are no longer required to make disclosures related to the fair value of financial instruments not recorded at fair value. Therefore, upon adoption of ASU 2016-01, the ASC 825, Financial Instruments, disclosure, similar to the one shown above, will be removed.

Effective dates and transition

For employee benefit plans within the scope of ASC 960 through 965, the changes to FASB ASC 825-10 are effective for years beginning after December 15, 2018. However, early adoption is permitted beginning in 2016 for certain aspects of ASU 2016-01, including the changes to ASC 825-10 as described above.

What didn’t change?

While ASC 825, Financial Instruments, has been revised to change the applicability of the disclosures described above to only those entities meeting the definition of “public business entities,” other investment-related requirements of ASC 820, Fair Value Measurements, still apply to entities defined as “public entities”.

The definition of a nonpublic and public entity remain the same:

A nonpublic entity is any entity that does not meet any of the following conditions:

- Its debt or equity securities trade in a public market either on a stock exchange (domestic or foreign) or in an over-the-counter market, including securities quoted only locally or regionally.

- It is a conduit bond obligor for conduit debt securities that are traded in a public market (a domestic or foreign stock exchange or an over-the-counter market, including local or regional markets.

- It files with regulatory agency in preparation for the sale of any class of debt or equity securities in a public market.

- It is required to file or furnish financial statements with the Securities and Exchange Commission.

- It is controlled by an entity covered by criteria (a) through (d).

A few of the investment related disclosures still applicable to plans meeting the definition of public entity include the following:

- Additional disclosures for Level 3 investments, including a sensitivity analysis of changes to unobservable inputs

- Disclosures of all transfers between Level 1 and 2

See Appendix for sample disclosures related to the adoption of ASU 2016-01.

ASU No. 2017-06 - Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting

Overview

In February 2017, the FASB issued ASU No. 2017-06, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting (ASU 2017-06), which changes the presentation and disclosures for plans that participate in a master trust. Additionally, ASU 2017-06 simplifies the disclosure of 401(h) accounts in health and welfare plans.

Background

FASB defines a master trust as “a trust for which a regulated financial institution (bank, trust company, or similar financial institution that is regulated, supervised, and subject to periodic examination by a state or federal agency) serves as a trustee or custodian and in which assets of more than one plan sponsored by a single employer or by a group of employers under common control are held.”

Historically, master trusts were used primarily by defined benefit plans. However, over the years, more defined contribution and health and welfare plans began using master trusts. As the landscape of master trusts changed, there was inconsistent authoritative guidance amongst the various types of employee benefit plans. Therefore, the new standard’s goal is to improve the usefulness, clarity, and consistency of the master trust disclosures for all types of plans.

ASU 2017-06 introduces a new concept with plans having a “pided” or “unpided” interest in the master trust.

- Plans with an unpided interest have a proportionate share in the master trust such as defined benefit plans.

- Plans with a pided interest have a specific share in each asset of the master trust, which is common with defined contribution plans, especially participant-directed plans.

What Changed?

Master Trust Reporting

Below are the required disclosures for plans with a master trust (italics added to emphasize changes):

- Present the plan’s interest in each master trust and the change in its interest in each master trust in separate line items in the statement of net assets available for benefits and the statement of changes in net assets available for benefits, respectively.

- Disclose each general type of investment held by the master trust and the dollar amount of the plan’s interest in each of those general types of investment held by the master trust (see Appendix for a sample disclosure).

- Disclose the master trust’s other assets and liabilities and the dollar amount of the plan’s interest in each of those other assets and liabilities (see Appendix for a sample disclosure).

- The disclosure stating the percentage interest in the master trust is only required for plans with an unpided interest in a master trust. The requirement to disclose percentage interest in the master trust was removed for plans with a pided interest in the master trust.

- Disclose the net appreciation or depreciation (including realized and unrealized gains and losses) on investments in the master trust and investment income.

- Describe the basis used to allocate net assets and total investment income to the plan.

Investment-related Disclosure

Although the exposure draft of this ASU contemplated changes to ASC 820, Fair Value Measurements, and ASC 815, Derivative and Hedging, ultimately no changes were made when ASU 2017-06 was issued.

Health and Welfare Plan Change

ASU 2017-06 also amended ASC 965 to state that a health and welfare plan is no longer required to provide investment disclosures for 401(h) account assets. ASU 2017-06 added the requirement for the health and welfare plan to disclose the name of the defined benefit plan that holds the 401(h) account for the health and welfare plan and that provided the related investment disclosures.

Effective Dates and Transition

ASU 2017-06 is effective for fiscal years beginning after December 15, 2018. Early adoption is permitted. The amendments should be applied retrospectively to each period for which financial statements are presented.

ASU No. 2017-07 - Compensation Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Cost and Net Periodic Postretirement Benefit Cost

Overview

In March 2017, the FASB issued ASU No. 2017-07, Compensation Retirement Benefits (Topic 715): Improving the Presentation of the Net Periodic Cost and Net Periodic Postretirement Benefit Cost (ASU 2017-07). ASU 2017-07 affects the plan sponsor’s financial statements and does not impact the employee benefit plan’s financial statements.

The amendments in ASU 2017-07 require an employer to report the service cost component in the same line item or items as the other compensation costs arising from services rendered by the pertinent employees during the period. The other components of net benefit costs will be presented in the income statement separately from the service cost component and outside a subtotal of income from operations, if one is presented. The ASU provides clarity that the service cost component is the only component of the net benefit costs that directly arises from the employees’ service provided in the current period. As a result, when it is appropriate to capitalize employee compensation in relation to the construction or production of an asset, the service cost component applicable to the relevant employees is the appropriate amount to be considered for capitalization.

Effective dates and transition

For public business entities, ASU 2017-07 is effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. For all other entities, the amendments are effective beginning after December 15, 2018, and interim periods beginning after December 15, 2019. Early adoption is permitted as of the beginning of an annual period for which financial statements (interim or annual) have not been issued or made available for issuance.

The amendments in ASU 2017-07 will be applied retrospectively for presentation of net benefit costs in the income statement and prospectively for capitalization of service cost in assets. ASU 2017-07 provides a practical expedient which permits an employer to use amounts disclosed in its pension and postretirement plan notes for the prior comparative periods as the estimated basis for applying retrospective presentation requirements.

Appendix

ASU 2016-01 example disclosures

Pending new pronouncement potential disclosure

The following is an example of a pending pronouncement disclosure:

Pending new pronouncement

In January 2016, FASB issued Accounting Standards Update (ASU) No. 2016-01, Financial Instruments (Subtopic 825-10) - Overall Recognition and Measurement of Financial Assets and Financial Liabilities. ASU No. 2016-01 amended ASC 825, Financial Instruments, which eliminates the requirement to disclose the fair value of financial instruments not recorded at fair value required under ASC 825. This ASU is effective for years beginning after December 15, 2018. Management does not expect the adoption of this ASU to have a significant impact on the Plan’s financial statements.

Year of implementation potential disclosure

The following is an example of a disclosure in the year of implementation:

New accounting pronouncement

During 20XX, the Plan adopted Accounting Standards Update (ASU) No. 2016-01, Financial Instruments (Subtopic 825-10) - Overall Recognition and Measurement of Financial Assets and Financial Liabilities. ASU No. 2016-01 amended ASC 825, Financial Instruments, and eliminated disclosure of the fair value of financial instruments not recorded at fair value previously required under ASC 825. This standard was adopted retrospectively and had no impact on the Plan’s net assets or changes in net assets.

ASU 2017-06 example disclosure

Pending new pronouncement potential disclosure

The following is an example of a pending pronouncement disclosure:

Pending new pronouncement

In February 2017, FASB issued Accounting Standards Update (ASU) No. 2017-06, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), and Health and Welfare Benefit Plans (Topic 965) - Employee Benefit Plan Master Trust Reporting. ASU No. 2017-06 amends the master trust disclosure to require additional disclosures related to the Plan’s interest in the master trust. This ASU is effective for fiscal years beginning after December 15, 2018 and is required to be applied retrospectively for all comparative periods presented. Management does not expect the adoption of this ASU to have a significant impact on the Plan’s financial statements.

Year of implementation potential disclosure

The following is an example of a disclosure in the year of implementation:

New accounting pronouncement

During 20XX, the Plan adopted Accounting Standards Update (ASU) No. 2017-06, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), and Health and Welfare Benefit Plans (Topic 965) - Employee Benefit Plan Master Trust Reporting. As a result of the adoption of ASU No. 2017-06 additional disclosures related to the Plan’s interest in the master trust have been made. This standard was adopted retrospectively and had no impact on the Plan’s net assets or changes in net assets.

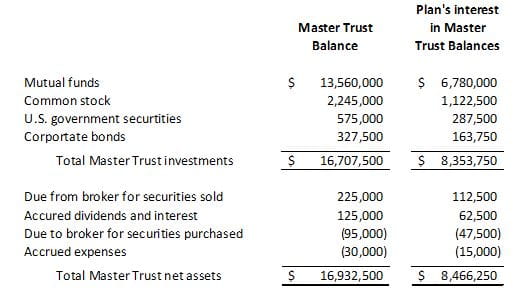

Sample master trust disclosure

The following disclosure was adapted from an example provided in ASU 2017-06 to show the new master trust disclosures including:

- Dollar amount of the plan’s interest in each of the general types of investment held by the master trust.

- The master trust's other assets and liabilities.

- Dollar amount of the plan's interest in each of those other assets and liabilities held by the master trust.