The Bipartisan Budget Act of 2015 completely overhauled how partnership audits will be conducted. The new audit rules will require significant changes to operating agreements and additional tax diligence in acquisitions and sales of partnerships. Partnerships should determine how the new rules will apply to their situations and revise their operating agreements accordingly.

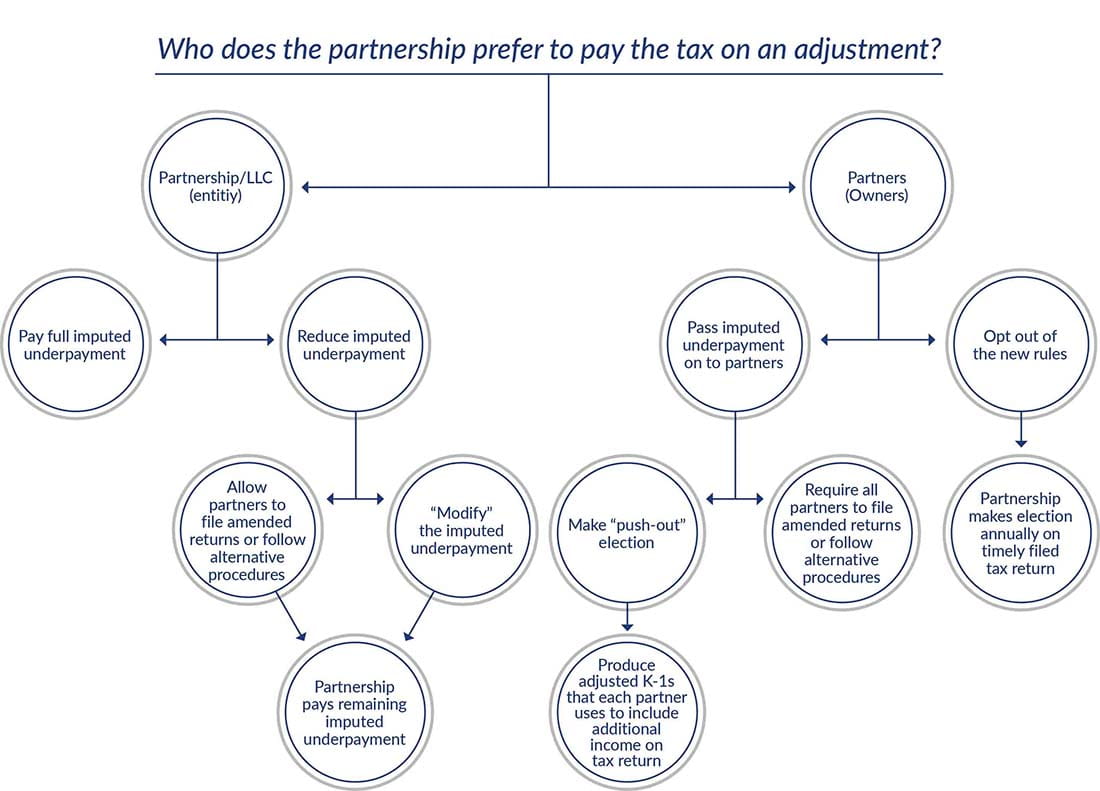

For federal income tax purposes, partnerships are flow-through entities, and no tax is paid at the entity level — it’s flowed through to the partners who pay tax on the income directly. However, under the new audit rules, tax resulting from an examination adjustment is calculated at the partnership level and any resulting tax deficiency, interest, and penalties are assessed directly against the partnership in the year of audit. While this is the application under the general rule, the new rules also allow a partnership to shift the responsibility or, at the very least, limit the burden to the partners by making certain elections.

For some, the new rules will be a breath of fresh air, as the administrative burden of the previous audit regime is eliminated if certain elections are made by the partnership. However, some may feel it’s unfair to apply the adjustment at the entity level. This is especially true if ownership changes result in current partners bearing the economic burden of the tax, even if the adjustment relates to a year in which they weren’t a partner.

Basics of new partnership audit rules

Effective date

The new rules go into effect for tax years beginning in 2018 and later. However, partnerships can elect into these new audit rules for tax years as early as 2016. To elect in early, you must make the election within 30 days of the notice for examination. Once the election is made, it can’t be revoked without the consent of the IRS.

General rules

The general rule is that an adjustment is applied at the partnership level along with any resulting tax deficiency, interest, and penalties. The additional tax is due in the year of adjustment (i.e., the current year). Elections are available to ensure that the tax burden continues to be imposed at the partner level.

The chart below shows certain options that may be available.

Election to opt out of new audit rules

A partnership is eligible to opt out if it has 100 or less partners and no partner is a partnership, trust, or disregarded entity. If the partnership has an S corporation as a partner, the shareholders of the S corporation will count toward the 100 partner rule.

An election to opt out must be made on the timely filed tax return every tax year. The partnership must also disclose the names and taxpayer identification numbers of all partners on its tax return. If your partnership opts out, you’re subject to the standard partnership audit procedures currently applicable to non-TEFRA partnerships. This generally results in each partner being audited individually with respect to any partnership item.

Modification of the imputed underpayment

The tax assessed against the partnership is calculated at the highest federal income tax rate in effect for the reviewed year. Under current law, that rate is 37 percent and is applied regardless of the makeup of the partners, or the character of the income subject to adjustment. You can modify the imputed underpayment by showing that a portion of the adjustment would be allocable to a partner who would pay a lesser tax rate (i.e., a C corporation partner taxed at a 21 percent rate, a tax-exempt entity that wouldn’t have owed tax, or an individual partner paying a 20 percent capital gains tax rate on an adjustment to a capital item). To modify, all required information must be provided to the IRS within 270 days of the mailing of the notice of proposed underpayment. Alternatively, a partner can file an amended return and pay its share of the adjustment based on an actual tax calculation, causing the imputed underpayment to be recomputed to exclude that partner’s share of the adjustments. In lieu of a partner filing a complete amended return, an alternative procedure can be followed that effectively provides the same result as an amended return but doesn’t require filing an amended return.

“Push-out” election

The “push-out” election allows a partnership to shift the economic burden of the additional tax due to the partners that were actually members during the reviewed year. This election is due within 45 days of the notice of the final adjustment. The partnership must then furnish statements to partners during the reviewed year within 60 days of when all of the adjustments are finally determined. The partnership must also submit an adjustment tracking report filed by the tax return due date for the adjustment year.

Each partner must recalculate its tax liability for the reviewed year and each subsequent year to the extent a change in the reviewed year affected a tax attribute carrying to a later tax year. As opposed to filing an amended return for the reviewed year, the partner must include the increased tax liability from all prior years on its tax return in the year in which the partnership provided the adjustment statement to the partner.

Other key aspects of partnership audit rules

Partnership representative – The “tax matters partner” under the TEFRA audit rules is replaced by a “partnership representative” under the new rules. The partnership representative has the sole authority to act on behalf of the partnership and the partners in an audit. The representative’s actions will bind the partnership and its partners. The role can be filled by a person other than a partner (unlike the tax matters partner). Alternatively, the partnership itself or a separate entity can serve as the partnership representative. However, if an entity is designated as the partnership representative, the partnership must appoint an individual to act on the partnership representative’s behalf. If the partnership doesn’t appoint a partnership representative, the IRS will select one.

Administrative adjustment requests (AAR) – Partnerships subject to the new rules aren’t permitted to file amended tax returns. Any voluntary adjustment must be made through an AAR. If the AAR would result in additional tax, the partnership may pay the tax or it may “push out” the adjustments similar to the rules that apply to an audit adjustment. If the AAR would result in a tax refund, a process similar to the “push-out” process is followed.

Statute of limitations – Generally, the assessment must be made within three years of the date the return was filed, the due date of the return, or the date an AAR was requested, whichever comes latest. In effect, these rules now make the statute of limitations of the individual partner irrelevant but also extend the statute when an AAR is filed.

What you should do now

While it’s unlikely that audits under these new rules will occur before 2020, partnerships and their advisors should begin preparing for the effect of the new regime. Partnerships should determine who they want to pay the tax (i.e. the partnership or its partners) and the methods it will use to achieve that result. Partnerships should consider revising their operating agreements to reflect the selected methodologies. They should also consider how specific their operating agreements should be. Is it sufficient to appoint a partnership representative and include broad language for guidance, or should the agreement have very specific requirements and directions for exactly which elections the representative should make in which circumstances? Below are some amendments you may wish to consider.

Potential amendments to operating agreements

Partnership representative - All partnerships should, at the very least, appoint or designate a process for appointing a partnership representative who can manage the examination process. This should be done even if the partnership plans to opt out of the new rules to provide protection in the event that the election is inadvertently missed. The operating agreement should address the extent of the partnership representative’s liability, if any, for failing to act in accordance with the terms of the operating agreement. Additionally, partnerships should consider whether a partnership representative should be indemnified for actions taken in that role. Consideration should also be given to how the partnership representative will be bound by the provisions of the operating agreement, particularly if they’re not a partner.

“Push-out” election - If the partnership falls into the new regime, they may want to require partners to file amended returns in the case of an exam, which would effectively shift the burden to its partners. It could also require partners to cooperate and provide any necessary information for the partnership representative to “modify” the adjustment.

Additional amendments - A partnership may want to include notification requirements at certain milestones of the exam or requirements of the partnership representative to consult with or obtain consent of the partners before taking a position, agreeing to a settlement, or making an election. Partners may also want to consider whether broad indemnification provisions, whether among the partners or between the partner and the partnership, to require all parties to be made whole if what is determined to be an improper amount of tax is paid by that party.

Opt-out considerations - If the partnership is eligible and plans to opt out of the rules altogether, the operating agreement should require the partnership representative to make the election annually. Additional amendments, similar to those discussed above, may also be recommended even though the new rules generally won’t apply in case the election is missed or if the partnership becomes unable to elect out. A partnership may also want to prevent partners from taking actions that could hinder an opt-out election. For example, transfer of partnership interest to a grantor trust would prohibit the partnership from making this election.

Considerations for mergers & acquisitions

Those buying or selling a partnership interest will want to ensure that any future adjustments are economically attributed to the correct parties. For example, a buyer may want to prevent the partnership from electing into the new rules early (for tax years 2016 and 2017), require it to opt out of the rules, or require a “push-out” election to be made. The selection of a partnership representative for the tax year with an ownership change should also be carefully considered. An indemnity clause can protect a buyer in a case where the adjustment is applied at the entity level for a reviewed year in which buyer wasn’t a partner.

Buyers should also consider more thorough tax due diligence. Historically, many buyers conducted less federal tax due diligence procedures on acquisitions of partnerships than corporations since most federal adjustments would still be attributed to the selling partners, as opposed to the partnership. However, these new rules, by default, transfer the exposure to the partnership. When combined with the repeal of the technical termination rules that no longer allow many buyers to treat acquired partnerships as brand new entities, the new rules make it critical that buyers are fully aware of all potential exposures before they complete an acquisition.

If you have questions about how the new audit rules might affect you or if you want to learn more about these rules, contact us today.