A nonqualified deferred compensation plan can help attract and retain your key staff in today’s competitive economy. However, compliance with Internal Revenue Code Section 409A can be complicated, the penalties are extremely punitive, and the IRS has no policy to negotiate settlements. Here are a few things to keep in mind as you navigate IRC 409A compliance.

Common Section 409A errors and penalties

Companies tend to make a number of errors when it comes to Section 409A compliance, including:

- Incorrect calculation of plan deferrals and distributions.

- Failure to make deferral or distribution elections in a timely manner.

- Failure to comply with Section 409A definitions for specified terms.

- Early payment of an amount payable in a later year.

- Late payment of an amount payable in an earlier year.

Unfortunately, with errors come significant penalties, including:

- Immediate income recognition of the participant’s entire vested plan balance (the “taxable amount”) with respect to the year of error.

- Potential late payment penalties and interest on the taxable amount.

- Additional 20% tax and “premium interest tax” on the taxable amount.

- Potential late penalties and interest on failure to withhold.

- Restating and refiling previous years’ tax forms (e.g., Forms W-2 and 1099 for companies and Form 1040 for plan participants).

Fortunately, the IRS has a correction program that can minimize or even eliminate Section 409A penalties — if they’re identified and corrected within two calendar years following the error. So, don’t wait; the longer you wait, the greater the possibility of an IRS audit and the less likely penalties can be abated.

Cost savings with Section 409A error correction

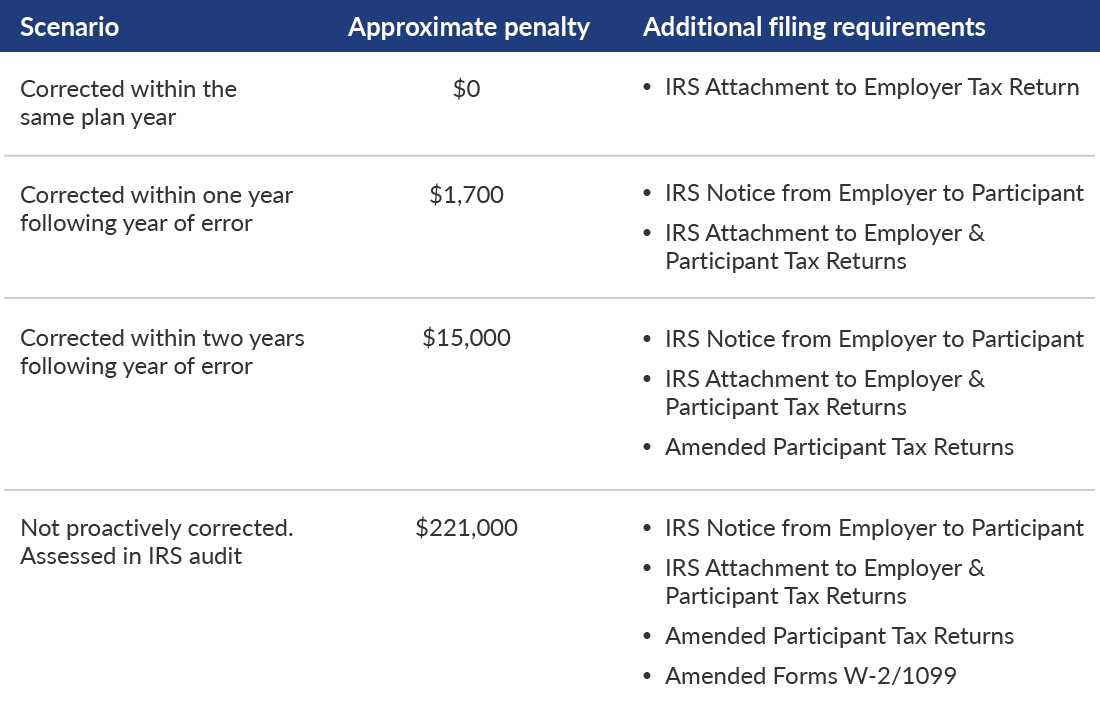

Imagine a biotechnology company with a nonqualified deferred compensation plan whose research manager has a $500,000 aggregate plan account balance. The research manager received a payment from one account with a value of $50,000 in a year earlier than elected. The following table illustrates the dramatic difference in penalties and filing requirements, depending on if and when an error is proactively addressed (assuming a 2% AFR rate):

For each correction in the scenarios above, the employee must pay the approximate IRS penalty in addition to repaying the accelerated payment — in our example, $50,000 — back to the employer. If the employee can’t repay the $50,000, then the error wouldn’t be eligible for correction, and the entire $500,000 plan account balance would be taxed.

The corrections, approximate penalties, and additional filing requirements are similar where the error involves a late payment of an amount payable in an earlier year. However, as the penalties require immediate income recognition of the participant’s entire plan balance, deferral errors generally have higher penalties where the error isn’t proactively corrected. In our example, the approximate penalty for a deferral error would be $500,000.

If the research manager was an officer, director, or 10% owner of the biotechnology company, then the penalties could be even higher under both the acceleration and deferral error.

Navigate 409A compliance with confidence: Contact our authors

Uncovering errors and navigating through the correction procedure can require help from a trusted expert. Our 409A specialists can help you meet regulatory compliance. Questions? Reach out to our team — we’re here to help.