2019 was an unexpectedly strong year for the bond market due to slower economic growth, falling inflation expectations, and global trade uncertainty. The result was a sizable, unexpected decline in long-term rates that flattened, and for a brief period inverted, the yield curve. The Fed’s pivot to cut short-term rates to stimulate the economy was another significant development, although the rally in long-term bonds had largely run its course before the Fed first eased in August.

Negative yields in countries outside of the U.S. created strong demand for Treasuries from foreign investors, and municipal bonds had a positive year due to heightened demand from individual investors looking for tax-advantaged yield.

The Fed is now signaling that they may be done cutting rates amid signs of more stable economic growth, mitigating recession concerns. Still, inflation expectations remain range-bound and growth expectations tempered, suggesting limited upside for long-term rates. However, this could quickly change in response to developments in trade negotiations, the direction of the global economy, or a rebound in inflation pressures — all of which could influence investor sentiment and impact long-term interest rates, credit spreads, and the shape of the curve.

Given these conditions, we believe that active management can play a critical role in managing risk and taking advantage of opportunities when they arise.

Looking ahead, we see fixed income demand extending into 2020 as investors continue to seek high- quality sources of income. Across taxable sectors, spreads are tight, limiting incremental income beyond that provided by Treasuries. While opportunities still exist in corporate credit, the relative strength of the consumer sector provides a favorable environment for mortgage- and asset-backed securities. Additionally, municipal bonds carry competitive yields on a tax-adjusted basis and remain an attractive option for many investors.

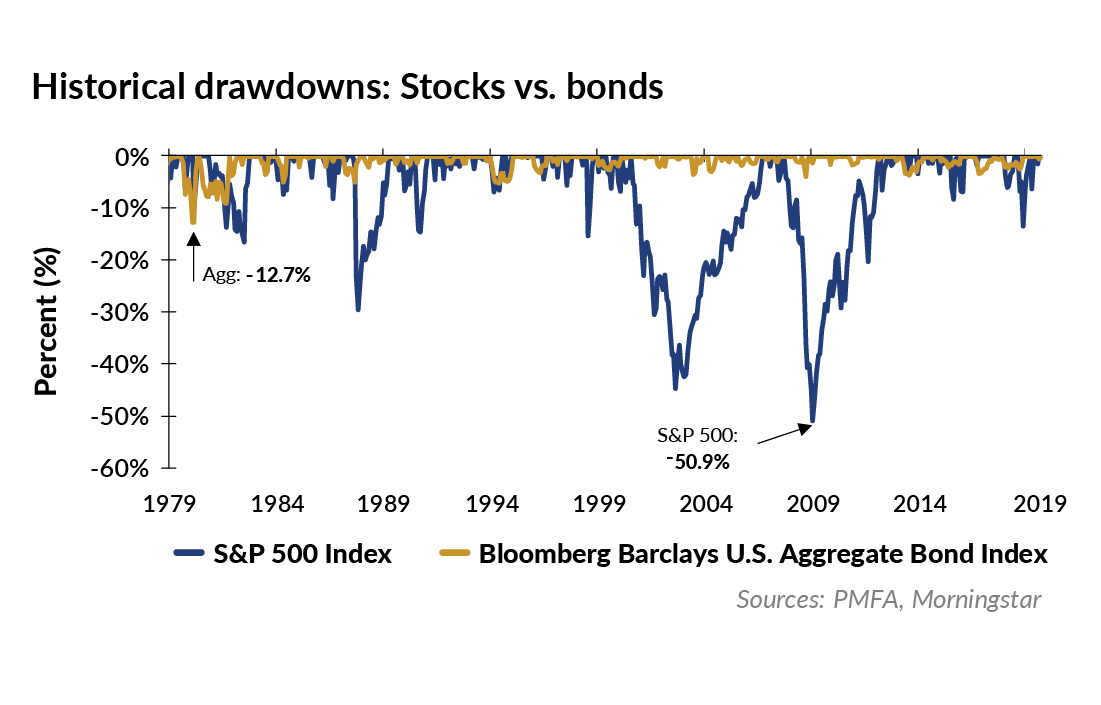

While we believe the economy is well-positioned for continued growth into 2020, uncertainty on numerous fronts serves as a reminder that high-quality bonds have historically been a risk reducer for a diversified portfolio, which can be particularly valuable during periods of equity market volatility.

The bottom line:

The performance outlook for bonds into 2020 is relatively muted, and returns are unlikely to be as strong as 2019. However, during uncertain economic times, we believe high-quality bonds are an especially important part of a balanced portfolio to provide high-quality income, reduce overall risk, and serve as a ballast to equities.