Given the range of uncertainties on a variety of fronts, one might have expected global equity markets to struggle in 2019. However, that couldn’t be further from the truth, with gains across the globe solidly in double-digit territory, led by returns of over 25% in the U.S. through the end of November. Looking towards 2020, we see a relatively supportive environment for equities, if anticipated conditions actually develop.

From a fundamental perspective, corporate earnings could be positioned for improvement in 2020, thanks in part to U.S. and global central bank easing, which has historically been supportive to economic growth and thus, to earnings as well.

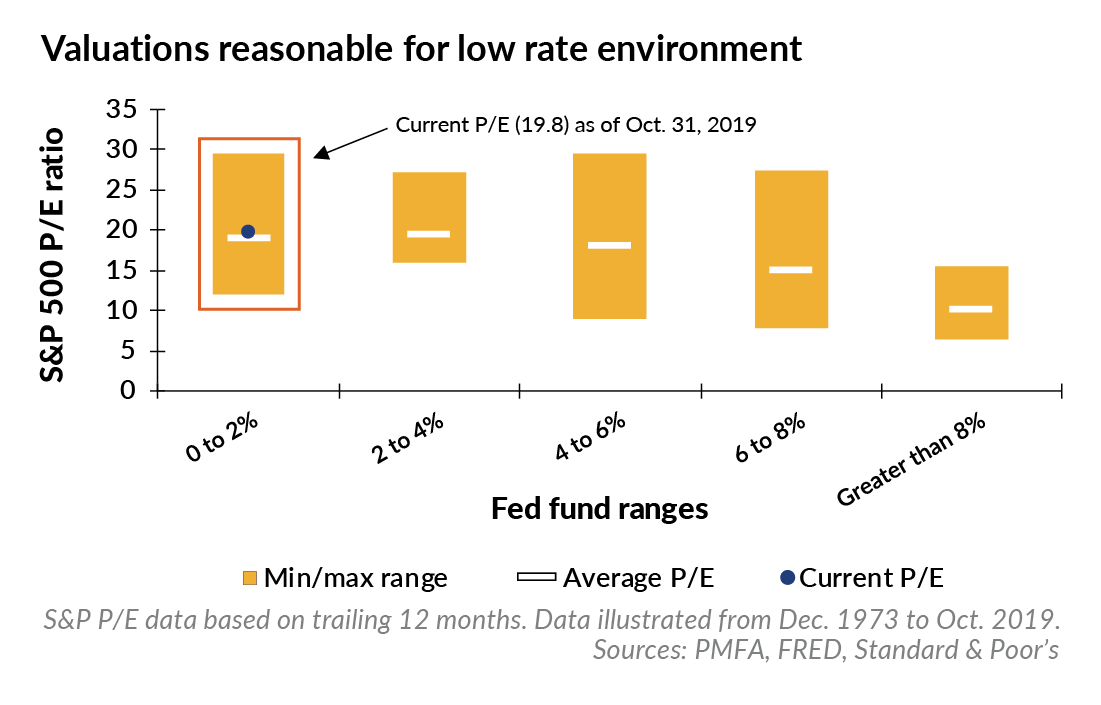

Valuations are full, yet still reasonable, in light of the relatively low interest rate environment in the U.S. and abroad. Assuming that economic growth stabilizes, and the Fed remains supportive, we believe the low-rate environment should continue to support valuations at current levels.

Some caution is called for, however, as markets face the potential for heightened volatility due to a lack of clarity around trade policy, potentially rising labor costs, geopolitical uncertainty and economic weakness in parts of Europe and Asia.

While acknowledging these risks, we also believe they are being priced in by investors to a good extent. Overly negative sentiment can make it harder to see potentially positive catalysts for equities, which certainly exist. A breakthrough in the trade dispute for example could nudge corporate America to free up capital investment. And, we’re heading into an election year, which has historically, though not universally, been favorable for U.S. equities.

Perhaps the most important support for the economy heading into 2020 is the resilient U.S. consumer, whose spending has fueled solid growth. There is also a meaningful correlation between consumer confidence and equity valuations, suggesting that valuations should be supported so long as consumers remain generally upbeat on the economy.

On the international front, we believe the economic slowdown outside of the U.S. could generate opportunities for international equities as global monetary policy and attractive relative valuations could support strong returns in foreign stocks. Multiple relative valuation measures favor international stocks over domestic equities by the most in nearly 40 years. While it’s impossible to say how this will play out over the short term, the valuation advantage alone should provide a tailwind to international equities over the coming years.

The bottom line:

So, the bottom line is we recognize that a range of risks are present, and periods of volatility are likely, particularly during this phase of the cycle. Yet, underlying fundamentals still support equities. And, while a repeat of the strong performance in 2019 is unlikely, we believe equities are still well-positioned to outperform cash and high-quality bonds over a multiyear period.