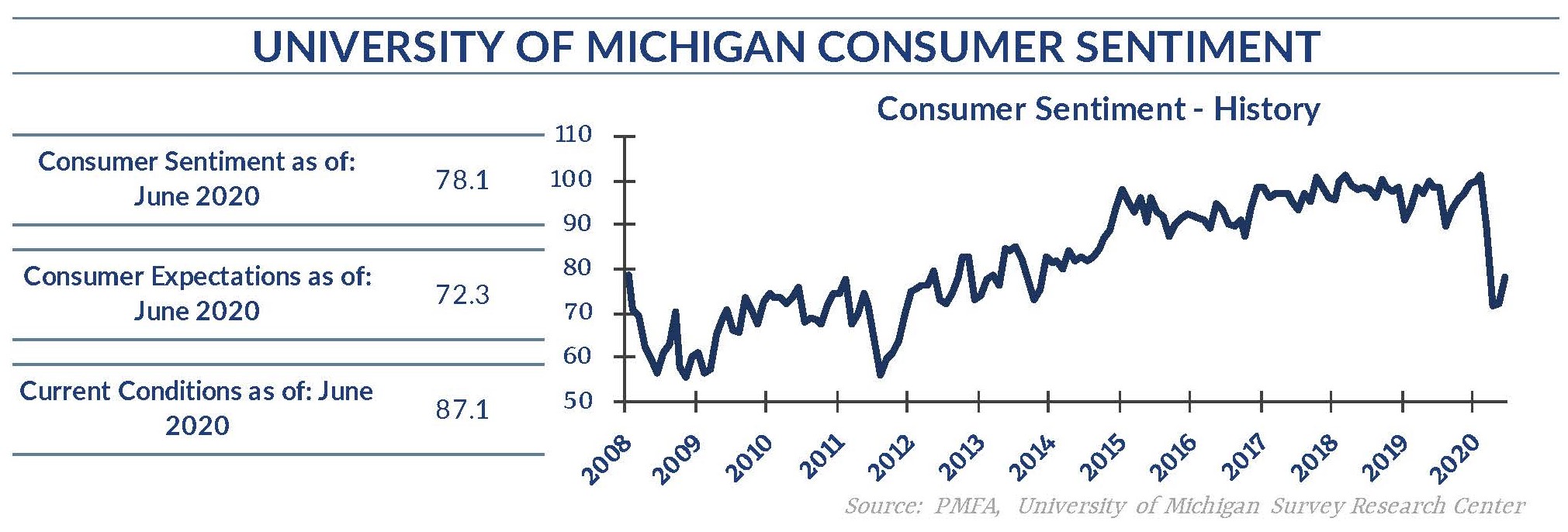

The University of Michigan’s Consumer Sentiment Index came in at 78.1 for the latter half of June, suggesting a slight deterioration since the preliminary result released earlier in the month. Even so, sentiment clearly improved in the past month as restrictions were lifted across a large portion of the country. Economists had expected a bit more improvement, but new outbreaks across the country have raised questions about the near-term outlook.

On a positive note, regions that had been hit especially hard earlier this year are showing meaningful signs of improvement, allowing for a gradual lifting of various restrictions on movement and business activities. Not surprisingly, the collective mood in those areas is improving.

Conversely, parts of the South and West are only now seeing the first wave of the virus begin to really take hold. In those regions where cases are now rising rapidly and the public health threat has become much more apparent, sentiment has unsurprisingly turned negative.

More broadly, evidence that the economy may have already bottomed provided not only a boost to the stock market, but also the general mood of consumers. The surprising surge in retail sales and payrolls in May were both very positive signs, but it is important to note that these gains are coming off what has been at times unprecedented lows in economic data.

This does not discredit the recovery by any means but shouldn’t be overlooked as it will likely take an extended period of time for the economy to fully recover. Layer in potential risks on the horizon, such as a resurgence of new virus cases or renewed tensions between the U.S. and China, and the road to recovery becomes a potentially bumpy ride.

The bottom line is that the path back to a strong economy is not without challenges. Uncertainty is still a key watchword, and relief that some of the hardest hit areas are seeing improvement only tells part of the story. The first wave is still making its way across the country, and the risk of a second wave is still very real. Improving consumer sentiment is an understandable development. Sentiment is still fragile and could easily experience another step back as parts of the country that had not been significantly affected now grapple with COVID-19 outbreaks, policies intended to reduce the public health risk, and the resulting economic fallout.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.