First, the bottom line: Cautious outlook curtailing discretionary spending

- Boil it all down and you have a consumer sector that’s become more subdued in its outlook and more cautious in its spending habits. The surprising pop in consumer sentiment last week pointed to the potential for some improvement in consumption as well, although the recent surge in oil prices may quickly dampen the mood if they translate to a sustained increase in prices at the pump.

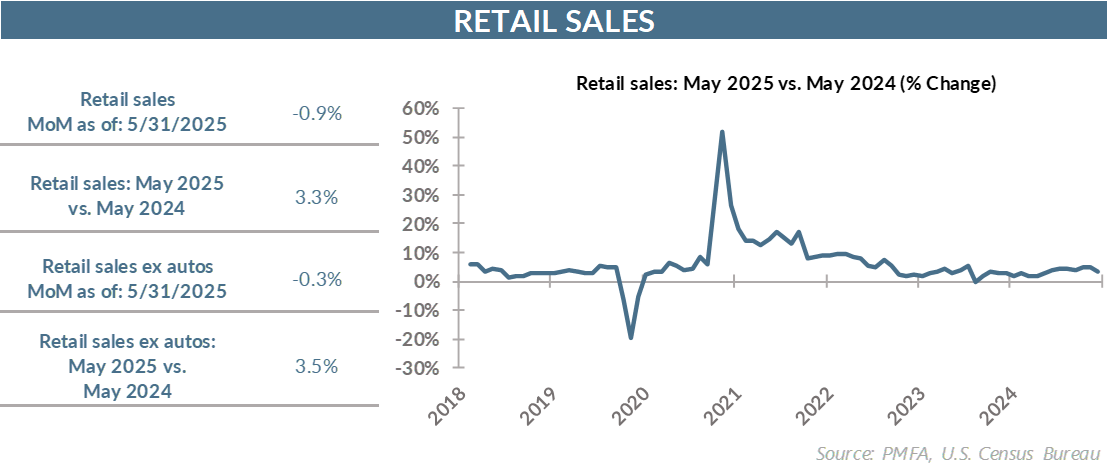

By the numbers: May retail results softer than expected

- Retail sales fell sharply in May, declining by 0.9% in month over month, while falling well short of an expected decline of 0.6%.

- May retail results extended a volatile pattern to start the year, which has seen monthly results vacillate between strongly positive and negative since January with a few flat months in between.

- Much of the May decline is directly attributable to a plunge in auto sales; dealerships reported a decline of 3.5% for the month. Ex-autos, the May dip was a more pedestrian 0.3%.

- It’s worth noting that the impact of the May report may not weigh on growth as much as the headline numbers alone might suggest. Control group sales, which feed directly into GDP calculations, rose by 0.4%.

- Still, the retail environment this year has been tepid, with average monthly sales having moved little since December, despite volatility in the month-to-month results. Given the overhang of uncertainty from tariffs, domestic polarization and growing tension related to immigration policy, and an increasingly tense geopolitical environment, it’s no surprise that the collective consumer mood has dimmed.

Broad thoughts: Policy uncertainty and tariff frontrunning impacted retail sector

- Today’s release all but confirmed that recent consumption and retail results were significantly influenced by consumers trying to front-run expected tariffs. That was particularly clear in the strong March sales gains; that one-month gain now appears increasingly anomalous across an otherwise lackluster retail environment this year, reflecting subdued sentiment as consumers recalibrated their near-term expectations for the economy and braced for higher prices.

- The announcement of DOGE-related federal job cuts early this year certainly played a role, but the much larger-than-expected tariff announcements in early April took a much larger toll, raising the specter of another surge in prices for consumers that are still trying to come to grips with the impact of the post-COVID-19 inflation surge.

- The initial reaction to tariff announcements was swift. Consumer expectations for inflation over the coming year immediately increased but have since receded a bit as actual inflation has been relatively benign. Even so, prices are expected to rise by about 5% over the coming year. Continued progress in trade negotiations and delayed implementation of some tariffs have helped to alleviate those fears.

- Even so, a less constructive view of the near-term outlook has curtailed discretionary spending — and not just for big-ticket items. The 0.9% decline in restaurant sales confirms that consumers were not only holding off on major purchases but also pinching pennies in their daily discretionary habits.

- Ultimately, consumers are still wary of what the changing policy landscape will mean for the economy, and what a potentially weaker economy and higher prices will mean for their ability to maintain or improve their living standard. For now, that’s translating to a tightening of their proverbial pursestrings as they look for greater clarity about what’s next.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.