First, the bottom line

- There’s no shortage of things for investors to worry about, but for now at least, the pessimistic tide has given way to a more optimistic wave that has emboldened animal spirits and lifted stocks.

- It’s not that consumers don’t recognize the risks that are present; they do. Instead, they appear to be adapting to the new reality of geopolitical instability and fluid policy, and the sense that developments can shift the narrative — and the resulting outlook — meaningfully and with little warning.

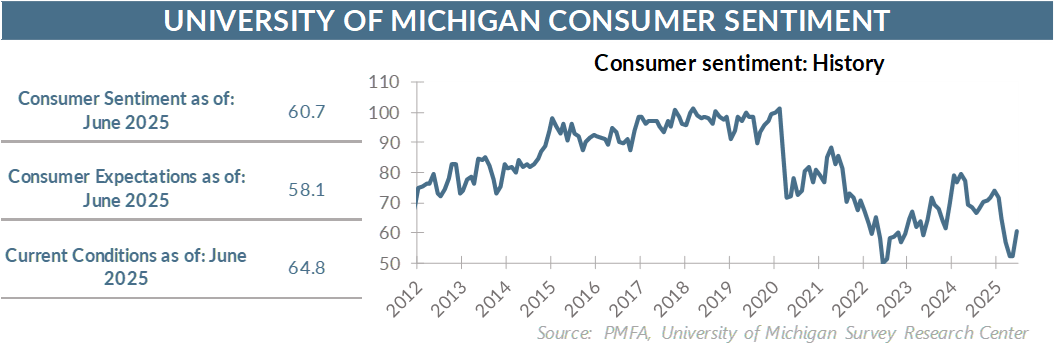

By the numbers: Strong gains in both current and expected conditions

- Consumer sentiment rebounded sharply in June, coming in at 60.7 in the University of Michigan’s second reading for the month. That represented a fractional uptick from the 60.5 reading reported two weeks ago, but a much more pronounced improvement from May’s 52.2 reading.

- The June result finally reverses a string of softer releases in 2025 that started at a current year high of 71.7 in January before sinking to just 52.2 last month.

- The relative optimism of consumers is apparent not only in their more positive assessment of current economic conditions, but in a significant improvement in consumer expectations for what lies ahead. The 11-point increase from 47.9 in May to 58.1 in June for the forward-looking component of the index was the strongest in nearly three years.

Broad thoughts

- Continued positive developments in trade negotiations, reductions in previously announced tariffs, and constructive inflation and labor market reports have all contributed to an improvement in the collective mood.

- Among the more notable developments has been the relative stability of inflation readings. Against the backdrop of a largely negative tone in recent months, recent inflation data has been fairly tame. That could still change in the months ahead, but consumer anxiety concerning potential inflation had gotten well out in front of reality. The fact that price increases thus far haven’t been as pervasive or extreme as consumers had feared has helped to allay concerns that a new inflation wave is at the doorstep.

- At the same time, the wheels of the labor market are grinding slower. Job creation remains positive, but job openings continue to decline as jobless claims edge higher. That could create a growing headwind to household income and spending if it continues.

- The fragile state of the Middle East remains a wild card, despite some hopeful indications that tensions could be ratcheting back. Oil prices have been unusually volatile in recent weeks, reinforcing its susceptibility to ongoing developments in the region, but remain well above their May low.

- Still, investors have once again climbed the proverbial wall of worry to drive the S&P 500 and Nasdaq back to record levels, just a few months after the Liberation Day tariff announcements ignited a wave of selling pressure that took indexes up to the precipice of bear market territory.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.