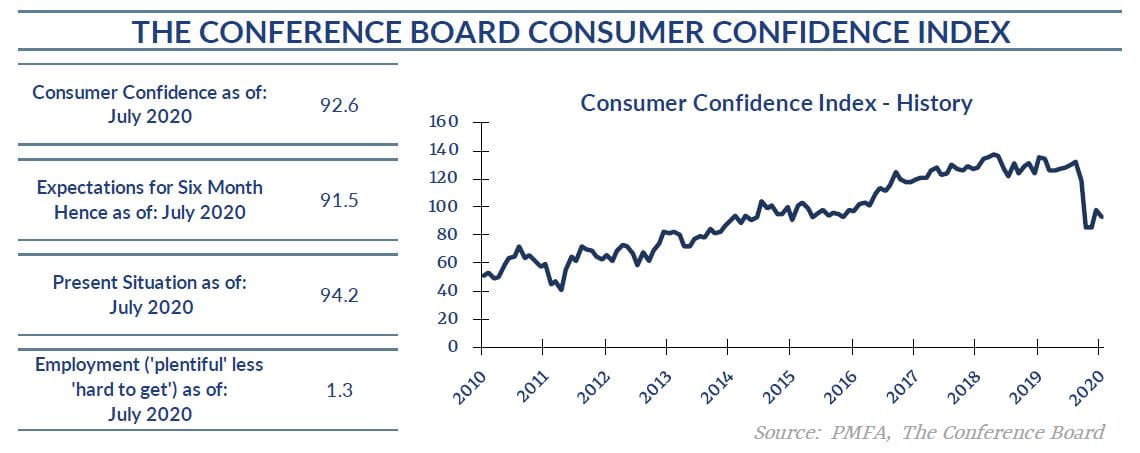

Optimism waned in recent weeks as a resurgence in COVID-19 cases across the country dashed hopes for continued improvement on both the public health and economic fronts. The Conference Board’s measure of consumer confidence dipped to 92.6 in July, falling short of expectations of 96.3 and giving back some of last month’s gain.

Consumers’ assessments of current conditions improved modestly, but the outlook for overall business conditions and the labor market over the next six months both dimmed, undoubtedly in anticipation of the growing health risk and expectations for expanded limits on traveling, public gatherings, and the resulting negative fallout for many businesses.

The decline partially reversed an unexpectedly strong degree of improvement in the overall consumer demeanor in June, as a range of restrictions were lifted across parts of the country that had been harder hit by the first wave of the virus. Even with this more recent setback, the index remains moderately above its long-term average of 86.3.

The primary concern weighing on the country is clearly noneconomic, but with very significant economic repercussions. The surge in cases recently has been a concerning development that signals the growing risk to the economy, and one that’s starting to become clear in timely economic data.

Initial jobless claims had dropped precipitously from their peak, but the pace of improvement had slowed in the past month. Last week’s jobless claims edged higher for the first time since March, providing evidence that progress on the road to recovery may be stalling.

Just as the earlier decline in COVID-19 cases had previously prompted a lifting of restrictions, the resurgence of COVID-19 cases has slowed progress, delaying the reopening of many businesses. While some parts of the country and sectors of the economy are doing better, others are directly feeling the impact.

The bottom line is that the consumer sector and the economy broadly remain vulnerable as policymakers assess the evolving public health risk created by COVID-19. Any aggressive steps that may be taken to clamp down on its spread may be beneficial in reducing health risk, but could at the same time exacerbate economic conditions and endanger a fragile recovery. Consumers are clearly aware of that risk and are understandably cautious in their assessment of the path forward for the next several months.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.