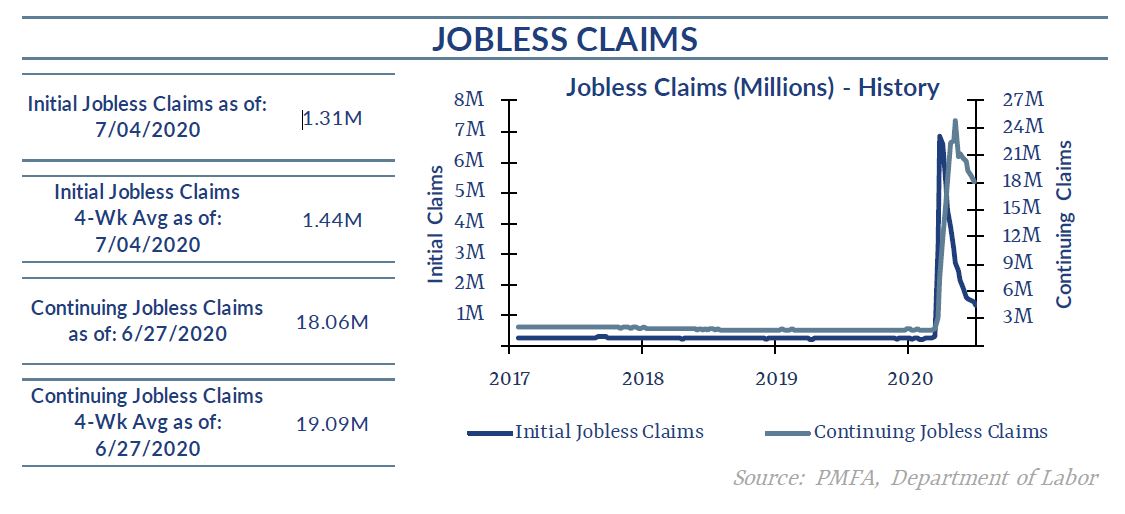

First-time unemployment claims continue to trend lower from record levels but remain exceptionally high. Although the number of ongoing claims continues to decline, there are signs that the pace of improvement is slowing.

First-time unemployment claims continue to trend lower from record levels but remain exceptionally high. Although the number of ongoing claims continues to decline, there are signs that the pace of improvement is slowing.

Initial claims for Americans applying for first-time unemployment insurance was again a seven-digit figure, coming in at 1.314 million, moderately better than expectations for 1.38 million. Prior-week first initial claims were revised down by 14,000 to 1.413 million.

Although first-time claims remain elevated and are declining at a measured pace, continuing claims are falling more rapidly. For the week ended June 27, continuing claims declined by nearly 700,000 to 18.06 million — still an exceptionally large number. Even so, that reduction reflects employers adding workers back to payrolls at a solid pace and provides further evidence that net job creation remains solidly positive.

Not surprisingly, the sharp decline in claims over the past two months has been apparent in the improving jobless rate, which fell again last month to 11.1%, down from 13.3% in May. The number of unemployed Americans has improved substantially since April as restrictions were lifted across much of the country and employers began to rehire workers.

However, optimism about the near-term outlook has dimmed somewhat in recent weeks. Certainly, all indications are that the economy has bounced back more rapidly than expected, but that pace of recovery is unlikely to be sustained.

The greatest risk to the improving labor market conditions is the resurgence of COVID-19, as outbreaks rise nationwide. Growing pressure on policymakers to take aggressive steps to restrict travel and activity in an effort to curtail the spread of the virus will have a predictably negative economic impact, which would almost certainly push jobless claims higher once again.

As such, it’s quite possible that claims take a step back before continuing to trend lower. The speed at which restrictions, cancellations, and lockdowns impacted the economy broadly and labor market conditions in March illustrated how quickly conditions can change. Although parts of the economy have since adapted and a second wave of closures may not be as impactful, it would be a setback for an economy still gathering its strength after being knocked to the mat.

The bottom line is that recent jobs data still points to a mending economy, but one that’s still very vulnerable to the risk presented by the surge in COVID-19 cases and, more notably, the policies employed to reduce the inherent health risk.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.