With November quickly approaching, the presidential election is increasingly dominating the news cycle. Over the coming weeks, headlines and commentators will be making predictions on the outcome of the election. However, a look at historical market performance may provide some insight on the topic.

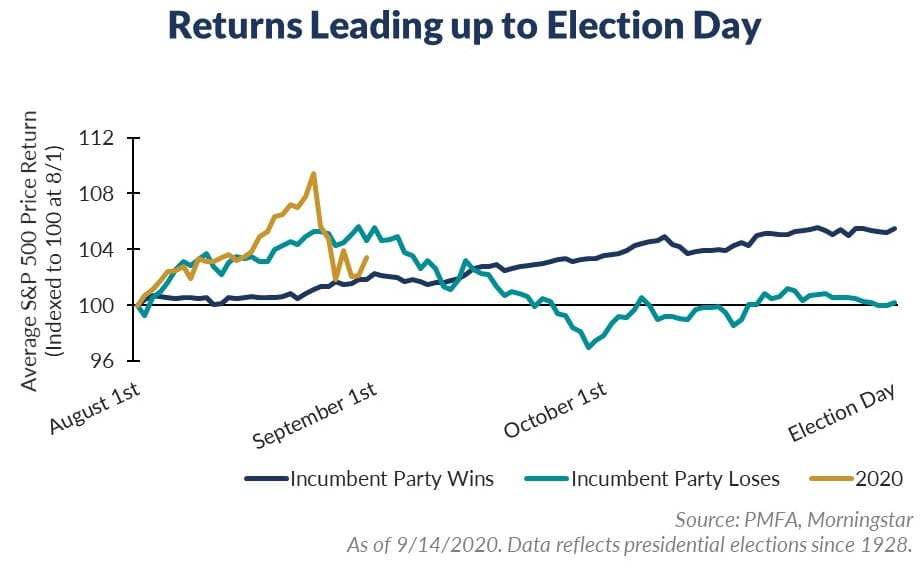

Since 1928, average market returns have exhibited some correlation with the election outcome. On average, strong performance in the final three months before Election Day has been a good sign for the incumbent. Conversely, an uptick in volatility accompanying flat or negative returns during that time has typically foreshadowed a change in the party residing at 1600 Pennsylvania Ave.

Of course, various factors are likely to impact performance in the coming months, including COVID-19 containment efforts and the resulting impact to the economy, potential fiscal stimulus legislation, and geopolitical events. The bottom line is that there are a range of factors beyond the election that could influence investor sentiment and market returns in the coming months.

Changes in party control of the White House haven’t meaningfully impacted long-term returns. History is clear: policy changes can create short-term volatility, but the long-term drivers of equity returns are apolitical.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.