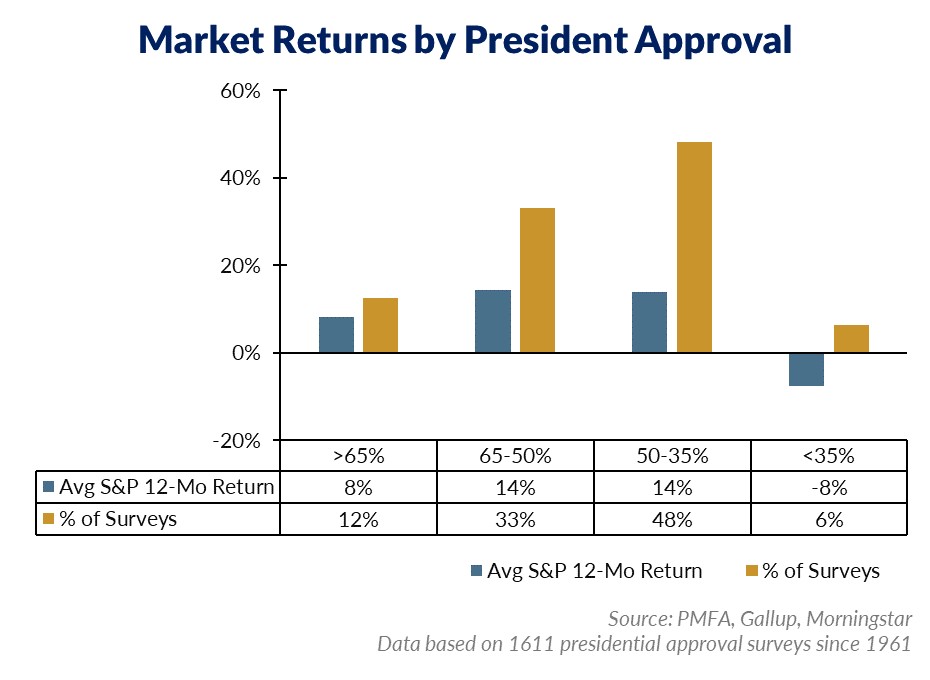

The outcome of the November election remains unclear, with many close races in key battleground states likely to decide the outcome. However, what is clear is that many Americans are dissatisfied with the state of politics today, as both presidential and congressional approval ratings are well below 50%. But does a heightened discontentment with politics or policy extend to a negative environment for stocks?

As illustrated in the chart above, voter satisfaction has not correlated strongly with stock market performance. Equities have typically performed well even with presidential approval ratings below 50%. The exception would be during periods of extreme disapproval (under 35%), which tend to correspond with recession or war — both of which represent significant sources of uncertainty for investors. Those periods tend to be relatively brief, occurring only 6% of the time. Perhaps surprisingly, average S&P 500 market returns have been higher when presidential approval ratings have been moderately below 50% than when they were above 65% — which often correspond with tragedies or heightened risk, such as in the aftermath of the Kennedy assassination, the first Gulf War, and Sept. 11.

Though the outcome of the presidential election is still uncertain, history has shown long-term performance trends of the stock market tend to be largely unaffected by political outcomes or general voter satisfaction. Stick with your long-term plan.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.