First, the bottom line: Overall retail activity was brisk in June

- Consumer spending bounced back in June, following a few soft months in which tariff talk and fears of higher prices on a range of imported goods dominated the consumer mindset.

- While those same concerns persist, prices broadly haven’t surged in recent months as many had feared. That opened the door for consumers to feel comfortable to spend a bit more freely, even with many questions related to trade and tariffs yet to be resolved.

- The path ahead is still far from clear though. If anything is certain, it’s that the uncertainty about prices will continue to influence consumer behavior, whether by accelerating purchases, trading down to lower-priced alternatives, or delaying discretionary outlays. All are on the table.

By the numbers: Consumer spending bounces back

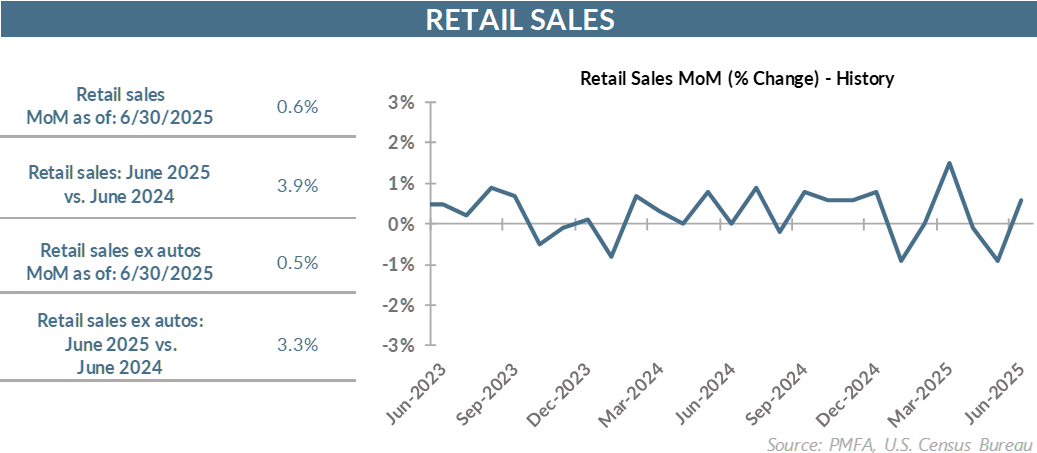

- Retail sales rose unexpectedly in June, increasing by 0.6% month over month, easily topping forecasts for a more pedestrian 0.1% bump. Control group retail sales, which feed directly into GDP calculations, rose by a solid 0.5% for the month.

- Gains were reasonably well distributed across various retail sectors, ranging from groceries to automobiles and staples to discretionary. Even so, department store sales tumbled by 0.8% in June and contracted 3.6% over the past year, illustrating the longer-term trend of consumers moving away from those long-term bastions in favor of online commerce.

- Sales of electronics, appliances, and furniture were fractionally negative again in June — all products which may be disproportionately reflecting the impact of tariffs that have been put in place already.

- Notably, gas station sales were flat, indicating that consumers didn’t have to spend more out of necessity to fuel their cars last month despite the start of the summer travel season. That undoubtedly provided a bit more wiggle room in household spending, ultimately benefiting other retail sectors.

Broad thoughts: Consumers recovering from post-tariff announcement shock

- The surprisingly strong retail results were well timed, coming on the heels of an exceptionally weak 0.9% decline in May. It also extends a volatile trail of monthly results since the start of the year.

- Retailers have been whipsawed month to month by spending that has shown no discernible, sustained trend either positively or negatively. Six months into the year, retailers have posted just two months of strong gains, punctuated by two sharp declines and two relatively flat sales months.

- How much of the volatility in monthly retail data can be traced back to tariffs is difficult to gauge, but there’s no doubt that the consumer response to tariff-related announcements played a meaningful role.

- Retail results softened considerably in the immediate aftermath of the April tariff announcements that were much larger than had been anticipated. With the lion’s share of those tariffs subsequently delayed or reduced and expectations being adjusted more broadly, consumers appear to be bouncing back from their initial shock and opening their wallets a bit more freely, at least for the time being.

- The surprisingly solid June retail results still come with an asterisk. Month-to-month results remain choppy, falling short of an unambiguously positive retail environment. Further, the tariff cloud looms on the horizon, with the potential for sizable tariffs to become reality in just a few weeks.

- Whether newly announced tariffs are ultimately implemented at their current magnitude and in the announced time frame remains to be seen. The uncertainty created by shifting trade policy may accelerate some near-term spending, but higher prices over the longer term would have a dampening effect on consumption.

Media mention:

Our experts were recently quoted on this subject in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.