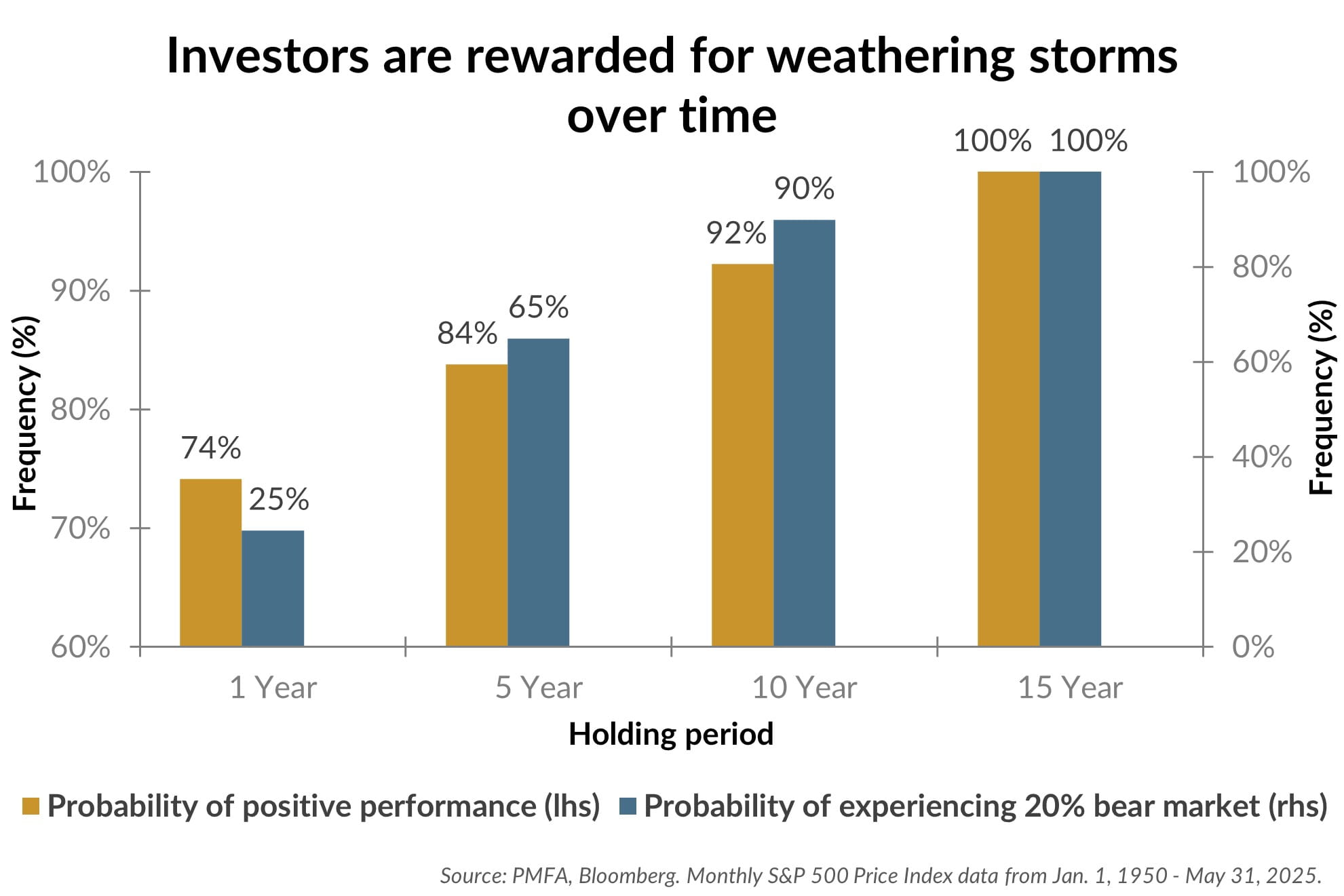

Investing in equities is often seen as a long-term strategy, and with good reason. As shown in the chart above, historical data suggests that the probability of achieving positive returns increases in tandem with the length of the holding period. Based on rolling monthly returns since 1950, the S&P 500 has exhibited positive performance across every 15-year holding period.

By staying invested over time, investors harness the power of compounding growth. Despite market setbacks (or even bear markets) that may last for several months or even a few years, major market indexes have historically trended upward in most years (74% of the time) and decades (92% of the time). This long-term growth trajectory increases the likelihood of positive returns for patient, disciplined investors.

However, a longer holding period also means that investors will inevitably experience periods of turbulence as well. The chart above illustrates that, in a given one-year holding period, there’s a 25% chance of a bear market, defined as a 20% drawdown in stocks. That probability increases to 90% over a 10-year holding period; a decade without a bear market is indeed rare. Historically, the duration of equity bear markets in the United States has been much shorter than those of typical bull markets. Even more importantly, the depth of market declines is usually far less than the strength of subsequent recoveries.

Despite periodic volatility and even bear markets, remaining disciplined and committed to one’s investment policy has historically proven beneficial over time. In due time, any long-term investor will inevitably face down a bear market, while still maintaining their ability to earn positive returns over time. In that regard, the odds are still very much in any investor’s favor.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.

© 2025 YCharts, Inc. All rights reserved, The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided “AS IS” with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.