The bottom line? Sticky services inflation keeping CPI elevated and the Fed on hold

- Consumer inflation remains solidly above the Fed’s 2% target, having eased only modestly over the past year. Coupled with the threat of higher tariffs in the coming months, the inflation outlook still appears to be sufficiently uncertain to keep the Fed on pause for the time being.

By the numbers: CPI edges up, but tariff impact still limited

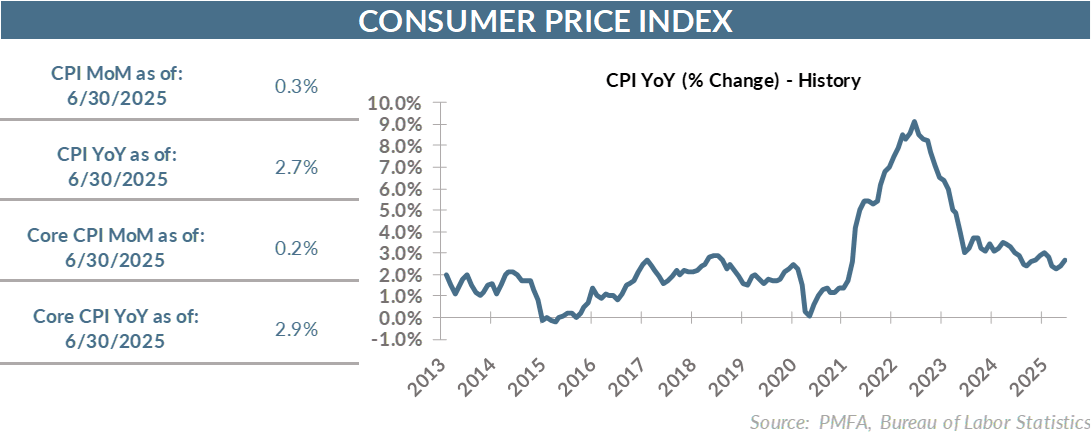

- The consumer price index rose 0.3% in June, in line with forecasts. Core CPI, which excludes food and energy, rose by a slightly more constrained 0.2%, besting the forecast of a 0.3% increase last month.

- Despite the relatively modest June increases, the trailing 12-month readings for both measures of consumer prices edged higher. Headline CPI surged from 2.4 to 2.7%, while core rose from 2.8% in May to 2.9% in June.

- Notably, the overwhelming drivers of inflation continue to bubble up from the services sector. Food prices rose by 3.0% over the past year, particularly due to rising prices at restaurants; the cost of dining out rose 3.8% over that period.

- Despite a 0.9% surge in June, energy prices declined over the past year, helping to keep top-line inflation in check.

- Price increases on other goods remain quite constrained, having risen by a modest 0.7% over the past year.

- Boil it all down, and it’s not the goods economy that’s the primary cause for inflation remaining stubbornly elevated. That could change if the full scope of threatened tariffs become reality, but for now, their impact has been relatively benign.

Broad thoughts: Tariff talk heats up, but flexibility is key

- The bifurcation in underlying price pressures between the goods economy and the services economy is still notable.

- Rising shelter costs is a critical piece of the inflation puzzle given their heavy weighting in the index and the elevated pace of cost increases. While well off their cyclical highs, housing inflation of close to 4% continues to be a major challenge for consumers, particularly renters and those looking to buy a home.

- Beyond shelter, rapidly rising prices across much of the services sector has made the path back to 2% inflation a difficult one, tying the Fed’s hands and keeping a floor under interest rates.

- With few exceptions, service sector inflation remains elevated; medical, transportation, recreation, and education-related services rose by 3.4–4.0% over the past year, illustrating that it’s not just a shelter story.

- The fact that goods inflation remains a relative bright spot may be surprising given all the tariff talk in recent months. Expectations have been volatile, but implementation delays have mitigated their impact thus far.

- The recent flurry of threatened tariff increases will give consumers and Fed policymakers reason for caution, although it’s far too early to conclude that they’ll become reality. Nonetheless, it’s a strong signal that inflation worries could persist and upside risk to goods prices remains. That uncertainty is likely to keep the Fed in a holding pattern and short-term policy rates higher for longer.

- Further progress in trade negotiations could alleviate the magnitude of uncertainty, but recent developments have largely trended in the opposite direction.

- Conversely, even with higher tariffs again on the table, developments over the last few months have demonstrated a high degree of flexibility being employed by the Trump administration in both the magnitude of potential tariffs and the timing of potential implementation.

- That flexibility in tariff policy provides a potential off-ramp should the administration decide to take it. That will likely require additional concessions from trade partners to get a deal done or, at a minimum, justify a patient approach in negotiations with America’s trade partners. Whether or not that will be the case remains to be seen.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.