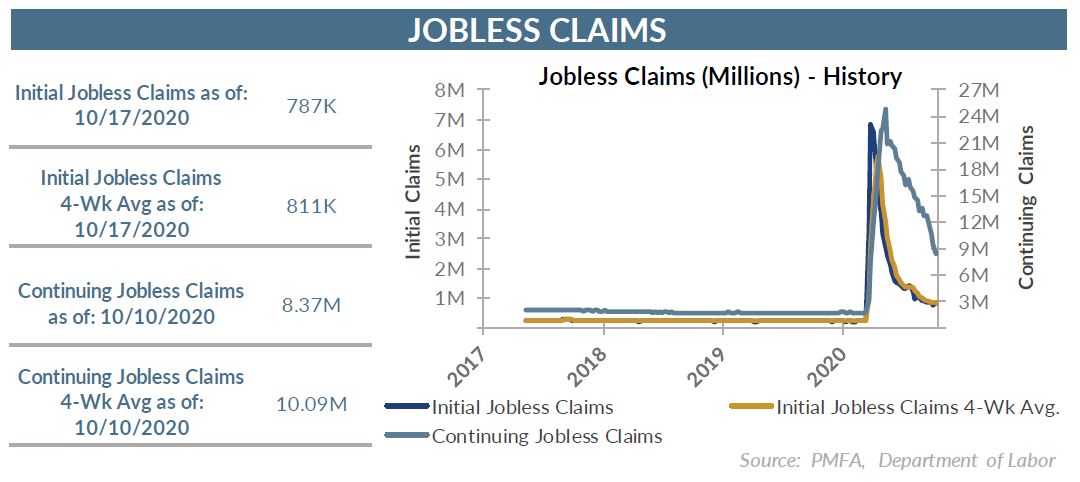

Jobless claims dropped unexpectedly sharply last week, declining to 787,000 from a revised 842,000 for the prior week. Expectations were for a decline to about 870,000 from the first estimate of 898,000 for the week ended October 10. Continuing claims also dropped dramatically from about 9.4 to 8.37 million — down by over 1,000,000 in just one week.

Jobless claims dropped unexpectedly sharply last week, declining to 787,000 from a revised 842,000 for the prior week. Expectations were for a decline to about 870,000 from the first estimate of 898,000 for the week ended October 10. Continuing claims also dropped dramatically from about 9.4 to 8.37 million — down by over 1,000,000 in just one week.

Claims had held firmly at levels above 800,000 since late August, as layoffs remained stubbornly high. Though still highly elevated relative to historical standards, initial claims have come down significantly from their pandemic high of nearly 6.9 million in late March.

One key factor in this week’s decline was California’s decision to start accepting new claims again after a multiweek shutdown initiated to process the backlog of claims in the state. During that period, the Labor Department was simply carrying forward the final pre-shutdown total each week as an estimate of claims for the state. As the state with the largest workforce in the country, that number was significant, and potentially overstated, distorting potential improvement in the numbers. The effect was significant, as claims in California totaled about 159,000 compared with about 226,000 that had been used as a placeholder since the week ended September 12. With hindsight, that likely overstated claims to some degree in recent weeks.

Although the magnitude of the weekly decline was exacerbated by the use of likely overstated estimates for California over the past month, it’s still paints a positive picture of continuing improvement in labor market conditions. If anything, it suggests that there was more progress over the last month than was apparent in the reported numbers.

Looking forward, the big concern is the acceleration in COVID-19 cases and the potential for restrictions being reimposed to attempt to reduce its spread. At a minimum, that would dampen continued improvement and could lead to an outright reversal in progress on the jobs front at least temporarily.

Additionally, the status of negotiations in Washington for another stimulus bill remain a concern, particularly given the impact on the millions of workers still displaced by the pandemic. Supplemental unemployment insurance benefits provided by the CARES Act were a lifeline for households that experienced a loss of income from layoffs. With about 11 million workers still sidelined, a compelling need for additional support still exists, but with the presidential election rapidly approaching, political maneuvering is a significant part of the calculus of negotiations between the two parties. Some form of relief is almost certain; the question is ultimately about size and timing.

The bottom line? The report is good news for the labor market and for the economy. Although the pace of improvement has slowed, the recovery remains firmly on track.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.