Editor’s Note: This article was originally published on March 26, 2021, but was updated on April 6 , 2021 to reflect an announcement by the Small Business Administration that applicants will not be required to obtain either a Data Universal Numbering System (DUNS) number or an account with the federal System for Award Management (SAM).

The recently enacted American Rescue Plan Act of 2021 (ARPA) included a $28.6 billion dollar Restaurant Revitalization Fund (RRF) to help eligible food and beverage businesses that have been affected by the COVID-19 pandemic. The RRF will provide restaurant revitalization grants via an application process that will be managed by the Small Business Administration (SBA). As is often the case in the early days after a new program like this is enacted, the legislation has given us a big-picture view of the intended relief for affected restaurants while simultaneously raising many questions about how the program will be administered. Here’s an overview of what we know at this point, some thoughts on the possible interaction of this new relief with the Paycheck Protection Program (PPP) and employee retention credit (ERC) rules, and some insights on things affected businesses can be doing now to prepare for the application process.

Eligibility for RRF grants

The restaurant revitalization grants will be available to establishments such as restaurants, bars, taprooms, tasting rooms, and other similar businesses where the public gathers for the primary purpose of being served food or drink. The legislation also extends eligibility to caterers, food trucks, food stands, and similar businesses that serve food without offering a traditional dining area. A special rule clarifies that any of the foregoing establishments that are located in an airport terminal or owned by a tribal government may be eligible for the grants.

The RRF provisions of the ARPA do exclude certain businesses from RRF eligibility, including:

- Businesses owned or operated (together with any affiliated business) with more than 20 locations as of March 13, 2020, regardless of whether the locations do business under the same or multiple names

- Any business that has applied for a “Shuttered Venue Operator Grant”

- Publicly traded companies

- Businesses operated by a state or local government

Businesses that submit RRF grant applications must also make good-faith certifications that the uncertainty of current economic conditions make these grants necessary to support their ongoing operations. This certification is similar to that found in the PPP loan application.

Key takeaway: These rules establish a two-step eligibility determination that first looks to the nature of operations and then focuses on specific exclusions. The affiliation rules are of particular interest given the potential for disqualification where more than 20 locations are operated on an aggregated basis. The ARPA describes affiliation as being based on either a 50%-or-greater ownership test or the contractual authority to control a business. Further guidance is expected to define this affiliation in greater detail.

Determining the amount of restaurant revitalization grants

Grants are based on the “pandemic-related revenue losses” suffered by eligible businesses and are subject to limitations of $10 million per eligible entity and $5 million per location operated by the entity. Pandemic-related revenue losses are calculated based on one of the following four rules, depending on the length of time that the business has been in operation:

- General rule: The general rule is that pandemic-related revenue losses are calculated by deducting 2020 gross receipts from 2019 gross receipts, then reducing that amount by any first and Second Draw PPP Loan proceeds received.

- Special rules:

- If the eligible business wasn’t in operation for all of 2019, then the calculation compares annualized gross receipts for 2019 and 2020. For this purpose, businesses compute their average monthly gross receipts for the months of operation in the year and then multiply such amount by 12.

- Businesses that opened after Jan. 1, 2020, and before March 11, 2021, will compute their grant amount by adding up their eligible payroll costs and then deducting the amount of gross receipts during the year.

- Businesses that haven’t opened yet can qualify for a grant based on the amount of eligible payroll costs incurred as of March 11, 2021, the date the ARPA was enacted.

The ARPA allows the SBA to issue guidance providing alternative formulas for these special rules, but no guidance has yet been issued.

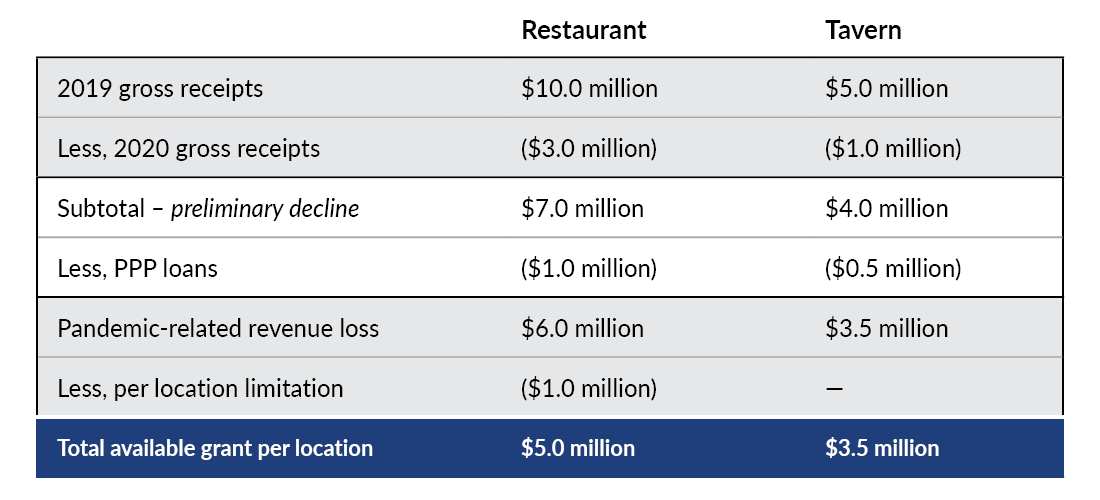

The following examples illustrate the calculation of a restaurant revitalization grant in two different scenarios:

- Example #1: ABC, Inc. operates a restaurant and a tavern under different brand names. Both locations began operations before 2019. The businesses suffered gross receipts declines during 2020 as they were forced to suspend on-premises dining for most of the year. ABC Inc. did receive PPP loans, but is also eligible to apply for $8.5 million in restaurant grants based on the following calculation:

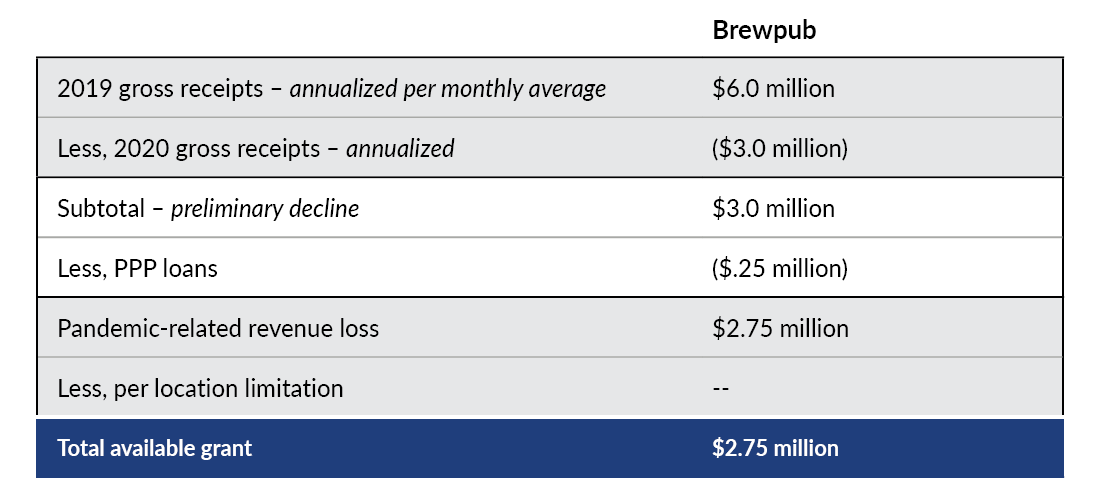

- Example #2: DEF, LLC operates a one-location brewpub that began operations in July 2019. For the 2019 calendar year, it generated a total of $3.0 million in gross receipts or a monthly average of $500,000. Thus, its annualized gross receipts for 2019 was $6.0 million. During 2020, DEF only generated an average of $250,000 per month, or $3.0 million for the year. It received $250,000 in PPP loans, and is eligible for $2.75 million in RRF grants based on the following calculation:

Use of grants

Restaurant revitalization grants must be used to pay qualifying expenses during the covered period. Any grants not fully utilized in this manner must be returned to the SBA. Specific expenses that are eligible include:

- Payroll costs

- Mortgage principal & interest payments

- Rent payments (except for prepayments)

- Utilities

- Maintenance costs

- Supplies (including personal protective equipment & cleaning supplies)

- Food & beverage costs

- Covered supplier costs (utilizing the PPP definition)

- Operational expenses

- Paid sick leave

The covered period for the RRF began on Feb. 15, 2020, and ends on Dec. 31, 2021. However, the ARPA allows the SBA to extend the end date to any time prior to March 11, 2023.

Key takeaway: Similar to PPP loans, the RRF grants include terms directing recipients to use the funds to cover a variety of operational costs within a covered period. The covered period began prior to the enactment of this program, so we expect additional guidance will describe how to document use of funds for prior expenses. The potential extension of the end of the covered period is also a key point of interest. If the ending date is extended further into the future, then recipients will be provided with greater opportunities to plan which expenditures to fund with these grants as compared to other incentive programs.

Coordination of ERC, PPP, and RRF

The RRF is another form of business support program for the restaurant and hospitality industry that has implications for both 2020 and 2021. Previously, these businesses were eligible for PPP loans (First and Second Draw) and the ERC. RRF grants will now be available to cover similar expenses, with effective dates that overlap at various points. However, these programs have anti-duplication rules that require consideration. The coordination of benefits from these different COVID-19 relief programs will present a significant operational challenge for businesses as they attempt to optimize the benefits while staying within the rules of each program. For example, eligible businesses may wish to allocate payroll expenses to supporting PPP loan forgiveness and ERC claims first and utilize the RRF grants for other eligible expenses (e.g., food and beverage inventory costs). At a minimum, this will require consideration of the applicable rules and coordination of planning to optimize the benefits under each program.

Key takeaway: The forthcoming guidance from the SBA is eagerly anticipated since it will clarify many practical implications for RRF grant recipients. In the interim, any businesses that will be eligible for RRF grants should revisit their ERC and PPP computations to determine the prior expenses that have been utilized under those programs. Projections for the remainder of 2021 will also be helpful for projecting the coordination of these programs through the remainder of the effective dates of each.

Preparing for the application process

While the RRF program was enacted on March 11, 2021, it cannot be utilized until the SBA provides additional guidance as well as application forms. This guidance has not been released yet but is expected in the coming weeks. Once the application process opens, the ARPA requires the SBA to prioritize applications from small businesses owned and controlled by women and veterans, as well as socially and economically disadvantaged small businesses, for the initial 21 days of the application period. Applicants who qualify under one of these categories will be expected to submit a self-certification of eligibility along with their application. After the initial 21 days, all grant applications will be processed.

A particular subject of interest is the procedural system that the SBA will utilize for accepting RRF applications. On March 30, 2021, the SBA announced that applicants will not be required to obtain either a Data Universal Numbering System (DUNS) number or an account with the government’s System for Award Management (SAM) website. That announcement was welcome news given that those registrations would add complexity, and potential time delays, to the application process. Interested applicants should continue to monitor the SBA website in the coming weeks for further details on the application process. The SBA will begin accepting applications for the Shuttered Venue Operators Grant program on April 8, 2021, so it is anticipated that announcements regarding RRF applications will be coming soon.

Watch for SBA guidance, prepare in advance

While the ARPA provided great news for many restaurants with the creation of the RRF, several key details remain unclear. Expect additional guidance from the SBA on topics such as:

- Timing and logistics of the application process.

- Clarification on the attribution rules that will determine what qualifies as an “affiliated business” for the “20-location” limitation.

- Details on the content of self-certifications for priority applications as well as the certification of good-faith need for funds.

- Confirmation of the covered period that will be utilized.

- Coordination of RRF grants with PPP loans and other programs.

- Further clarification of the expenses that may be funded with RRF grants.

The ARPA makes clear that, with the exceptions of the priority application period and the $5 billion set aside for lower-revenue businesses, the application process will be first-come, first-served. As we’ve seen with other COVID-19 relief programs, it’s likely that the funds will be depleted quickly. If you think you may be eligible for a restaurant revitalization grant, it’s best to get started on the preliminary applications as soon as possible and monitor the SBA website closely for news about the application process and related guidance.

Please contact Plante Moran if we can be of any assistance to you in applying for an RRF grant.