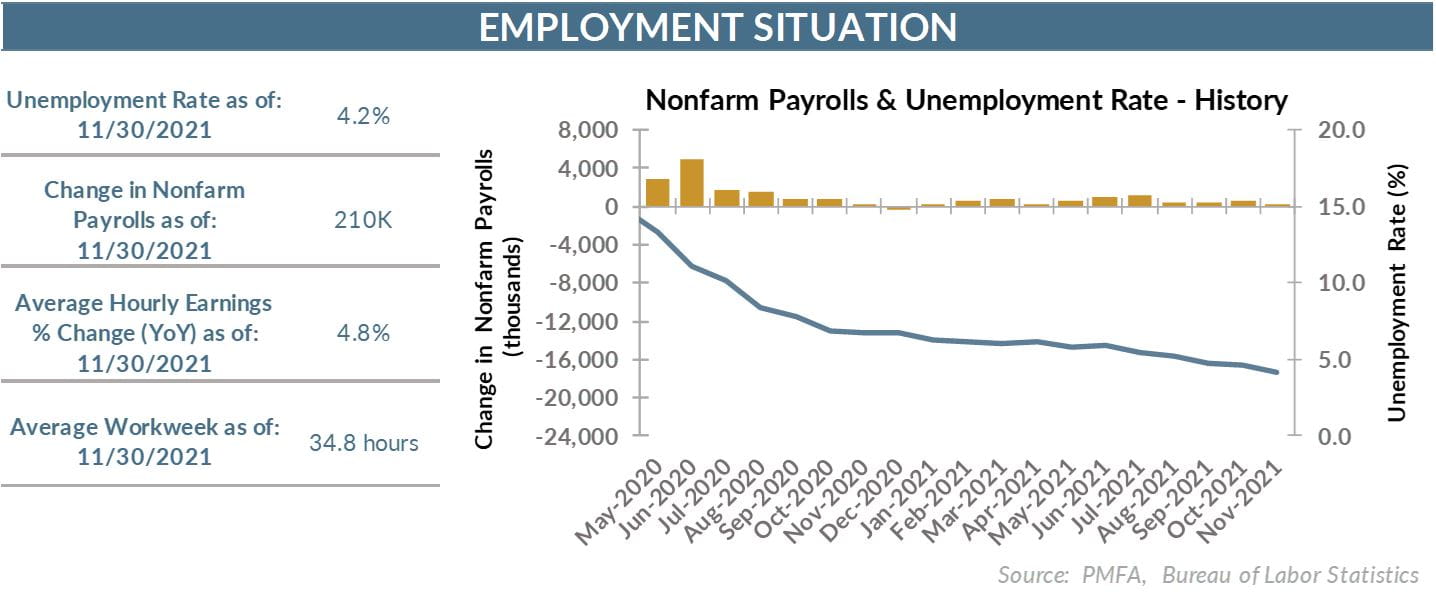

By most measures, the November jobs report was quite positive, despite a considerable downside miss on jobs created during the month. The unemployment rate dropped to 4.2% in November, its lowest level since February 2020 — shortly before the COVID-19 pandemic broadsided the U.S. economy, shutting it down virtually overnight. The decline from 4.6% in October was more substantial than the forecast for a modest decline to 4.5%. Additionally, a broader view of joblessness that incorporates individuals who are working part time due to economic conditions also fell to 7.8%. Both measures point to a labor economy that continues to recover, gradually returning toward its pre-pandemic state.

By most measures, the November jobs report was quite positive, despite a considerable downside miss on jobs created during the month. The unemployment rate dropped to 4.2% in November, its lowest level since February 2020 — shortly before the COVID-19 pandemic broadsided the U.S. economy, shutting it down virtually overnight. The decline from 4.6% in October was more substantial than the forecast for a modest decline to 4.5%. Additionally, a broader view of joblessness that incorporates individuals who are working part time due to economic conditions also fell to 7.8%. Both measures point to a labor economy that continues to recover, gradually returning toward its pre-pandemic state.

Beyond the decline in the jobless rate, the big surprise in the report was the comparatively weak nonfarm payroll gain of just 210,000 in November, falling well short of expectations for a 545,000 gain. Revisions to the preceding two months added 82,000 jobs, taking some of the edge off of that one-month gap. Moreover, the three-month average gain of 378,000 is still consistent with a labor economy that’s expanding at a strong clip.

There are some indications that the lackluster payroll gain may have been distorted by seasonal factors, as the nonseasonally adjusted increase of 778,000 was substantially higher. Statistical adjustments are particularly challenging to apply right now given the volatile conditions of the last few years. Additionally, the significant lift of over 1.1 million in the number of employed individuals in the household survey points to a much better month for job creation than what the headline nonfarm payrolls number alone suggests.

Regardless of the progress made, there is still much work to be done to push through the negative lingering effects of the COVID-19 pandemic and related economic fallout. Total nonfarm payrolls remain nearly 4 million below their February 2020 peak, and the total labor force is 3 million below its level for the same month. Even those gaps don’t tell the full story, as long-term growth trends in the labor force would have been expected to lift the labor force by another two million workers or more since early last year. The gap remains large, helping to explain how tight conditions in the labor market are today.

Tight conditions are readily apparent in surging hourly wages, which rose by 4.8% over the past 12 months, as the competition to attract and retain workers remains intense. The monthly gain of 0.3% was the lowest since March though, perhaps an indication that pressures are easing as the pace of growth cools and more individuals return to the workforce. The labor force participation rate rose by 0.2% to 61.8%, its highest point since March 2020.

In part, the economy is now seeing the unintended negative consequences to the decision of fiscal policymakers to push all their chips to the center to stimulate growth over the past year. Few would have anticipated that supply chain disruptions would remain so acute or that labor market conditions would remain so tight, creating an environment in which both the economy’s supply and demand sides pushed inflation to levels not seen in decades. Although fiscal support has waned, its impact is now forcing the Fed’s hand to not only take steps to cool the economy but to do so more aggressively than what previously appeared necessary.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.