Although they have little to no bearing on the near-term outlook, equity valuations have been a good indicator of long-term returns. When valuations are low, long-term forward-looking returns tend to be higher; when valuations are high, the opposite is true. As such, we pay close attention to valuations as we evaluate portfolio positioning through the lens of long-term opportunities.

Of course, there are multiple ways to attempt to value stocks, but we believe that doing so through the lens of earnings remains appropriate. Earnings growth tends to be the primary driver of returns over the long term, with expansion or contraction in valuation multiples acting as either a tailwind or a headwind over time.

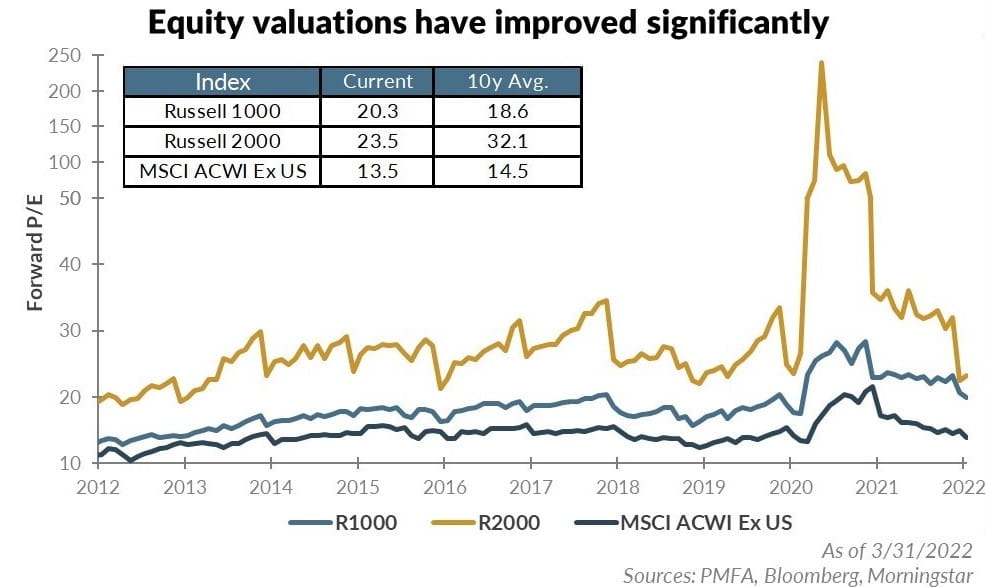

As illustrated above, the price/earnings (P/E) ratio for major stock indexes surged in 2020, as analysts slashed earnings expectations in the early days of the pandemic and recession. The subsequent rebound in earnings since mid-2020 more than offset strong equity returns though, allowing some of that valuation froth to be relieved.

More recently, performance has dimmed, as inflation concerns, central bank tightening, and war in Ukraine have dampened investor enthusiasm. The decline in broad market indexes in recent months, coupled with continued solid earnings growth, has further reined in valuation multiples. By virtually any measure, stocks are priced more attractively now than they were a year ago. Small caps are trading at a significant discount to their 10-year average valuation, while foreign stocks are priced at a near-record discount to U.S. markets. Large caps look the most expensive relative to the last decade but still don’t appear grossly overvalued today.

The bottom line? Equity valuations are nowhere near all-time highs and already attractive opportunities have generally become more interesting in recent months.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.