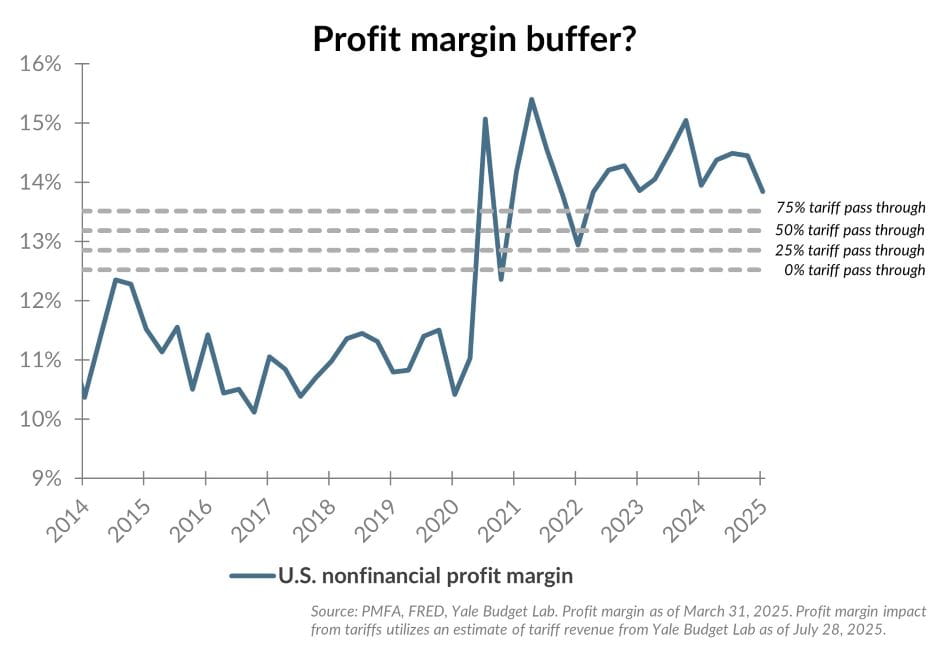

Multiyear trends in corporate earnings suggests that some firms may be well-positioned to absorb at least some of the impact of newly implemented tariffs. Input costs for most imported materials, components, and finished goods are expected to rise, but companies that have built a growing profit margin cushion since 2020 likely have additional flexibility to absorb at least a portion of those additional costs.

While not representative of all businesses, S&P 500 profit margins remain well above pre-pandemic averages, bolstered by solid pricing power, operational efficiencies, and disciplined cost management in recent years. Margins have dipped from their recent peaks but remain historically elevated, particularly in highly profitable tech-oriented sectors. Other sectors, such as consumer staples where margins are typically narrower, may have less flexibility. Further, smaller businesses may feel a greater impact, necessitating that more of the additional tariff cost be passed along to their customers.

Recent regional Federal Reserve business surveys suggest U.S. businesses in aggregate may absorb roughly 40% of the cost burden, while consumers (50%) and foreign exporters (10%) absorb the rest. The chart above illustrates the potential impact on profit margins under various scenarios. In more competitive industries, firms may have to shoulder more of that burden. Balancing the need to hold market share and sustain profitability will make decisions related to absorbing tariffs versus passing them through even tougher.

The bottom line? The impact of tariffs won’t be uniform across the economy, with every business regardless of industry or size having to decide how much to absorb and how much to pass through. Consumers will see higher prices in the coming months, but the burden of tariffs aren’t going to fall solely on households to absorb.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.