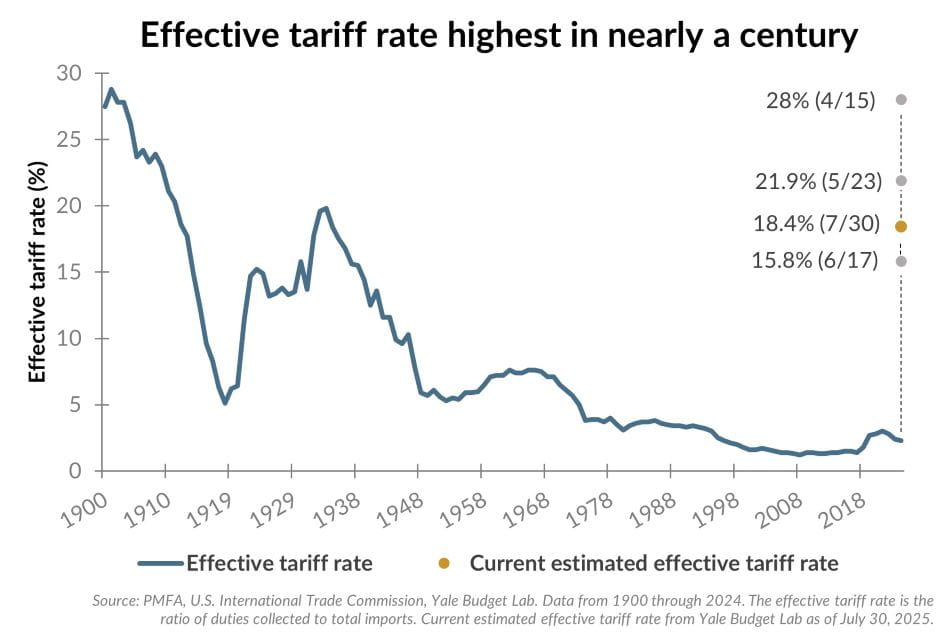

As of July 30, the effective U.S. tariff rate was estimated at 18.4%, which — if fully implemented — would be the highest since 1933. Estimates of the effective rate have been fluid in recent months, ranging from a high of 28% in April to 15.8% in mid-June. The recent uptick from the mid-June low follows a wave of new trade measures announced in July, including a 25% tariff on Indian imports and expanded levies on Chinese goods.

For context, the effective tariff rate averaged just 2.5% in 2024, underscoring the magnitude of change to trade policy this year. Some domestic industries may benefit from increased protection, but the broader impact is mixed. If current policy holds, Yale Budget Lab projections suggest a 0.4% drag on GDP and potential job losses approaching 500,000 by year-end. Still, with negotiations with many trade partners ongoing, the range of potential outcomes remains wide.

For investors, the effective tariff rate represents more than just a shift in trade policy. Companies will have to adapt as they consider how to best position themselves to manage costs, retain market share, and optimize profitability. For some, the absorption of at least a portion of the additional cost associated with import levies will weigh on earnings. Consumer spending is also expected to be influenced in the near term as higher prices chew into household discretionary spending.

The combined effect will alter the outlook for growth and inflation. To what degree? That remains an open question.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.