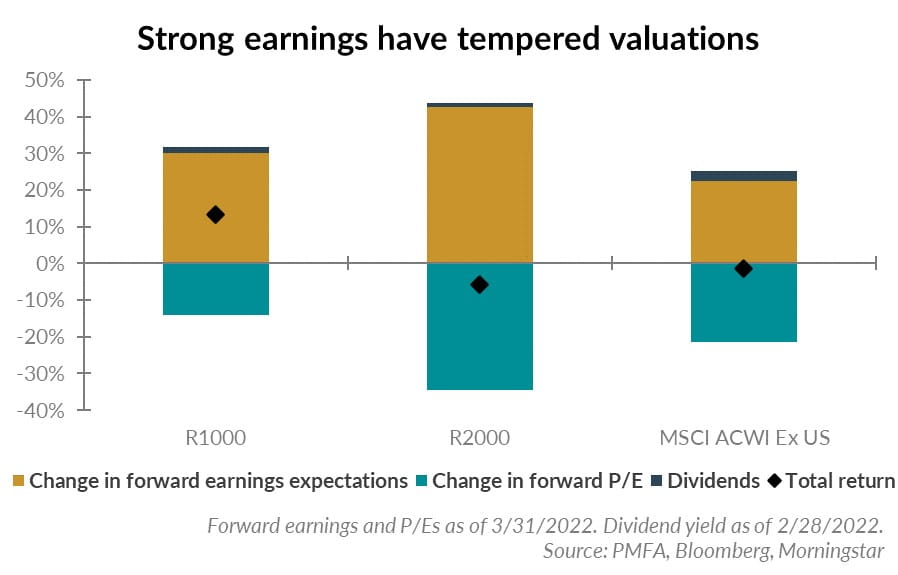

What was behind the notable contraction in equity multiples over the past year? As the economy bounced back in 2020, corporate earnings also rebounded much more quickly than anticipated. Robust stock market returns didn’t keep pace with earnings growth, which was even stronger. As illustrated above, earnings growth globally topped 20% for the year ended March 31, led by a gain of more than 40% for the Russell 2000 index of small-cap stocks. The recent downdraft in markets since mid-December has also played a role, but a relatively modest one by comparison. The rebound in earnings has been a major factor, with dividends contributing modestly as well. Although earnings growth for the coming year is expected to be more subdued, the actual results of the last year provide a strong base to build upon.

Any view on valuations should also take into consideration the interest rate environment. Looking ahead, the degree of upside in long-term interest rates remains a significant question. Higher short-term rates are a foregone conclusion at this point, but long-term yields have remained surprisingly well anchored in recent months. An unexpected surge in long-term rates could be a catalyst for additional volatility and a further paring of equity multiples. Given the expectations already priced in, an even more aggressive upward move in rates than is anticipated would be needed to push equity investors to recalibrate their expectations. That would likely mean that inflation doesn’t begin to recede over the latter half of 2022 as expected, and the Fed has to pump the proverbial brakes quicker and harder to cool economic conditions.

The bottom line? The strength of corporate earnings over the past two years was a key driver behind robust stock returns but also behind the reduction in equity valuations. As a result, stock valuations generally look more attractive than they were a year ago. Recent volatility notwithstanding, that’s good news for long-term equity investors.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.