First, the bottom line: Surging imports skew Q1 growth picture

- The further refinement of Q1 GDP to reflect additional information didn’t change the picture much. The story remains the same: The economy contracted modestly in the first quarter, largely due to a surge in imports, as consumers and businesses alike attempted to front-run tariff-induced price hikes.

By the numbers: It’s all about trade. Mostly.

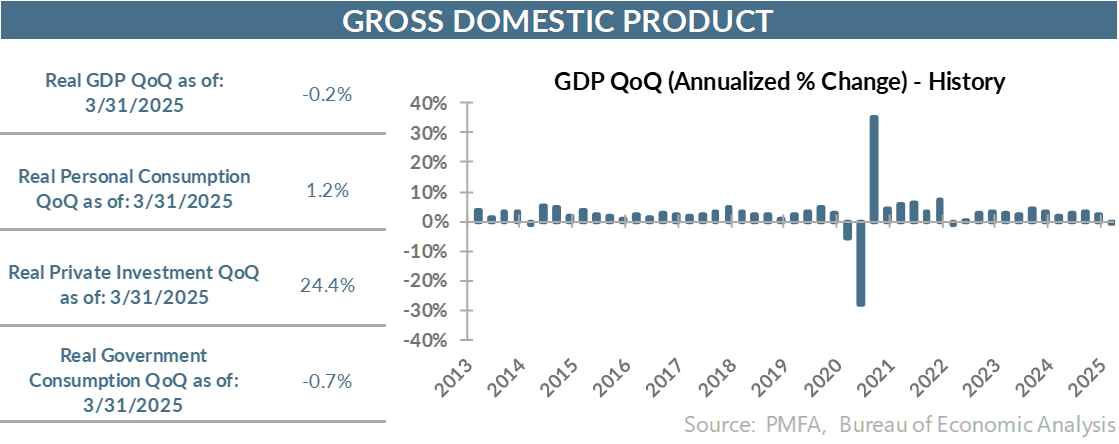

- Today’s GDP release refined the data a bit, leading to a slight improvement in the reported contraction in Q1. That being said, the -0.2% print for the quarter versus the previously reported -0.3% doesn’t remotely change the narrative.

- Underlying the fractionally negative growth in the first quarter was one primary catalyst — a sharp widening in the trade deficit that shaved multiple percentage points off top-line GDP growth for the quarter.

- Taken in isolation, the trade deficit knocked down growth by 4.9 percentage points. That drag was mitigated by a lift from inventory investment during the quarter, which went hand in hand with the surge in imports. The 2.6 percentage point positive contribution by inventories effectively cut the top-line impact of trade-related volatility by more than half.

- The impact of tariff front-running alone was easily the difference between growth of around 2% for the quarter and modest contraction.

- That’s not to say that the loss of momentum in the economy was solely a result of trade flows and businesses stockpiling to weather the trade storm. Growth in personal consumption expenditures slowed considerably in Q1 to just 1.2% from a brisk 4.0% pace in the previous quarter.

- A more cautious consumer mindset was evident in all spending categories spanning goods and services but was most notable in big-ticket items. Spending on durable goods contracted by 3.8%, a sharp reversal from the 12.4% advance in Q4.

Trade court ruling: Good news, but not enough to restore confidence

- The weak start to the year notwithstanding, it remains to be seen how consumers and businesses will choose to navigate the mixed news on trade and tariffs in the coming months. A flurry of recent news has helped to lift spirits as the worst potential near-term outcome for tariffs will be avoided, but it’s far from over.

- An easing in pessimism was readily apparent in the positive reaction in the futures market to yesterday’s news that the U.S. Court of International Trade has put a hold on many of the tariffs announced by the Trump administration.

- While the court’s decision will be appealed, it provided at least a temporary spark of optimism that feared price hikes for a wide range of imported goods will be delayed further, if not avoided. But its impact shouldn’t be overstated. The decision alone isn’t enough to precipitate a return to “business as usual” for consumers, small businesses, or corporate America.

- Plenty of questions remain, and are likely to restrain spending, hiring, and business investment until a more definitive “new normal” can be reached with major U.S. trade partners. The rules of the game continue to change, and it’s that instability in part that will continue to weigh on confidence.

- What that will mean for near-term economic results remains to be seen. The headwind of surging imports has subsided, lifting one challenge to Q2 growth. Looking ahead, consumers will hold the key. If the labor market stays on a solid footing, household spending — even if it’s somewhat sluggish — could be enough to keep the economy advancing in the coming months.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.