Many businesses have been adversely affected by a change in the tax treatment of research and experimentation (R&E) expenses that went into effect on Jan. 1, 2022. Instead of having the option to currently deduct R&E expenses, businesses will need to begin amortizing Internal Revenue Code (IRC) Section 174 R&E expenditures — over five years for U.S.-based expenses and over 15 years for foreign research expenses. The law applies to a broad range of costs typically associated with research and development, as well as “any amount paid or incurred for the development of any software.” This change resulted in a significant reduction in deductible expenses for 2022 and will continue to do so in 2023 and future years, leading to higher taxable income. Businesses are continuing to feel the pinch of this change based on their 2022 filings and their estimated quarterly tax calculations for 2023.

For many taxpayers, the first step in complying with these new rules is creating an accounting process that accurately tracks the costs that must be amortized. The good news is that many of these amortized costs could also qualify for the research and development (R&D) tax credit under IRC Section 41. Similar to 2022, businesses are facing a significant increase in their tax bills again as a result of amortizing R&E expenses, but could potentially reduce that bill if they take the next step and determine which of those costs qualify for the R&D tax credit.

Not all Section 174 R&E costs are R&D expenditures

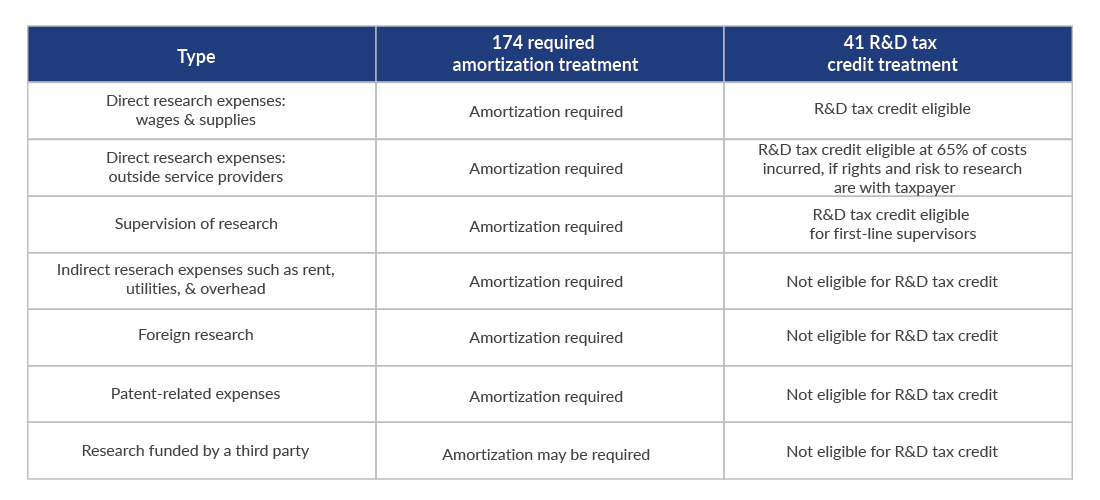

It’s important to note that not all of the costs required to be amortized under Sec. 174 will automatically qualify for an R&D tax credit. The new law’s reach is broad, and Sec. 174 covers all of a taxpayer’s direct and indirect research or experimental expenditures incurred, while the R&D tax credit allows for only direct research expenses. Here are some examples of expense categories with differing treatment between Sec. 174 and Sec. 41:

Five-year impact of Section 174, with and without R&D credit

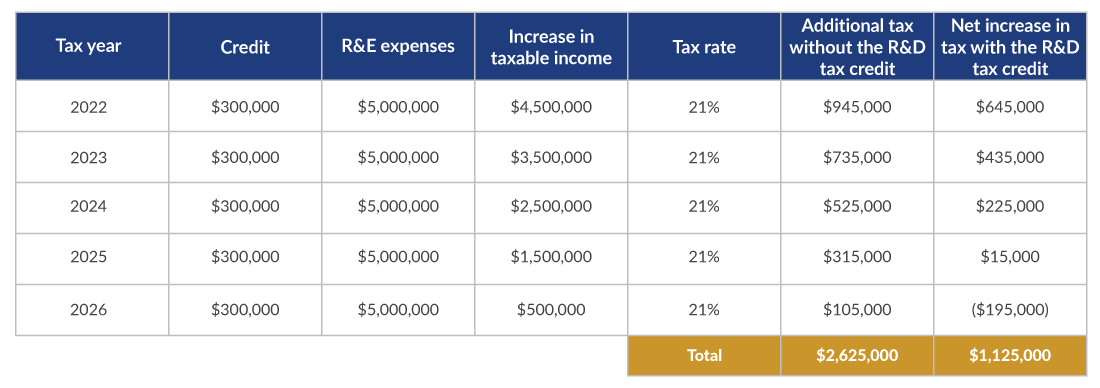

Consider a C corporation with $5 million in annual U.S. R&E expenses that must now be amortized under Sec. 174. An R&D credit study shows that the business qualifies for a $300,000 R&D tax credit based on those costs. The table below shows the impact of the amortization requirement on that business’s taxable income over the next five years, with and without the R&D tax credit.

The dollar-for-dollar reduction in tax liability delivered by the R&D tax credit saves this company $1.5 million in federal income over a five-year amortization period.

R&D tax credits limited by NOLs

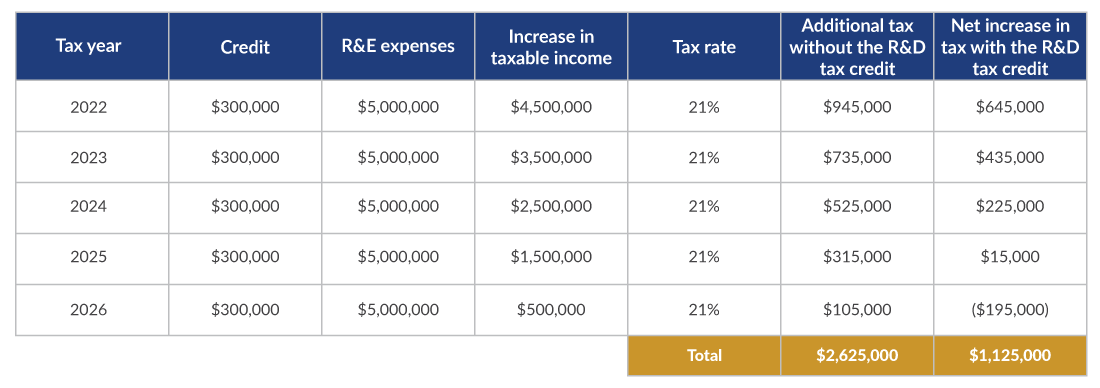

In the past, some businesses have considered claiming the R&D tax credit but dismissed it when they weren’t able to use the credit immediately, due to net operating losses (NOLs). The example below shows how the Sec. 174 R&E amortization rules will accelerate the utilization of NOL carryforwards for some businesses, making the R&D tax credit a valuable tax-planning tool.

Because the changes to Sec. 174 amortization reduces the expenses the business can deduct in 2023, it pushes the taxpayer from a taxable loss into a taxable income position for the year. Then, NOLs from prior years are carried forward and utilized, but not enough to wipe out the entire tax liability. The R&D tax credit can now reduce that balance on a dollar-for-dollar basis in 2023, whereas it would have provided no current benefit to the business if the full $5 million in R&E expenses had been deducted.

Legislative uncertainties with Section 174

On Sept. 8, 2023, the IRS issued Notice 2023-63 interim guidance on the treatment of research costs. The Notice responds to some technical questions from taxpayers on required capitalization requirements under Section 174. The Notice also requests comments be submitted by Nov. 24, 2023 but will take comments submitted after the date into consideration. There are still efforts underway to repeal or push back Section 174 amortization. At this time, however, businesses should be on the lookout for proposed regulations in 2024 and planning for tax year 2023 as if the R&E amortization rules will remain in effect when they file their 2023 tax returns.

If your business invests in developing new products, processes, or software, an R&D tax credit study could help to offset the impact of the R&E amortization rules on your 2023 income taxes. To learn more about how your business may qualify for this tax-saving credit, don’t hesitate to contact one of our tax credit specialists.