As the year-end approaches, health insurance companies have a few tricky accounting items to get ahead of. Technology enhancements at your organization, new regulations, and changes to claim trends owing to the pandemic could all impact your financial reporting and budgeting this year. Get up to date on these trends to make sure you’re ready, and reach out to us (or your actuary and tax advisor) if you need help, as much of what’s covered here is quite complex.

1. Social determinants of health

Social determinants of health (SDOH) — and the collection of related data — is one of the biggest emerging issues that health plans will face in the near-term. As governments aim to gather more data on the potential impacts of SDOH on health plan members, especially for Medicaid and Medicare members, health plans will need to consider how they might gather, track, and relay this data to state and federal regulators.

To handle SDOH data, you may need to add technology buildouts to your existing claims system, if you have that capability. If you don’t, you’ll likely need to buy a new claims system or other add-on software to perform these tasks. You may even need additional technology tools to analyze the data. What does this mean for your accounting? New considerations you can’t afford to ignore — specifically, capitalization and amortization requirements from both a GAAP and statutory perspective for any new or additional internal use software you acquire. New technology can be expensive, so don’t leave any tax credits on the table here.

2. Accounting for internal use software

Speaking of accounting for new software, the Financial Accounting Standards Board (FASB) has recently issued a few Accounting Standards Updates (ASUs) regarding just that, providing perspective on fees and implementation costs. Two to note are ASU 2018-15, Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That is a Service Contract, and ASU 2015-05, Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement.

Review your tools and check to see if there’s a license to run the software. If so, it can qualify as an intangible asset to be capitalized under ASU 2015-05. Even certain costs incurred during the development stage of the software implementation may be eligible to capitalize under the revised GAAP guidance through ASU 2018-15.

The statutory accounting policies and procedures (specifically, SSAP 16R — Electronic Data Processing Equipment and Software) has adopted the majority of the provisions of these ASUs with some modifications, such as prescribed amortization periods and non-admit considerations. Make sure you review the SSAP policies and procedures so you know you’re getting it right. Failure to do so could lead to misstated assets, overstated expenditures, and again, losing out on tax credits that you aren’t aware you qualify for.

3. Rising claims and claims adjustment expenses

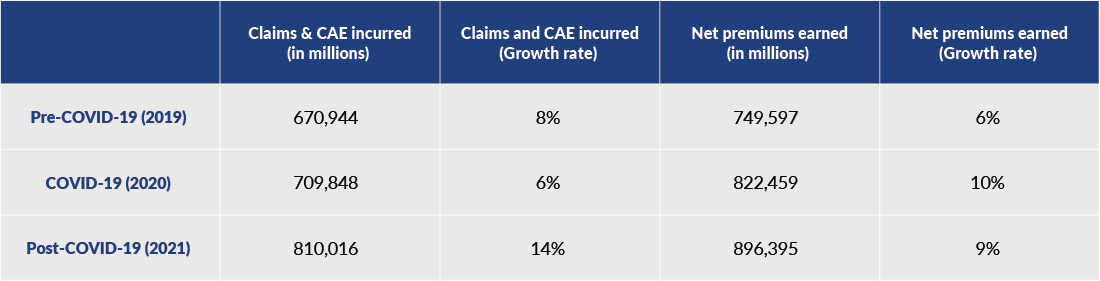

The growth rate of claims and claims adjustment expenses (CAE) incurred in 2021 outpaced the growth rate of net earned premiums in 2021, and the trend appears to be continuing. Of course, COVID-19-related illness led to more claims, but other issues such as getting treatment that had been delayed due to the pandemic, worsening health due to those delays, and worsening mental health have compounded the negative effects and added dramatically to the volume and size of claims.

*Data from S&P Capital IQ – Financial Highlights for Health Industry

The resulting elevated claim ratios and decreasing investment income have had a significant impact on health insurer operations across the industry. If these trends persist, you’ll need to start factoring in the potential effects on reserves, including premium deficiency reserves (PDR), at the onset of the policies for both GAAP and statutory reporting. Per ASC 944-60-25-4, a premium deficiency needs to be recognized if the sum of expected claim costs and claim adjustment expenses, expected dividends to policyholders, unamortized acquisition costs, and maintenance costs exceeds related unearned premiums.

Through year-end and into the next year, keep an eye on upcoming regulatory initiatives and climbing claim costs, particularly as they pertain to capitalizing projects costs appropriately, determining reserves, and establishing ample premium rates to support their population’s claim experience.

Don’t leave anything on the table

Everyone in the health insurance industry is looking for creative ways to navigate the financial challenges of the last few years. Start by making sure you’re not leaving any tax credits on the table, capitalizing eligible costs, and reserving appropriately. Consult with your accounting professional to ensure you’ve covered everything above, and get in touch if you need more assistance.