Significant legislation was enacted in 2021 and 2022 that has dramatically expanded the available tax credits, tax incentives, and other funding opportunities related to the green energy sector. Several of these are built on previously existing programs, but many are new and widely applicable. The breadth of qualifying activities is significant, including the production of electricity; production of solar, wind, and energy equipment; installation of energy-efficient upgrades to businesses and homes; and the acquisition of electric vehicles (EVs) and charging equipment. Going further, new monetization options open the benefits of qualifying activities to nonprofits, governments, and other organizations that are tax-exempt. This vast array of new and enhanced options creates opportunities for almost all taxpayers and organizations. Here are some of the most important opportunities for you to consider.

How did we get here? Overview of recent legislation

Considerable attention was paid to tax legislation in recent years, with numerous seismic changes proposed. Ultimately, the core tax rules relating to the corporate tax rate, capital gain tax rate, trusts, and estate and gift taxation were left largely intact. However, numerous tax opportunities now exist due to one core bill and two related bills. These opportunities may be especially attractive to businesses that are managing the impact of new capitalization rules for research and development expenses or those seeking to achieve a variety of environmental, social, and governance (ESG) goals.

The Inflation Reduction Act of 2022 (IRA) was signed into law on Aug. 16, 2022, as the culmination of more than a year of negotiations among members of the Democratic Party. The vast majority of tax increases proposed in the Build Back Better Act were excluded, so the primary focus of the IRA is a collection of climate and energy incentives intended to support domestic clean and renewable energy production. The tax credits and incentives included in the IRA generally took effect at the beginning of 2023. Beyond tax programs, the Department of Energy (DOE) was also provided with over $100 billion in funding to advance expansive grant and loan programs. The combination of tax incentives and broader funding are expected to spur adoption of new technology and equipment while shaping the broader supply chain.

Two other bills that were enacted in 2021 and 2022 on a bipartisan basis have some degree of overlap with the IRA. Those were the CHIPS and Science Act of 2022 (CHIPS Act) and the Infrastructure Investment and Jobs Act of 2021, (Infrastructure Act). The CHIPS Act provides a combination of tax incentives and funding to support the domestic semiconductor industry, which is much more targeted than the IRA but fits within the broader push for domestic manufacturing. The Infrastructure Act funds infrastructure improvements across the United States (bridges, roads, airports, ports, etc.) while also paving the way for improvements that support IRA programs (electric transmission, EV charging network, and pipelines for captured carbon, among others).

Key topics and categories of the Inflation Reduction Act

Below is a detailed breakdown of the tax credits and incentives included in the IRA:

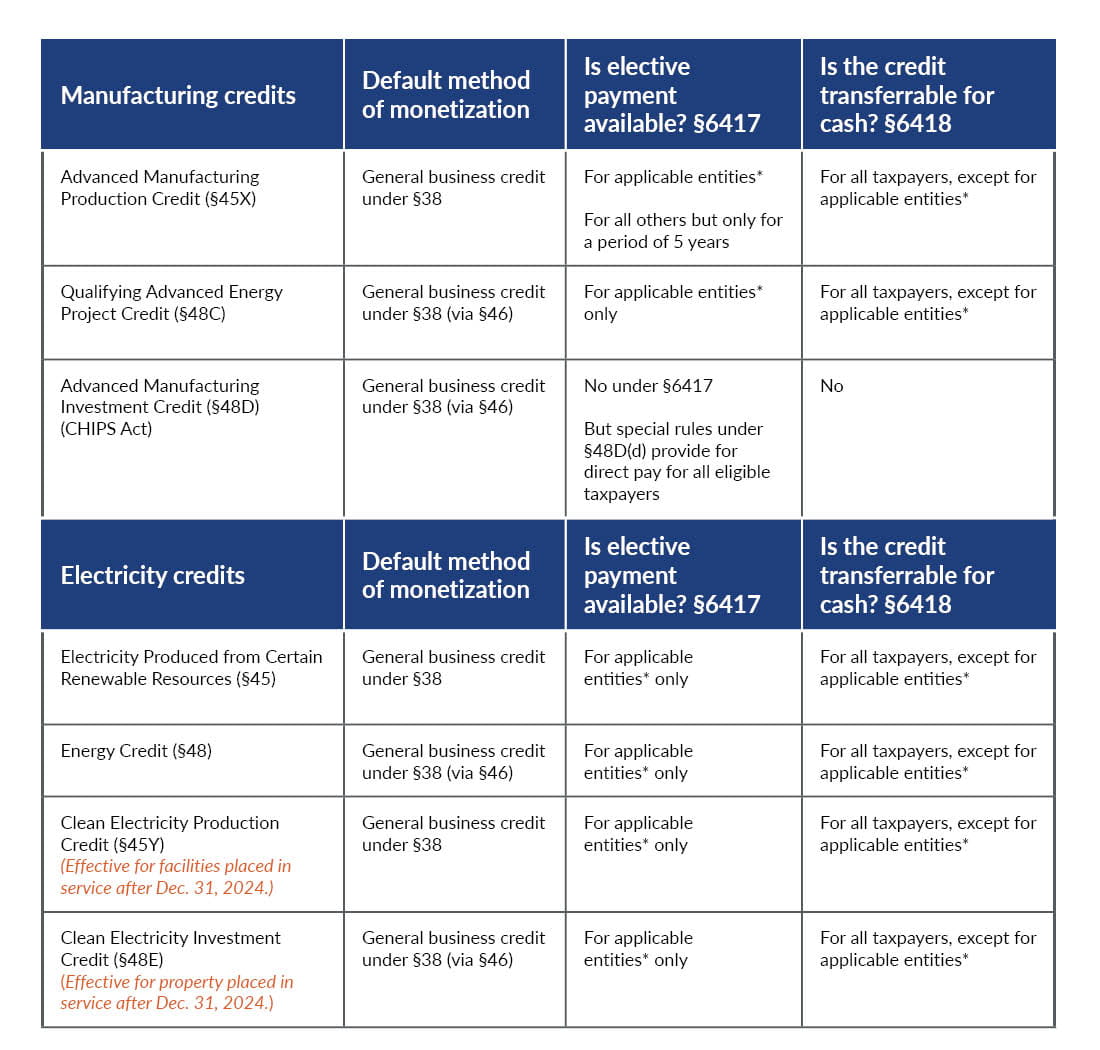

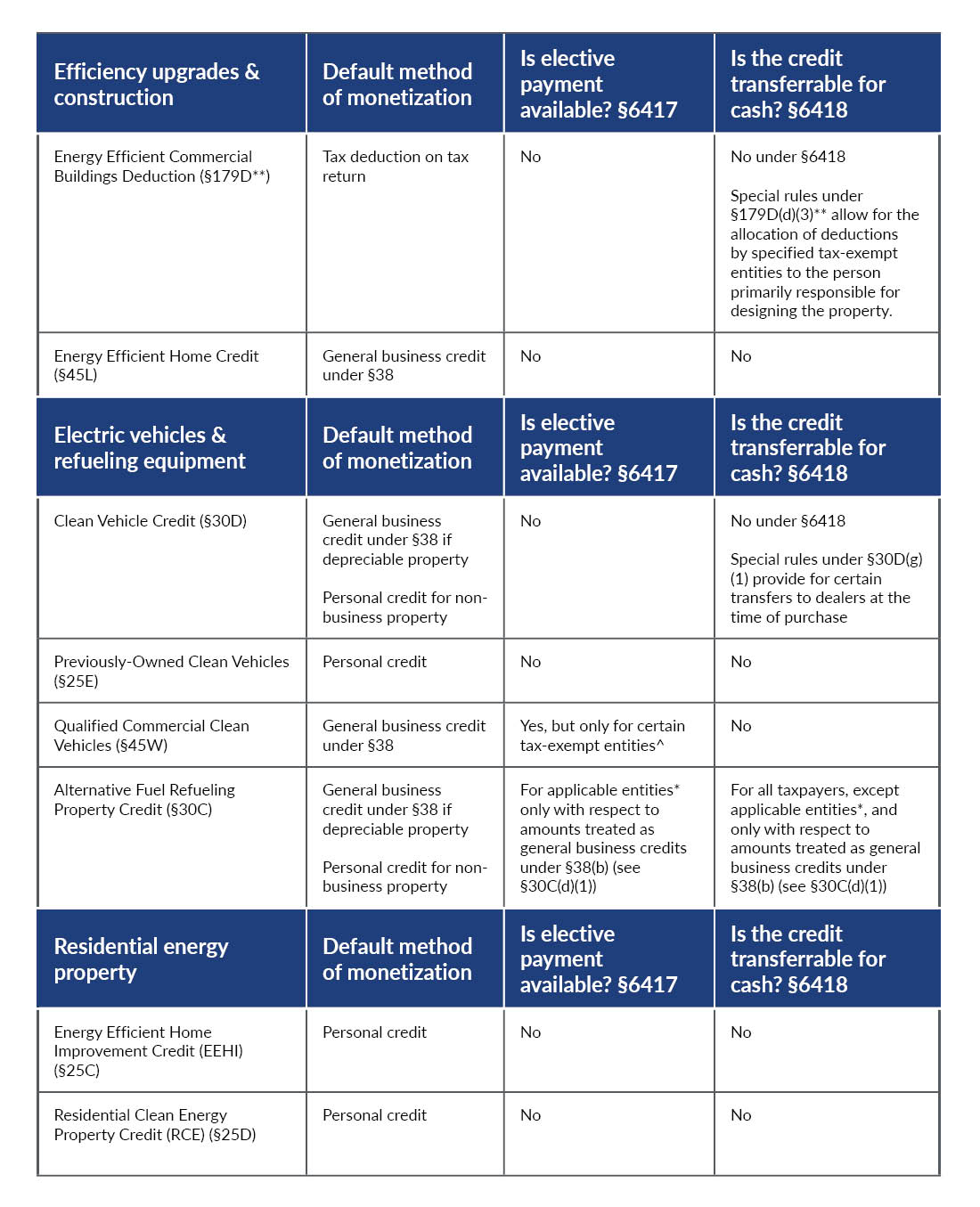

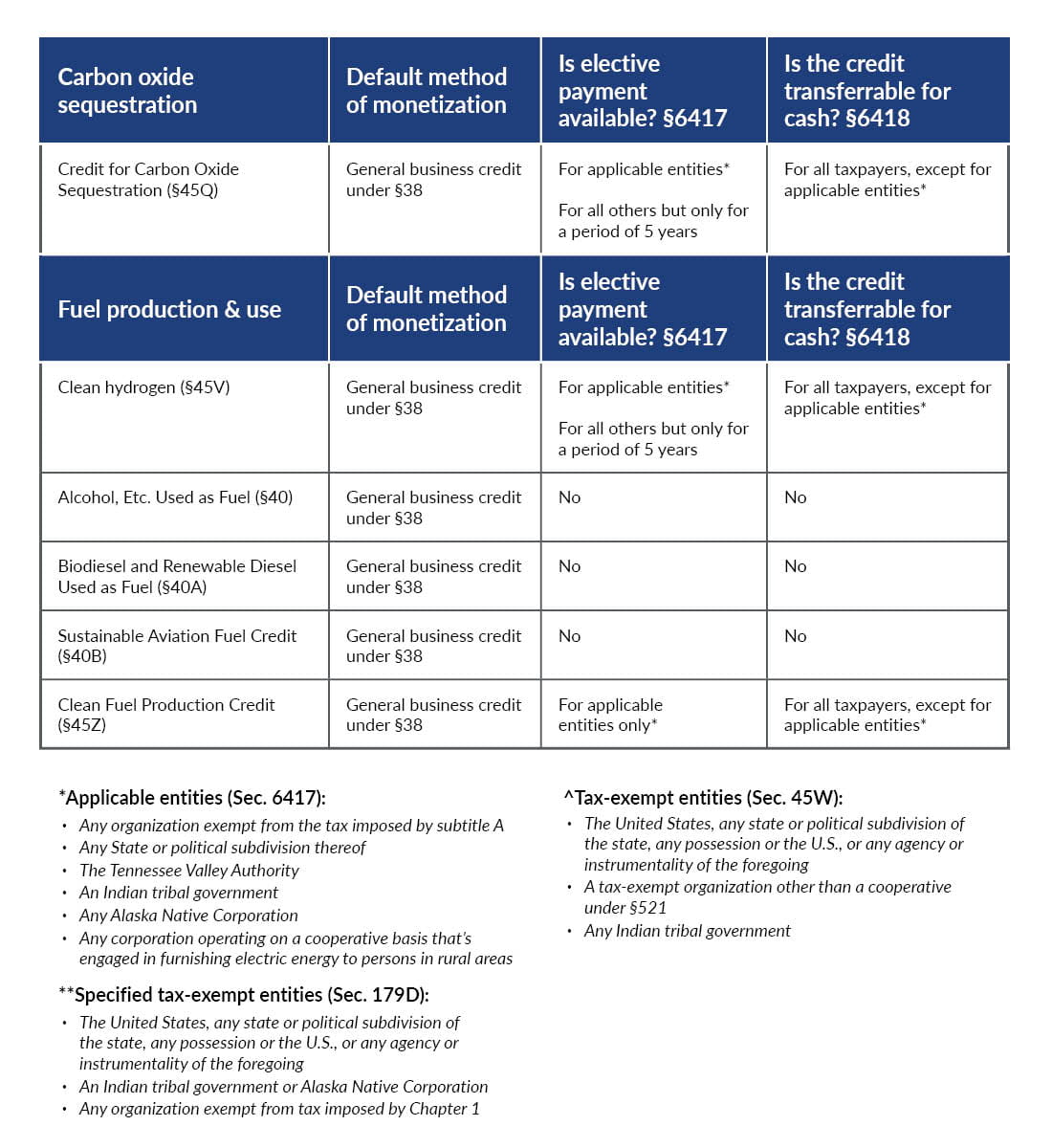

- How to benefit? New and enhanced monetization options — The IRA provides two new options for the monetization of tax credits. One option, involving sales of credits for cash, is especially useful where projected tax credits are likely to outweigh the current and near-term tax liabilities of those generating the credits. In addition, a second option paves the way for a variety of tax-exempt entities to obtain the cash benefit of tax credits in the absence of traditional tax liabilities.

- Credit computations: Baseline, 5x multiplier, and bonus options — Most of the tax incentives include tiered calculations, with enhanced amounts triggered through compliance with special rules. These rules amplify the available benefits while adding complexity to qualification and documentation.

- Tax credits for manufacturers— The IRA includes two key tax credits for manufacturers. Importantly, those credits are available to businesses that manufacture key components for the green energy sector (e.g., solar, wind, and battery equipment). The CHIPS Act also created a similar tax credit structure for businesses engaging in the production of semiconductors or semiconductor equipment.

- Electricity production from renewable and clean resources — A core component of the IRA is an expansion of tax credits related to the production of electricity from renewable resources. On this front, two existing credits were modified significantly for the near term while two new credits are set to take effect in future years.

- Clean vehicles and refueling equipment — Prior to the IRA, tax credits were available for the acquisition of EVs and installation of charging equipment. Those credits have been modified and expanded significantly. In addition, two new tax credits were created that provide incentives for businesses to purchase EVs and for individuals to purchase used EVs.

- Energy-efficient upgrades and construction— The IRA also expanded tax incentives related to the installation of energy-efficient building upgrades and the construction of energy-efficient homes.

- Residential energy property — Tax credits for individuals have also been expanded for the installation of a variety of energy efficiency and green energy upgrades at their homes.

- Credit for carbon oxide sequestration — The tax credit for the capture and use of carbon oxide was also expanded by the IRA. This provides enhanced incentives for those that either capture carbon as part of an industrial facility or through direct air capture.

- Fuel production and use credits — Finally, the IRA created a new tax credit generated by the production of “clean hydrogen” and modified the tax credits regime related to certain transportation fuels.

How to benefit? New and enhanced monetization options

The IRA created two new monetization options that are expected to drive greater interest in the enhanced tax credits. Those options are responsive to two potential challenges. First, the breadth and significance of IRA credit opportunities could naturally result in the accumulation of excess credits by taxpayers with limited ability for their use in the near term. Second, tax credits offset income tax liabilities, so entities that are generally not subject to tax might not be able to benefit from these opportunities. As outlined below, there are now multiple paths for taxpayers to generate cash benefits from qualifying activities. (Please see the table at the end of this article, which describes the monetization options available for each of the tax credits.)

- Direct use or allocation to investors (Sec. 38 general business credit) — The default mechanism for using business related tax credits is the existing general business credit rules under Sec. 38. Such rules result in a dollar-for-dollar reduction in the taxpayer’s federal income tax liability, subject to an annual limitation. Specifically, the limitation is equal to the taxpayer’s net income tax, minus the greater of the tentative minimum tax for that tax year or 25% of the taxpayer’s tax liability that exceeds $25,000. Thus, the credits can generally offset at least 75% of the taxpayer’s federal tax liability for the year with unused credits carrying forward to the next tax year. Partnerships and S corporations that generate credits allocate such amounts to their investors for use.

- Transferability: Transfers of credits in exchange for cash payment (Sec. 6418) — A new option allows taxpayers to sell credits to an unrelated taxpayer in exchange for cash payment. This is available to taxpayers and excludes tax-exempt entities (e.g., the applicable entities described below under Sec. 6417). The cash received in the sale is not included in taxable income of the transferor. The payment is nondeductible by the transferee that uses the tax credit against its own tax liability. Additionally, the transferee is unable to further transfer the credit and must apply it in the year that it was earned by the transferor. This option is expected to provide expedited monetization but may involve a market discount due to counterparty risk and due diligence requirements.

- Direct pay: Tax refunds through elective payment (Sec. 6417) — Certain taxpayers also have the option to elect to receive a direct payment from the IRS in the form of a refund as a deemed overpayment of taxes. This option is primarily intended for applicable entities, which are defined to include: tax-exempt organizations, state or political subdivisions, the Tennessee Valley Authority, Indian tribal government, any Alaska Native Corporation, or any corporation operating on a cooperative basis that’s engaged in furnishing electric energy to persons in rural areas. The deemed overpayment and refund construct provides access to tax credit benefits for such entities that ordinarily wouldn’t have federal income tax liabilities. Furthermore, all other taxpayers can use the elective payment process for a limited period of time for three specific credits (Sec. 45X, Sec. 45Q, and Sec. 45V) that are discussed in more detail below.

The IRS and Treasury Department released initial guidance related to the transferability and direct pay monetization options in mid-June 2023. That guidance includes a new set of frequently asked questions, proposed regulations for transferability and direct pay for IRA-related credits, proposed regulations for direct pay of the semiconductor credit from the CHIPS Act, and temporary regulations implementing a pre-filing registration program. Additional guidance is expected as the 2023 calendar year advances and will formalize the monetization options and procedures.

Credit computations: Baseline, 5x multiplier, and bonus options

The majority of enhanced tax credits and incentives include multiple levels of benefits depending on whether certain requirements are satisfied. There are four core concepts applicable to many of the tiered computations:

- Base amounts (initial and amplified) — The enhanced credits begin with a base amount, which is typically amplified by a 5x multiplier. The key driver of the amplified amount is satisfaction of prevailing wage and apprenticeship hour requirements. However, some projects will be exempt from those rules if construction began before Jan. 29, 2023, or if the project is below a certain size. Prevailing wage rules require the payment of minimum hourly wages established by the DOL to all contractors and subcontractors involved in the project. Apprenticeship rules similarly mandate the completion of a specific amount of project hours by apprentices. The IRS has released initial guidance interpreting these rules in Notice 2022-61 and prevailing wage data is maintained by the DOL. The prevailing wage and apprenticeship hour requirements will likely add labor costs and documentation burdens to many projects but will provide the benefit of unlocking amplified credits.

- Energy community bonus amount — Projects located in an energy community qualify for additional bonus credits. Projects are in an “energy community” if located in brownfield sites, census tracts where a coal mine closed after 1999 or a coal-fired power plant was retired after 2009, or areas where 25% of local tax revenues are related to the extraction, processing, or storage of coal, oil, or natural gas at any time beginning in 2010. The U.S. Department of Energy maintains a site with a map showing potential Energy Community Tax Credit Bonus areas. Initial guidance has also been provided in Notice 2023-29 and Notice 2023-45.

- Domestic content bonus amount — An additional credit increase is available for projects meeting domestic content requirements. Those rules require the use of steel, iron, or manufactured products produced in the United States. Specifically, steel or iron must generally be derived from manufacturing processes taking place in the United States, except metallurgical processes involving refinement of steel additives. Furthermore, manufactured products will be deemed to be produced in the United States if not less than the adjusted percentage of the total costs of all manufactured products of the facility are attributable to products minded, produced, or manufactured in the United States. The adjusted percentage varies based on the applicable credit and tax year when equipment is placed in service, but ranges between 20 and 100%. Additional details will be necessary to implement this rule, including the process for a taxpayer to certify its use of domestic content. It’s expected that guidance will be forthcoming on the process of implementation. Please see Notice 2023-38 for additional details and rules on the domestic content bonus credit.

- Other bonus amounts — Additional bonus credits are available based on special rules applicable to the various tax credits. For example, additional credits are available for the installation of solar or wind facilities in a low-income community, on Indian land, as part of a low-income residential building project, or as part of a qualified low-income economic benefit project. Under this rule, projects are considered to be located in a qualified “low-income community” when located in a census tract with a poverty rate of at least 20%, where the median family income (MFI) is 80% or less of statewide MFI, or on “Indian land.” Indian land is defined as land located within the boundaries of an Indian reservation or lands held by a tribe. In order to qualify under this rule, taxpayers must complete an application process and receive an allocation of such credits. See Notice 2023-17 for initial guidance related to low-income community bonus credits.

Tax credits for manufacturers

Manufacturers have three predominant credit options based on the IRA and the CHIPS Act:

- Advanced Manufacturing Production Credit (Sec. 45X) — A significant new tax credit is a production credit under Sec. 45X for businesses that manufacture and sell a variety of energy components. Specifically, this includes the production of solar energy components, wind energy components, inverters, battery components, or critical minerals. To qualify, the taxpayer must both produce the eligible components and sell them to an unrelated person after Dec. 31, 2022. Production must also occur within the United States. The amount of this credit is calculated through different methods depending on the specific components that are produced and sold (e.g., stated rates based on the electricity output of the system, capacity of the battery, or weight of components, among others). The Sec. 45X credit is a favored credit that’s eligible for the expanded direct pay mechanism for a period of five years. Thus, taxpayers other than applicable entities may choose to either use the credit directly, sell such credits under Sec. 6418, or file for tax refunds under Sec. 6417 for a maximum of five years.

- Qualifying Advanced Energy Project Credit (Sec. 48C) — The second credit that specifically benefits manufacturers is the advanced energy project credit under Sec. 48C. This is an enhanced tax credit provided to those that place in service new investments into industrial or manufacturing facilities for the production or recycling of components for the green energy supply chain. This credit previously existed but has been expanded to cover new investments and $10 billion in additional funding has been provided. Those modifications took effect on Jan. 1, 2023. Some of the definitions of qualifying investments mirror those of the Sec. 45X credit discussed above, but this credit is much more expansive albeit with a certification process requirement. Qualification for this credit requires an advance application and the receipt of an allocation of such credits through a competitive process administered by the DOE. Those allocated tax credits will then be claimed in the future after the qualifying equipment is placed in service. Initial guidance from the IRS has been published in Notice 2023-18 and Notice 2023-44. Further guidance on the application process and criteria is found on the DOE’s website.

- Advanced Manufacturing Investment Credit (Sec. 48D) — The third credit for manufacturing and production is an investment credit found in Sec. 48D that was included in the CHIPS Act. This is a new tax credit provided to manufacturers that place in service qualified property as part of an advanced manufacturing facility. Such facilities include both those that manufacture semiconductors and those that manufacture semiconductor manufacturing equipment. Qualified property must be placed in service after Dec. 31, 2022. However, if the construction of the property began before 2023, then only the basis of property constructed after Aug. 9, 2022, may be included in the computation of the credit. Similar to the Sec. 48C credit above, the Sec. 48D credit is obtained through a competitive application process administered by the Commerce Department. Initial guidance from the IRS has been provided in the form of proposed regulations on the program overall and special elective payment rules.

Electricity production from renewable and clean resources

Multiple tax credits are generated by the production of electricity from specific resources. In this context, taxpayers have the choice of either claiming an investment tax credit calculated based on the cost of installing the equipment or a production tax credit calculated based on the annual amount of electricity produced. The IRA expanded the two previously existing credits and added two new credits with delayed effective dates. The current and future credits are largely similar, but the specific rules will change depending on the year in which qualifying equipment is placed in service.

- Electricity Produced from Certain Renewable Resources Credit (Sec. 45) — The IRA amended the production tax credit based on the generation of electricity from certain renewable resources. The qualifying action here is the production of electricity (in kilowatt (kW) hours) from “qualified energy resources” at a “qualified facility” during the first 10 years the facility is in operation. Such production must occur within the United States or a possession of the United States, and the electricity must be sold to an unrelated taxpayer. Qualified energy resources for purposes of this credit include wind, solar, biomass (open- and closed-loop), geothermal, irrigation power, municipal solid waste, qualified hydroelectric, and marine and hydrokinetic energy.

The Sec. 45 credit is generally equal to 0.3 cents per kW hour of electricity, but this is increased to 1.5 cents per kW if either: (1) the facility has a maximum net output of less than 1 megawatt (mW) (alternating current), (2) the prevailing wage and apprenticeship requirements are satisfied, or (3) construction began before Jan. 29, 2023. The credit can also be increased by increments of 10% of the calculated amount if the domestic content requirements are satisfied or the facility is located in an energy community.

- Energy Credit (Sec. 48) — The IRA also expanded the investment tax credit related to installation of certain energy property. This credit mirrors the Sec. 45 credit discussed above but is more expansive in the types of property that will qualify. For this purpose, the term “energy property” includes: qualified small wind energy property; solar equipment used to generate electricity, to heat or cool a structure, or to provide solar process heat; geothermal equipment used to produce, distribute, or use energy from a geothermal deposit; qualified fuel cell property or microturbine property; combined heat and power property; equipment using the ground or groundwater as a thermal energy source to heat a structure or as a thermal energy sink to cool a structure; waste energy recovery property; energy storage technology; qualified biogas property; and microgrid controllers. It also includes “interconnection property,” which is property to connect smaller capacity facilities (maximum net output of 5 mW or less) to the electric grid.

The Sec. 48 credit is initially equal to 6% of the basis of qualifying energy property, but this is increased to 30% if either: (1) the facility has a maximum net output of less than 1 mW of electrical (alternating current) or thermal energy, (2) the prevailing wage and apprenticeship requirements are satisfied, or (3) construction began before Jan. 29, 2023. That credit percentage can be increased by additional 10% increments if domestic content rules are satisfied, or the project is placed in an energy community. Additional bonus credits (10 or 20% increments) are available to solar and wind facilities that are placed in service of a low-income community under Sec. 45(d)(1), on Indian land, as part of a low-income residential building project, or as part of a qualified low-income economic benefit project. However, such low-income bonus credits require an advanced application and a resulting allocation of environmental justice solar and wind capacity limitation. Taken together, the spectrum of potential tax credits could range from 6 to 70% of the eligible basis, subject to several specific details.

- Future credit: Clean Electricity Production Credit (Sec. 45Y) — Taxpayers are eligible for the Sec. 45Y credit if they produce electricity at a qualified facility and either sell the electricity to an unrelated taxpayer or install a special meter and then either sell, use, or store such electricity. For this purpose, a qualified facility is one that: (1) is used for the generation of electricity, (2) is placed in service after Dec. 31, 2024, and (3) achieves a zero-greenhouse gas emissions rating. Qualified facilities are further limited to claiming this credit for a 10-year period beginning when the facility is placed in service. Overall, this credit is very similar to the Sec. 45 credit but doesn’t mandate the resources used to generate electricity. Instead, a greenhouse gas emissions rating system will be established to determine qualification.

The base credit amount is 0.3 cents per kW of electricity but is increased to 1.5 cents if the facility either: (1) has a maximum net output of less than 1 mW (alternating current), or (2) satisfies the prevailing wage and apprenticeship hour requirements. Those credit amounts are subject to inflation-based adjustments in future years. This credit is also subject to a four-year phase down beginning the first calendar year after the later of the year in which greenhouse gas emissions from electricity production are 25% of the 2022 level or 2032.

- Future credit: Clean Electricity Investment Credit (Sec. 48E) — The Sec. 48E credit is the investment credit analog to Sec. 45Y. As such, the core qualifications, including the definition of a qualified facility, are nearly identical. The core definitional distinctions are that the Sec. 48E credit also applies to energy storage technology and qualified interconnection property.

Similar to the Sec. 48 credit, the base percentage for the Sec. 48E credit is 6% but is increased to 30% if either: (1) the facility has a maximum net output of less than 1 mW of electrical (alternating current) energy, or (2) the prevailing wage and apprenticeship requirements are satisfied. Additional 10% bonus increments are available if the facility is located within an energy community or the domestic content requirements are satisfied. Finally, additional credit allocations of 10% and 20% are available for facilities placed in service in connection with low-income communities. Such credit allocations are obtained through an application process similar to the one under Sec. 48.

Clean vehicles and refueling equipment

New and enhanced credits are available for the acquisition of clean vehicles and refueling property. Key details are embedded in these rules, but these are generally aimed at providing incentives for businesses and individuals to adopt electric vehicles and fuel cell vehicles (FCVs). To this end, the IRA modified two existing credits and added two new credits:

- Clean vehicle credit (Sec. 30D) — The IRA modified and expanded the credit for the purchase of new clean vehicles that are primarily used in the United States. That credit is outlined in greater detail here and special rules apply to vehicles acquired prior to 2023. The Sec. 30D credit may be claimed by businesses and individuals but is subject to an income-based phase out. Qualifying vehicles must: (1) have a gross vehicle weight (GVW) rating of less than 14,000 pounds; (2) be propelled by an electric motor drawing on a battery with a capacity of at least 7 kW hours that’s capable of being recharged from an external source, or it’s powered by 1 or more fuel cells; (3) be made by a qualified manufacturer (except for FCVs); (4) undergo final assembly in the United States; and (5) have an MSRP that doesn’t exceed $80,000 for vans, sport utility vehicles, and pickup trucks or $55,000 for other vehicles.

The expanded credit amount is made up of two components equaling up to $3,750 each, for a total maximum of $7,500 per credit. This is also subject to an income-based phase out. One component (the critical mineral requirement), is satisfied if a threshold percentage of critical minerals used in the battery were either: (1) recycled in North America; or (2) extracted or processed in either the United States or any country with which the United States has a free trade agreement. The second component (the battery components requirement) is satisfied if the value of battery components that were manufactured or assembled in North America equals or exceeds a phased in percentage. The credit is also subject to a full phase-out if the modified adjusted gross income (MAGI) of the taxpayer exceeds $300,000 for joint filers, $225,000 for heads of households, and $150,000 for all other filers. The taxpayer may apply the lower of the MAGI for the year in which the vehicle is placed in service or the MAGI for the prior year.

- Credit for Previously Owned Clean Vehicles (Sec. 25E) — The Sec. 30D credit discussed above is specific to new vehicles, so the IRA added a new credit for certain purchases of used EVs and FCVs beginning in 2023. To qualify, the purchase must: (1) involve a sales price of $25,000 or less, (2) be acquired from a licensed dealer, (3) the model year of the vehicle must be at least two years earlier than the calendar year of the purchase, and (4) the vehicle can’t have been purchased by another qualified buyer after Aug. 16, 2022. Qualifying vehicles must have a GVW of 14,000 pounds or less, and the vehicle must either be an EV with a battery capacity of at least 7 kW hours or be an FCV.

The credit amount is equal to the lesser of 30% of the sales price or $4,000. However, the credit is phased out for taxpayers with MAGI in excess of: $150,000 for joint filers, $112,500 for heads of households, and $75,000 for all other filers. Importantly, taxpayers can use the lower MAGI from either the year of the purchase or the prior tax year.

- Credit for Qualified Commercial Clean Vehicles (Sec. 45W) — The qualified commercial clean vehicles credit recently codified in Sec. 45W is specifically provided to businesses that place in service “qualified commercial clean vehicles” that are acquired after Dec. 31, 2022, and before Jan. 1, 2033. The credit is calculated as the lesser of: (1) a percentage of the cost of the vehicle (30% of EVs and 15% for FCVs); or (2) the incremental costs of the clean vehicle over the cost of a comparable vehicle powered by a gasoline or diesel internal combustion engine. The maximum credit is $7,500 for vehicles with a GVW rating of less than 14,000 pounds and $40,000 for all vehicles exceeding that amount. Qualified commercial vehicles must be depreciable in the hands of the taxpayer and meet additional definitional rules. However, the Sec. 45W credit will generally provide much more expansive benefits to businesses since it doesn’t require satisfaction of the numerous special rules that are found in the Sec. 30D credit (battery component and critical mineral requirements, purchase price limitation, MAGI phase-out, etc.).

- Alternative Fuel Refueling Property Credit (Sec. 30C) — The alternative fuel refueling property credit found in Sec. 30C is a previously existing credit that was significantly expanded for property placed in service after Dec. 31, 2022. Qualifying property must be installed in either: (1) a census tract defined as a low-income community for purposes of the New Markets Tax Credit (poverty rate of at least 20% or not exceeding 80% of median family income comparison test), or (2) a census tract that wasn’t designated as an urban area based on the most recent census. Qualifying refueling property includes certain qualified clean fuel vehicle property that utilizes: (1) electricity; (2) fuels composed of at least 85% ethanol, natural gas, liquefied petroleum gas, or hydrogen; (3) mixtures, including biodiesel, diesel fuel, or kerosene; and (4) after Dec. 31, 2024, transportation fuels under Sec. 45Z. The credit calculation depends on whether the property is depreciable by the taxpayer (e.g., installation by a business).

- Businesses: For businesses, the credit is equal to 6% of the cost of any qualifying refueling property placed in service for the year. That credit percentage is increased to 30% if either: (1) prevailing wage and apprenticeship hour requirements are satisfied, or (2) construction of the project began before Jan. 29, 2023. However, this credit is subject to an overall limitation of $100,000 per any single item of qualifying refueling property. That overall limitation is a significant expansion from prior rules. Previously, this was capped at $30,000 with respect to all qualifying refueling property placed in service during the year by the taxpayer.

- Individuals: For individuals, the credit is equal to 30% of the cost of any qualifying refueling property placed in service for the year. This is subject to an overall limitation of $1,000 per any single item of qualifying refueling property.

Energy-efficient upgrades and construction

The IRA includes additional tax incentives focused on energy-efficient upgrades to commercial buildings as well as the construction of new energy-efficient homes. These programs previously existed but were expanded and modified significantly. While these are both tax incentives, one takes the form of accelerated depreciation, and the other is a production tax credit.

- Energy-Efficient Commercial Buildings Deduction (Sec. 179D) — Enhanced deductions are provided to businesses that place in service energy-efficient building property or energy-producing property. Starting Jan. 1, 2023, the baseline deduction amount is $0.50 per square foot but is increased by $0.02 for every percentage point decrease in energy and power costs in excess of 25%, up to a maximum of $1.00 per square foot. Those amounts are amplified by 5x, up to $2.50 per square foot and a maximum of $5.00 per square foot if either: (1) the installation began prior to Jan. 29, 2023, or (2) the project satisfies prevailing wage and apprenticeship hour requirements. Additionally, the rules regarding eligible property and computations were relaxed to provide more benefits if the taxpayer wants to periodically upgrade their energy-efficient property after four years.

Organizations exempt from tax are generally unable to benefit from enhanced tax deductions. However, the Sec. 179D program allows certain tax-exempt organizations to allocate the deduction to the person primarily responsible for designing the property. This is available with respect to: (1) tax-exempt organizations; (2) the United States, any state or political subdivision of the state, any possession of the United States, or any agency or instrumentality of those governments; and (3) an Indian tribal government or an Alaska Native Corporation. Please note that this is a different list of tax-exempt organizations from the list of applicable entities under Sec. 6417.

- New Energy-Efficient Home Credit (Sec. 45L) — The IRA also modified the production tax credit resulting from the construction and sale of qualified new energy-efficient homes. The changes extend the availability of the credit through the end of 2032 as well as increasing the maximum credit amounts for qualified energy-efficient property, subject to certain energy savings and prevailing wage standards. The credits are calculated as follows:

- Dwelling units eligible to participate in the Energy Star Residential New Construction Program or the Energy Star Manufactured New Homes Program: $2,500 per unit that meets the applicable energy savings requirements, or $5,000 per unit that is certified as a zero-energy ready home by the DOE.

- Dwelling units eligible to participate in the Energy Star Multifamily New Construction Program: For multifamily homes, the base credit amount per dwelling unit is $500 for units that meet the Energy Star Multifamily Home standard, and $1,000 for units that meet the Zero Energy Ready Home standard. These credit amounts per dwelling unit are increased to $2,500 and $5,000, respectively, if the prevailing wage requirements are met.

The guidance in Notice 2022-61, referenced above with respect to the prevailing wage and apprenticeship requirements for purposes of Sec. 48, also applies (and is the only guidance available as of July 14, 2023) for determining the prevailing wage requirements under Sec. 45L. As mentioned above, while the new Sec. 6418 allows for the transfer of a variety of tax credits from one taxpayer to another, the Sec. 45L credit is not one of those credits — meaning that the Sec. 45L credit remains nontransferable. The credit can only be claimed by an “eligible contractor” on the qualified energy-efficient property when the qualified energy-efficient property is acquired from the eligible contractor by another party.

Residential energy property

These credits are discussed in greater depth in our article focused on credit opportunities for individuals, but here is a summary of those programs:

- Energy-Efficient Home Improvement Credit (EEHI) (Sec. 25C) — This is an enhanced credit provided to individual taxpayers that either: (1) complete energy-efficient improvements, (2) incur residential energy property expenditures, or (3) complete home energy audits during the year. Annual credits are initially capped at $1,200 per individual, and per-category limits also apply (e.g., $600 per year for windows). However, an additional $2,000 in annual credit is available for purchases of certain heat pumps, water heaters, and other equipment. Thus, the true maximum annual credit is $3,200 for individual taxpayers.

- Residential Clean Energy Property Credit (RCE) (Sec. 25D) — This is another enhanced credit provided to individuals that place in service a variety of clean energy resources (e.g., solar, wind, fuel cells, geothermal). This has been expanded to include battery storage technology and biomass fuel property. The credit is calculated as 30% of the cost of qualified expenditures made for property placed in service between 2022 and through 2032. That credit percentage drops to 26% in 2033 and 22% in 2034, before being fully phased out for property placed in service after 2034.

Credit for carbon oxide sequestration

The carbon oxide sequestration credit has been available pursuant to Sec. 45Q since 2008 but was significantly modified by the IRA. This generally requires the capture of carbon by a qualified facility and the use or storage of such captured carbon. The capture and disposal, use, or utilization must occur within the United States or a possession of the United States. The term “qualified facility” means an industrial facility or direct air capture facility, which either: (1) is a direct air capture facility capturing not less than 1,000 metric tons of qualified carbon dioxide during the tax year; (2) is an electricity generating facility that captures not less than 18,750 metric tons of qualified carbon dioxide during the tax year and for which the design has a capture capacity of at least 75% of the baseline carbon dioxide production of the unit; or (3) is any other type of facility that captures not less than 12,500 metric tons of carbon dioxide during the tax year. Construction of a qualified facility must generally begin before Jan. 1, 2033. Additionally, a qualified facility that claims Sec. 45Q credits is ineligible for credits under Sec. 48C, Sec. 48E, Sec. 45V, Sec. 45Y, and Sec. 45Z.

The credit amount is calculated as a stated amount per metric ton of qualified carbon oxide that is captured. However, the amounts vary widely depending on when the equipment is placed in service, the type of facility involved, and the method of storing, using, or otherwise using the captured amounts. Prevailing wage and apprenticeship hour requirements also apply for purposes of Sec. 45Q and multiply credit amounts by five. This is another favored credit, for which taxable entities are eligible for direct pay monetization under Sec. 6417 for a period of five years.

Fuel production and use credits

A combination of new and modified tax credits relates to the production and use of certain fuels. This is another situation where modified credits apply to the first years after enactment of the IRA but are then replaced by a new tax credit in the future.

- Clean hydrogen (Sec. 45V) — This is a new production tax credit for taxpayers that produce “qualified clean hydrogen” at a qualified production facility. Clean hydrogen must be produced through a process resulting in greenhouse gas emissions of not more than 4 kilograms (kgs) of carbon dioxide per kilogram of hydrogen. A qualified facility only includes the first 10 years of operation. The facility must also: (1) be owned by the taxpayer, (2) production must occur in the United States as part of a trade or business, and (3) construction of the facility must commence before Jan. 1, 2033. Amplified credits are available if prevailing wage and apprenticeship hour requirements are met. Furthermore, this is the third credit for which direct pay under Sec. 6417 is available in some form to all eligible parties (tax-exempt and taxable entities).

- Alcohol, Etc. Used as Fuel (Sec. 40) — This is an enhanced credit for taxpayers producing and either using or selling alcohol for use as a fuel, mixtures of alcohol and gasoline or a special fuel, or ethanol. Production and use must occur within the United States prior to Jan. 1, 2025. Special registration requirements also apply to second generation biofuel producers.

- Biodiesel and Renewable Diesel Used as Fuel (Sec. 40A) — This is a further enhanced credit for taxpayers using or selling biodiesel, biodiesel mixtures, or qualified agri-biodiesel. This has been expanded to allow renewable diesel and certain aviation fuel to qualify as biodiesel. However, any applicable sales or use must occur before Jan. 1, 2025.

- Sustainable Aviation Fuel Credit (Sec. 40B) — This is a new tax credit for taxpayers with respect to the sale or use of qualified mixtures in a trade or business, which are: (1) produced in the United States, (2) used or sold for use in an aircraft, and (3) the fuel is transferred to an aircraft tank in the United States. The amount of the credit is amplified if the fuel meets certain life cycle greenhouse gas emissions standards. The Sec. 40B credit is available for fuel sold or used after Dec. 31, 2022, and before Jan. 1, 2025.

- Future credit: Clean Fuel Production Credit (Sec. 45Z) — This is a new tax credit provided to taxpayers producing clean transportation fuels. It includes a delayed effective date that will generally replace the Sec. 40, 40A, and 40B credits for activities occurring after Dec. 31, 2024. Such fuels must be: (1) suitable as fuel for highway vehicles or aircraft, (2) have an emissions rate of not greater than 50 kg of carbon dioxide per 1,000,000 British thermal units (mmBTU), and (3) not derived from coprocessing an applicable material with a feedstock that’s not biomass. The production must occur in the United States and the producer must also meet registration requirements. Amplified credits are available if prevailing wage and apprenticeship requirements are met.

Monetization options available for each of the tax credits