Changes made to Internal Revenue Code (IRC) Section 958 by the Tax Cuts and Jobs Act (TCJA) appear to have gone farther than Congress intended toward removing safeguards against downward attribution of ownership interests in non-U.S. entities. The result: Ownership by a “U.S. person” (i.e., any U.S. entity, such as a U.S. citizen or resident, a domestic corporation, a domestic partnership, etc.) of a 10% interest in a foreign parent corporation that has at least one U.S. subsidiary could trigger attribution rules between the foreign parent, the U.S. subsidiary, and any other worldwide subsidiaries that result in the treatment of the subsidiaries as controlled foreign corporations (CFCs) for U.S. reporting purposes.

Prior to the TCJA, IRC Section 958 included subsection (b)(4), stating that the downward attribution rules elsewhere in the IRC did not apply to treat a U.S. person as owning the stock owned by a non-U.S. person. The TCJA eliminated that subsection for the last taxable year of foreign corporations beginning before Jan. 1, 2018, and each subsequent year going forward. In effect, the attribution rules themselves didn’t change so much as a piece of the law that exempted many multinational business structures from them was eliminated. At that point, even though nothing had effectively changed in the ownership structures of the businesses in question, multinational corporations with subsidiaries in different countries were subject to a new reporting requirement in the United States that few understood.

The potential challenges that arise out of this downward attribution have to be understood and addressed — both by existing businesses who may have failed to properly document these relationships since the law changed and by investors looking to purchase interests in global conglomerates that could trigger complicated reporting requirements and U.S. tax issues under the post-TCJA downward attribution regime.

What happened when the CFC attribution rules went into effect?

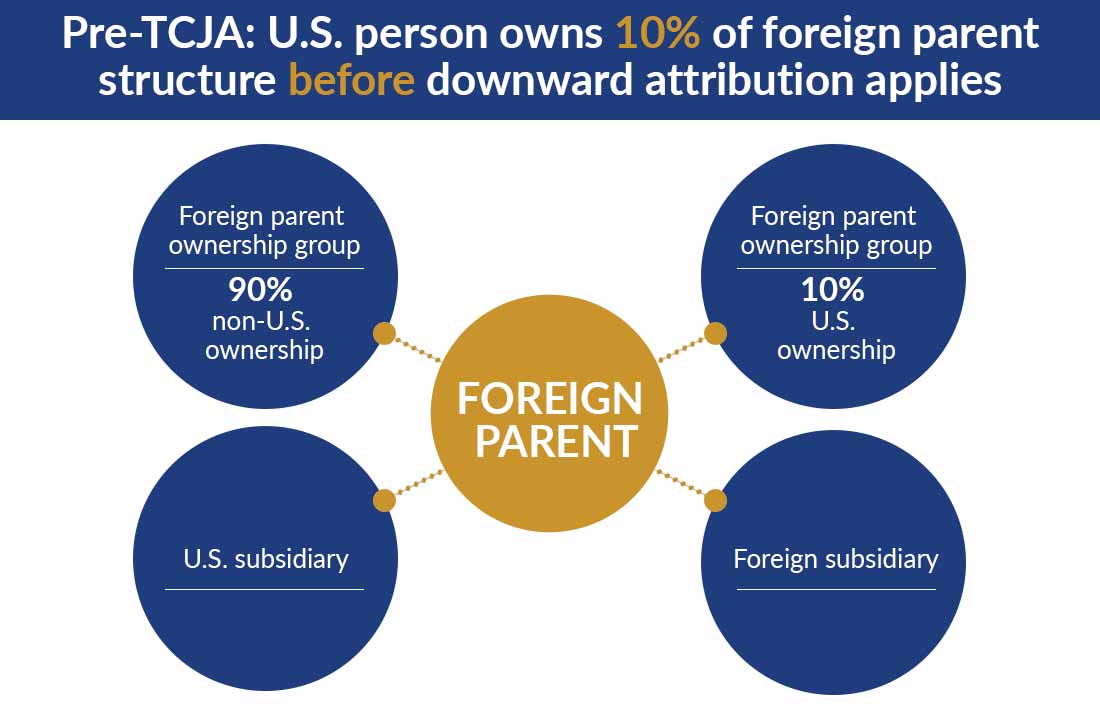

Perhaps the quickest way to illustrate the before and after is a side-by-side look at a simplified business structure. Consider a foreign parent company — 10% of that foreign parent is owned by a U.S. person. The foreign parent wholly owns one U.S. subsidiary and one non-U.S. subsidiary.

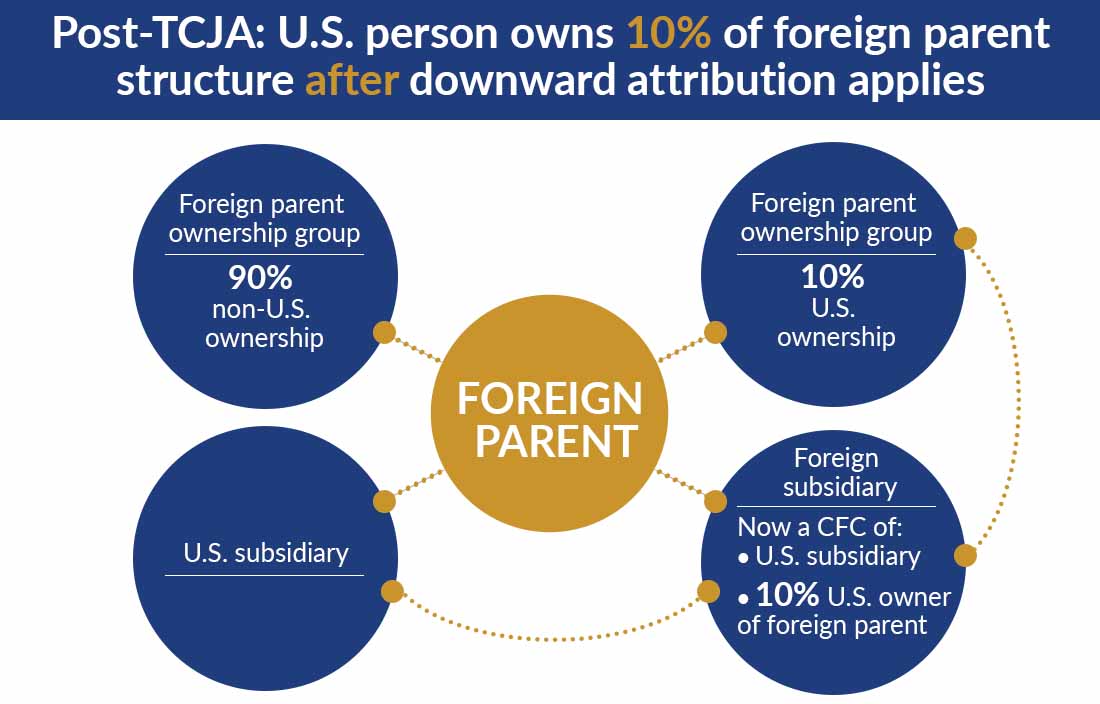

The rules in effect prior to the TCJA changes to IRC 958 protected the U.S. participants in this structure from downward attribution. Now, let’s look at the impact of the Section 958(b)(4) repeal and the resulting relationships between the entities.

Because of the TCJA’s elimination of rules that protected U.S. persons from attribution of stock owned by non-U.S. persons, the CFC downward attribution rules now apply to both the 10% U.S. investors in the foreign parent and the U.S. subsidiary of the foreign parent. (Technically speaking, the repeal of IRC Section 958(b)(4) actually triggered downward attribution issues for all U.S. owners of the foreign parent, but the IRS provided relief in Rev. Proc. 2019-40 that limited downward attribution reporting when the foreign parent doesn’t have a 10% U.S. owner.)

The attribution rules basically tell the taxpayers that they will be substituted into the position of the foreign parent, and any interest that the foreign parent holds will be attributed to them as well. In this limited example, that makes the U.S. subsidiary and the 10% owner of the foreign parent 100% owners of the foreign subsidiary and triggers specific reporting requirements related to CFC stock ownership.

What happens when these entities are deemed to hold CFC stock?

In the simplified example above, the change in the downward attribution rules imposed a new filing requirement on the 10% U.S. investor above the foreign parent and on the U.S. subsidiary. Because both entities were deemed to hold an interest in a CFC once the law changed and ownership was attributed to them, they needed to file IRS Form 5471, “Information Return of U.S. Persons with Respect to Certain Foreign Corporations.” The rules impose a $10,000 fine for each U.S. person’s failure to file Form 5471 for each annual accounting period. For this very limited example, that’s $20,000 per year since 2018. Now consider multinational entities with 10% U.S. investors and dozens, if not hundreds, of foreign subsidiaries around the world. Even without any additional tax obligation, the penalties for failing to file could quickly run into the millions, especially if the taxpayer needs to consider multiple years going back to 2018.

On top of the additional filing requirements (and penalties for missed filings), U.S. investors holding a 10% stake in the foreign parent could incur additional U.S. tax liabilities if they are subject to anti-deferral rules in the U.S. law under GILTI and subpart F provisions.

The first step toward identifying a downward attribution issue

Several common components of a multinational corporate structure indicate the likelihood of a downward attribution scenario. Downward attribution will likely be triggered when:

- A foreign parent company owns a U.S. subsidiary.

- That same foreign parent company has subsidiaries that it operates in other countries.

- The foreign parent company has multiple investors that are U.S. tax residents, which could include private equity funds, individuals, and other businesses.

To begin identifying and correcting problems in this area, multinational businesses with significant ownership based in the U.S. should consider these steps:

- Review the global structure of the foreign parent and its subsidiaries to identify how much of the business is owned by U.S.-based investors and determine the impact of downward attribution.

- Understand the full legal ownership of the entire structure, especially the foreign parent (knowledge of the tax residency of upper tier investors is critical).

- If downward attribution rules do apply, determine the scope of reporting and U.S. tax impact to U.S. investors.

- Certain planning strategies may be available to mitigate and/or eliminate the negative impact of downward attribution.

Because these structures existed prior to the TCJA modification without any significant reporting or tax consequences, word has been slow to travel among affected groups about this important change. It’s clear from IRS activity in this area that enforcement will be ramping up and affected taxpayers should begin working to resolve any exposure in this area.