The Inflation Reduction Act (IRA) provided numerous tax credits and incentives for the adoption of renewable energy technologies. Importantly, this included the expansion of tax credits related to electric vehicles (EVs), hybrid vehicles, and supporting infrastructure. Commercial businesses, nonprofits, governments, and similar organizations purchasing such vehicles and equipment are now able to use three key tax credits to offset a portion of the cost of their investment. Namely, the Section 45W Qualified Commercial Clean Vehicles Credit, the Section 30C Alternative Fuel Vehicle Refueling Property Credit, and the Section 48 Energy Credit are often considered in combination.

Who can take advantage of these Inflation Reduction Act EV tax credits?

The tax credits addressed in this article are initially provided to businesses that place in service qualifying vehicles and equipment. Similar tax credits are also available to individuals with respect to their personal vehicles and installation of equipment at their residences. However, the implications for individual taxpayers won’t be discussed in this article.

Additionally, the credits discussed in this article are available to tax-exempt entities, governmental entities, and other nontaxpayers. Please see the details below for which tax-exempt organizations are eligible for these key credits.

Inflation Reduction Act Section 45W tax credit for Qualified Commercial Clean Vehicles

The IRA established a new tax credit, the Section 45W Credit for Qualified Commercial Vehicles. A different EV credit, the Section 30D Clean Vehicle Credit, remains available for both businesses and individuals. The benefits of that program phase out at income levels that render it largely inapplicable to businesses. Fortunately, the new Section 45W credit doesn’t include an income-based phase out and has much more expansive rules.

Which vehicles qualify for the Section 45W tax credit?

Both traditional motor vehicles (i.e., automobiles) and “mobile machinery” qualify for the credit. Mobile machinery is machinery permanently mounted to a mobile carriage that’s used for activities like construction, mining, and farming, such as a crane or forklift. The vehicle must be produced by a qualifying manufacturer that has entered into a written agreement with the IRS and provides periodic reports on its vehicles to the IRS. The IRS provides a list of qualifying manufacturers.

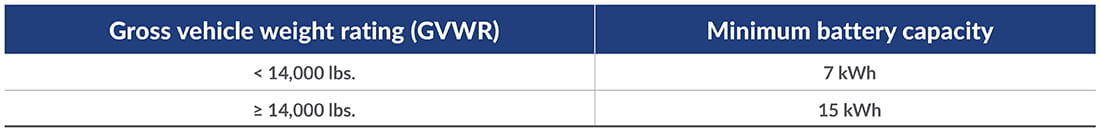

Vehicles and machinery eligible for the credit must be propelled either: to a significant extent by an electric motor, or by a hydrogen fuel cell. Hybrid vehicles utilizing both electric motors and internal combustion engines can also qualify. For vehicles propelled to a significant extent by an electric battery, the battery must be capable of being recharged by an external source and must have a certain capacity based on gross vehicle weight rating:

Additional rules apply to qualifying fuel cell vehicles. As a threshold matter, the vehicle must be powered by 1 or more cells that convert chemical energy directly into electricity by combining oxygen with hydrogen fuel that’s stored on board the vehicle in any form. Furthermore, passenger automobiles and light trucks using fuel cells must be certified to meet or exceed the Bin 5 Tier II emission level established by the Environmental Protection Agency.

The taxpayer must purchase or lease the vehicle for use primarily in the United States and not for resale. Additionally, the vehicle must be depreciable, eliminating the potential to claim the credit on a personal use vehicle. The rules clarify that qualifying vehicles purchased, but not leased, by tax-exempt entities will be treated as depreciable property for purposes of Section 45W.

How is the Section 45W tax credit amount calculated?

Each vehicle placed into service by the taxpayer after Dec. 31, 2022, is eligible for its own credit. Thus, the credits claimed on a tax return for Section 45W reflect an aggregate amount for all purchased qualifying vehicles. The credit calculation is subject to multiple tiers. A cost-based calculation is first applied and then an overall per-vehicle limitation is applied.

The credit amount is initially calculated as the lesser of the:

- Incremental cost of the vehicle. The vehicle’s purchase price, less the purchase price of a comparable gasoline or diesel-powered vehicle. A comparable vehicle is a vehicle that’s of comparable size and usage.

- Percentage of vehicle cost. The statutory applicable percentage is multiplied by the vehicle’s cost to purchase or lease. For hybrid vehicles (vehicles using both an electric battery and a gasoline or diesel-powered internal combustion), the percentage is 15%. For EVs (vehicles using solely an electric battery), the applicable percentage is 30%.

The IRS has provided safe harbors for determining incremental costs in 2023 and 2024. Specifically, the IRS will accept $7,500 as the incremental cost for all street vehicles with GVWR under 14,000 pounds, except for compact car plug-in hybrid vehicles. Vehicles not eligible for the deemed $7,500 incremental cost may utilize the incremental cost by vehicle class determined by the Department of Energy.

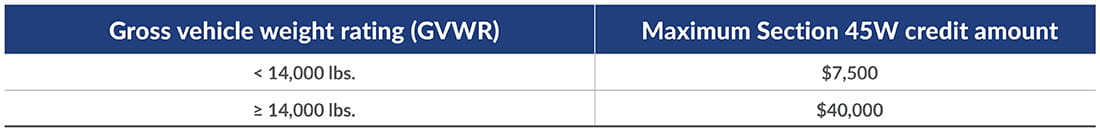

Even considering the calculated incremental cost of the vehicle or the percentage of vehicle cost, the Section 45W credit has a maximum credit per vehicle, based on gross vehicle weight:

Further, taxpayers may not claim the Section 45W credit in conjunction with the Section 30D Clean Vehicle Credit for the same vehicle. Additionally, to prevent a double benefit conferred by the credit, taxpayers must reduce their tax basis in the vehicle by the credit amount claimed.

Inflation Reduction Act tax credit: Section 30C Alternative Fuel Vehicle Refueling Property Credit

In addition to receiving a credit for purchasing clean vehicles, an organization may also receive a tax credit for installing property to refuel vehicles with alternative fuels under Section 30C. This includes EV charging stations. This credit existed prior to the IRA but was modified in significant ways. Individuals can take advantage of a reduced version of this credit by installing such equipment at their personal residence. However, the discussion that follows focuses on installation of property by businesses, tax-exempt organizations, governments, and similar organizations.

The Section 30C credit is calculated as a percentage of the cost of property that refuels vehicles with one of the following:

- Fuels composed of at least 85% ethanol, natural gas (including compressed and liquified), liquefied petroleum gas, or hydrogen.

- Mixtures that consist of diesel fuel and/or kerosene and at least 20% biodiesel.

- Electricity (i.e., EV charging stations).

- Transportation fuels, as defined in Section 45Z(d)(5), produced after Dec. 31, 2024.

What property qualifies for the Section 30C tax credit?

For property placed in service after 2022, four base requirements must be met. To qualify, the property must:

- Have its original use begin with the taxpayer.

- Be depreciable property, including installation by tax-exempts, governments, etc.

- Be used to store or dispense the fuels and electricity describe above.

- Be placed in service in an eligible census tract (either low-income or nonurban).

To clarify the census tract requirement, the property must be located in either a nonurban area or in a low-income community as defined by Section 45D(e). Nonurban areas are census tracts that haven’t been designated as urban areas by the Secretary of Commerce in the most recent decennial census. Section 45D(e) low-income communities are census tracts where: the poverty rate is at least 20%, or the median family income doesn’t exceed 80% of the statewide median family income (or, if the tract is metropolitan, doesn’t exceed 80% of the greater of the metropolitan area median family income or statewide median family income). While the census tract requirements seem complex, there is an interactive map from the Department of Energy that shows the eligibility status for each census tract in the United States.

How is the Section 30C tax credit amount calculated?

Similar to the Section 45W credit, the credit for refueling equipment is subject to a multistep calculation. This initially involves two alternative percentages of cost and is the subject to an overall limitation. As discussed in more detail below, the credit percentage is either 6 or 30%. However, the total credit for any single item of property is limited to $100,000. Before 2023, this credit was limited to $30,000 for all property placed in service during the tax year. By increasing the limitation and changing it to a “per item” threshold, the IRA dramatically increased the potential tax benefits for refueling property.

For depreciable property (e.g., nonresidential), the credit is initially calculated as 6% of the cost of the property, as reduced by any Section 179 expense deduction taken for the property. Much like other credits amended by the IRA, the amount of the credit for depreciable property can be increased by a multiplier of five (resulting in a credit amount equal to 30%) if certain prevailing wage and apprenticeship (PWA) requirements are satisfied. A limited grace period eliminating the need to satisfy the PWA requirements applied to projects for which construction began prior to Jan. 29, 2023. Any projects beginning after that date must satisfy those rules to obtain the 30% credit amount.

For the prevailing wage requirement, the taxpayer must ensure that any laborers and mechanics employed by the taxpayer, any contractor, or any subcontractor in the construction of the vehicle refueling property are paid wages at rates at least as high as the prevailing rates for construction, alteration, or repair of a similar character in the project’s locality as determined by the U.S. Department of Labor (DOL). To determine the prevailing wage rate, the DOL maintains a Wage Determination database.

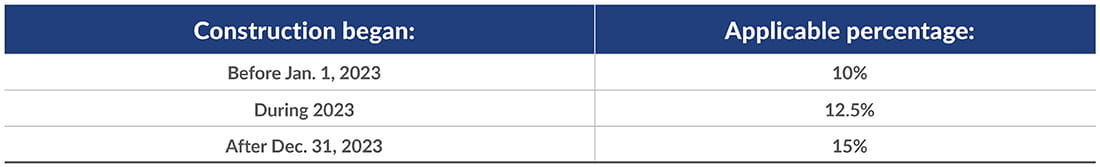

To satisfy the apprenticeship requirement, two components must be satisfied: apprentice participation and labor hours. Taxpayers must ensure that apprentices work a certain percentage of the total hours of construction, alteration, or repair work on the property. These requirements apply to the taxpayer, any contractors, and any subcontractors working on the installation of the property. These hour requirements are subject to any applicable requirements for apprenticeship-to-journeyman ratios set by the DOL. The applicable percentages of total labor hours depend on when construction of the property began, as outlined below:

It’s important that the taxpayer has detailed documentation supporting the prevailing wage and apprenticeship requirements are met. This likely means getting payroll and other documents from contractors and subcontractors used to construct the property.

Inflation Reduction Act Section 48 investment tax credit

Organizations acquiring EVs and charging equipment may also be interested in placing in service either renewable energy property (e.g., solar panels) and energy storage technology (e.g., battery backups). Both types of property are eligible for the expanded investment tax credit (ITC) pursuant to Section 48. The calculation of the ITC is very similar to that of the Section 30C credit described above. Thus, the credit is initially equal to 6% of the tax basis of the qualifying property. That amount is increased to 30% if either: (a) PWA requirements are satisfied, (b) the project has a maximum net output of less than 1 megawatt of electrical energy, or (c) the construction of the project began before Jan. 29, 2023.

Additional bonus credits are available if either the project is located in an energy community, or the equipment meets domestic content requirements. Energy communities include Brownfield sites and certain census tracts historically involving coal, oil, or gas production. Helpfully, the DOE maintains a website outlining the qualifying locations. Domestic content rules require the use of U.S. steel and manufactured components, where at least 40% of such components (by value) were produced in the United States. Where applicable, such bonus credits are each equal to 10% of the qualifying basis of the project (2% each if the project is only eligible for the 6% base credit). Taken together, installation of renewable energy property and battery storage could generate additional tax credits ranging from 6 to 50% of the eligible costs.

Realizing the Inflation Reduction Act tax credit value

Taxpayers have multiple options for claiming the Section 45W, Section 30C, and Section 48 credits. The default rule is that such credits are claimed as Section 38 general business credits. This means that the credits offset the federal income tax liability of the taxpayer in the year the property is placed in service, subject to certain limitations. Excess credits carryback three years and then carry forward 20 years. Additional options are available depending on the type of taxpayer placing in service the property.

Taxable businesses that can’t utilize their credits under the Section 38 rules may sell certain credits in exchange for cash payment. Application of the sale rules, under Section 6418, depends on the credits being claimed.

- Section 45W: The credit sale option isn’t available for the commercial clean vehicle credit.

- Section 30C and Section 48: The credit sale option is available to all taxable entities.

Special rules, under Section 6417 allow nontax-paying organizations to obtain tax refunds equal to the credit amounts by electing direct pay. The organizations eligible for direct pay depends on the credits being claimed.

- Section 45W: The direct pay option for the commercial clean vehicle credit is limited to: (a) the United States, any state or political subdivision thereof, any possession of the United States, or any agency or instrumentality of any of the foregoing; (b) a tax-exempt organization other than a cooperative described in Section 521; and (c) any Indian tribal government.

- Section 30C and Section 48: The direct pay option for refueling equipment and the ITC is more expansive. Such rules apply to tax-exempt organizations, a state or political subdivision of the state, the Tennessee Valley Authority, an Indian tribal government, an Alaska Native Corporation, or a rural energy cooperative.

To learn more about how you might qualify for the Section 45W, Section 30C, or Section 48 credits, please contact your Plante Moran advisor. Have additional questions on how IRA tax credits, incentives, and monetization options could impact your organization? Explore more from our tax leaders as they track the latest developments.