The Inflation Reduction Act (IRA) included a variety of tax provisions aimed at creating an ecosystem of credits and incentives to support green energy development and utilization in the United States. The interrelated network of new incentives coupled with improvements to existing programs was intended to encourage increased economic competitiveness, industrial productivity, and innovation. The wide-ranging tax benefits available to eligible entities include manufacturing credits, production credits, and other targeted enticements to drive investment into this sector.

Providing tax credits to those engaging in favored investments or production activities is not a new concept. What’s unique about the IRA is the creation of new ways for taxpayers to monetize these credits. Importantly, these include opportunities for nontaxable entities to generate cash refunds and for taxable entities to sell tax credits for cash. As a result, those investing in renewable energy technologies may need to consider several options available under the law including direct use of the credits, tax equity investments, sale of the credits, and (for certain eligible entities) elective or direct payment.

Direct use of Inflation Reduction Act tax credits

In the simplest scenario, taxpayers who make investments that qualify for one of the IRA tax credits can simply claim the amounts as a general business credit. That results in a dollar-for-dollar reduction in federal tax liability for the entity or, in the case of a passthrough, for the eligible partners or shareholders.

The rules effectively permit a corporate taxpayer to reduce a federal tax liability by up to 75% in any given year. Individual shareholders receiving pass-through credits can reduce their tax liability down to their tentative minimum tax or 25% of regular tax liability in excess of $25,000. Credits that aren’t used can be carried back three years and forward up to 20. Given the magnitude of some of the potential credit amounts, however, taxpayers who find that they may not be able to fully utilize the credits in a short window may consider a sale of the credits or, if eligible, the Direct Pay IRS option.

Direct pay gives nontaxable entities a monetization option

Tax-exempt organizations, states and their political subdivisions, and a few other types of nontaxed entities can monetize their credits under a new system known as direct pay, or elective pay. These applicable entities as defined in the Internal Revenue Code (IRC) qualify for a direct payment from the IRS. This direct payment is in the form of a tax refund based on a deemed overpayment of tax. Some commercial entities can also qualify for direct pay on claims for the Advanced Manufacturing Production Credit (45X), the Clean Hydrogen Credit (45V), or the Carbon Oxide Sequestration Credit (45Q).

An entity that satisfies all the eligibility requirements needs to complete a pre-filing registration with the IRS and make a valid direct pay election on its timely filed annual tax return (including extension). Entities don’t have the option of claiming the credits on an amended return, so it’s important to get the process right before the initial return is filed. Filing extensions for applicable tax returns may be particularly helpful for entities working to confirm their eligibility for IRA tax credits. Some entities that haven’t had a filing requirement with the IRS previously may need to figure out in what tax year they need to make the claim.

Sale of Inflation Reduction Act tax credits for commercial entities

Broadly speaking, the IRA included a transferability option for these incentives that allows taxpayers to sell their credits to unrelated parties for a cash payment. The purchaser then claims the credits on its federal tax return. The option to sell is available only for commercial entities while credits can be purchased by both individual taxpayers and businesses. Purchased credits can offset tax of widely held C corporations. Individual taxpayers may purchase credits directly or receive an allocation of credits purchased by partnerships or S corporations. However, individuals receiving purchase credits are subject to passive activity limitations. Such rules generally allow the credits to be used to offset tax on passive income (but not portfolio income.) Closely held C corporations can use credits to offset tax on active or passive income (but not portfolio income.)

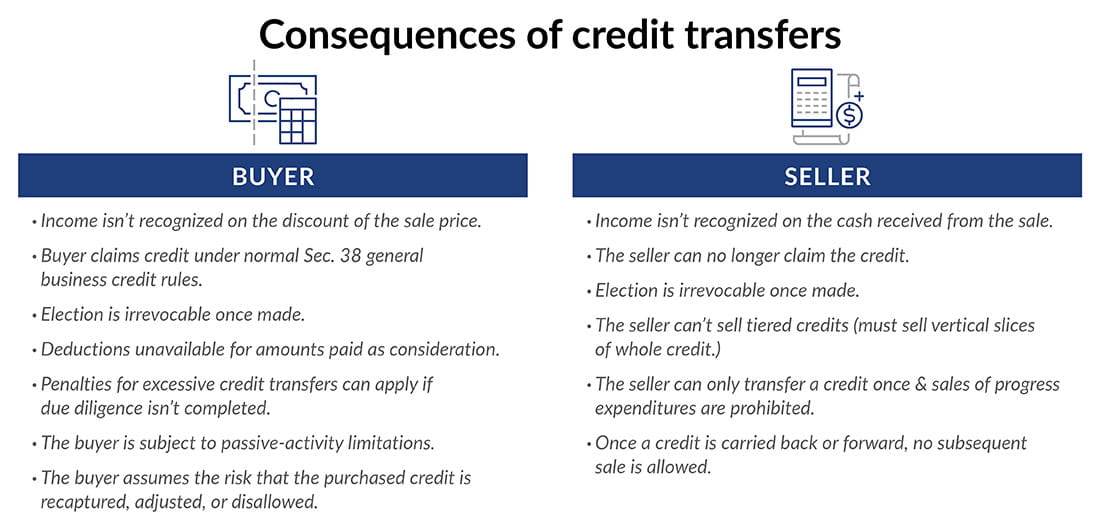

To transfer a credit, the buyer and seller make an election for each eligible property. The election is irrevocable, and the credit related to each property can only be transferred one time. However, the taxpayer generating such credits may sell them in any increments to buyers based on negotiations. Overall, credit purchase and sale transactions bear all the hallmarks of an M&A asset deal, including the initial letter of intent phase, due diligence, final negotiation, closing, and continuing obligations. The consequences of a credit transfer to both the buyer and the seller are listed in the following chart.

The buyer bears the risk that the IRS could adjust or disallow the credit, so due diligence will be a critical part of the process. Other potential complications exist here, such as a required five-year holding period for certain property giving rise to the tax credits. Buyers need to work closely with their due diligence providers to identify and quantify risks and address them in purchase negotiations.

On top of the risk issues, the parties need to understand the procedural considerations with the transaction as well. The seller is required to complete a pre-filing registration with the IRS and obtain a registration number. For this process, the IRS recommends allowing 120 days before the tax filing deadline. The buyer and seller must both make valid transfer elections by the due date (including extensions) of their tax return for the year in question. The rules also require that consideration must be paid in cash (or a few limited cash equivalents designated in the regulations) within a limited period of time.

Inflation Reduction Act credit-driven tax equity investment

Taxpayers investing in energy property who can’t use the resulting tax credit as a general business credit can also use a tax equity structure to monetize the tax credits. Monetizing tax credits utilizing various tax equity structures predates the IRA and will continue to be an option going forward. In tax equity structures, a third-party tax equity investor is admitted as a partner in the project and makes a capital contribution. The tax equity investor will own a negotiated percentage of the partnership (often 99%) during the five-year compliance period after the project is placed in service. After five years, the tax equity investor’s ownership decreases to a de minimis amount, and the tax equity investor typically exercises a right to exit the ownership group altogether. Utilization of a tax equity structure allows for the monetization of depreciation in addition to the tax credits. Energy property typically is subject to accelerated depreciation methods to increase the benefit of depreciation deductions. The trade-off to utilizing a tax equity structure relative to other monetization options — such as transferability — is the increased complexity that comes with the structure, which may require more upfront investments in professional fees.

Tax equity structures have continued to evolve since the passing of the IRA. For instance, the IRA allows for an additional strategy for combining credit transferability with a traditional tax equity structure to provide the tax equity investor with the ability to transfer the credit to a third-party buyer. This allows the tax equity investor additional flexibility as well as the ability to retain the depreciation benefits even if the tax equity investor elects to transfer the credits. Given the various monetization options and different tax equity structures, it’s recommended that you consult with tax credit professionals early to help assess the best path forward for a given project.

What’s next for eligible taxpayers?

Opportunities abound for entities claiming credits and those who want to purchase credits. Businesses, individuals, and eligible nontaxed “applicable entities” should consider current and potential future investments in energy property that could qualify for these valuable IRA tax credits. The analysis should encompass both credit eligibility as well as financial projections; taxpayers who might not have the income to get the full benefit of the credits on their own returns should consider monetization options as early as possible in the process. Potential credit buyers should review their tax capacity and consult with their tax advisor on appropriate strategies to purchase credits.

To learn more about how these rules could affect your business or eligible entity and about the latest guidance available from the IRS, consult with your tax advisor.