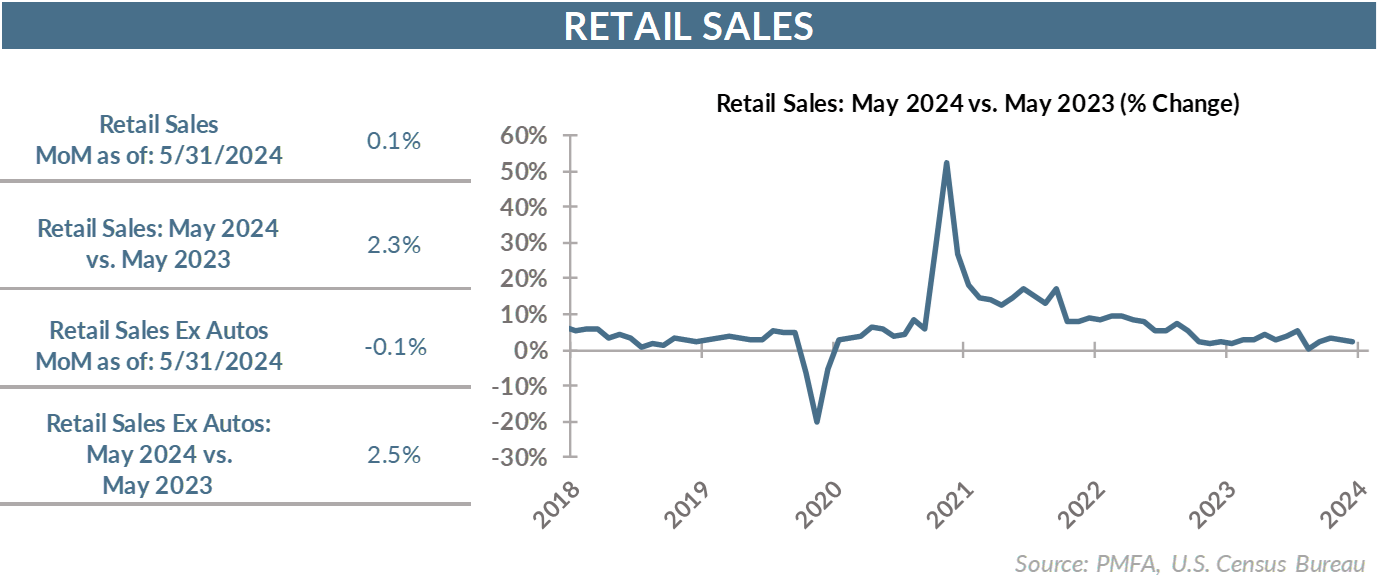

The retail environment remained cool in May, as sales edged up by just 0.1% — a meager gain, albeit better than April’s 0.2% decline.

The retail environment remained cool in May, as sales edged up by just 0.1% — a meager gain, albeit better than April’s 0.2% decline.

The underlying drivers of the May results were nuanced. Auto dealers saw a nice pickup in sales, which increased 0.8%. Gas stations experienced a 2.2% drop in top-line revenue, despite only a modest reduction in the average national price for a gallon of gas. Stripping out those two more volatile components left the rest of the retail sector mirroring headline sales growth of 0.1%.

Taken with other recent data, there are meaningful bits to be gleaned about the evolution of household sentiment and spending habits. Consumers appear to be increasingly sensitive to prices and are trading down to lower-cost options across a range of goods.

That’s readily apparent in the 0.2% dip in grocery store sales while restaurants experienced a 0.4% decline, as consumers trim their spending on food and other staples across the board.

There’s no doubt that many households continue to struggle under the weight of a sharp increase in prices in recent years. Although broad inflation measures suggest that the pace of price increases has slowed considerably, consumer prices are much higher and still rising. Even so, expectations are for a continued moderation in inflation over the coming year. With an improvement in that outlook, why are consumers trading down now?

A convergence of factors is weighing on households. Wage growth has slowed notably as labor demand has cooled. The excess savings stockpile that fueled a notable spending binge since 2020 has been largely exhausted. Credit card debt has been piling up at a rapid clip over the past three years, with the rate of delinquencies now increasing. The combination of the three has left most households with less ability to spend freely and a greater focus on budgeting effectively.

All of this points to a tougher retail environment, particularly for discretionary items. Trading down to less expensive brands may provide consumers with a bit of flexibility as they tighten their purse strings , but retailers are feeling the pinch.

The bottom line? The frothy consumer environment that fueled rapid economic growth in recent years has faded, as cooler labor market conditions, inflation, higher interest rates, and the exhaustion of excess savings are collectively taking a toll on household spending. For the retail sector, that translates to a much more selective consumer and, in turn, stagnating sales growth.

Meida mentions:

Our experts were recently quoted on this topic in the following publication:

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.