First, the bottom line: It could’ve been worse

- It’d be hard to make the case that the Q1 GDP report was good. It wasn’t. If there’s good news to be found, it’s that it was much better than some had projected

- Despite their significant misgivings about the near-term outlook, consumers set aside those doubts and continued to spend.

The numbers: Growth stalls in Q1 on surging imports, softer federal spending

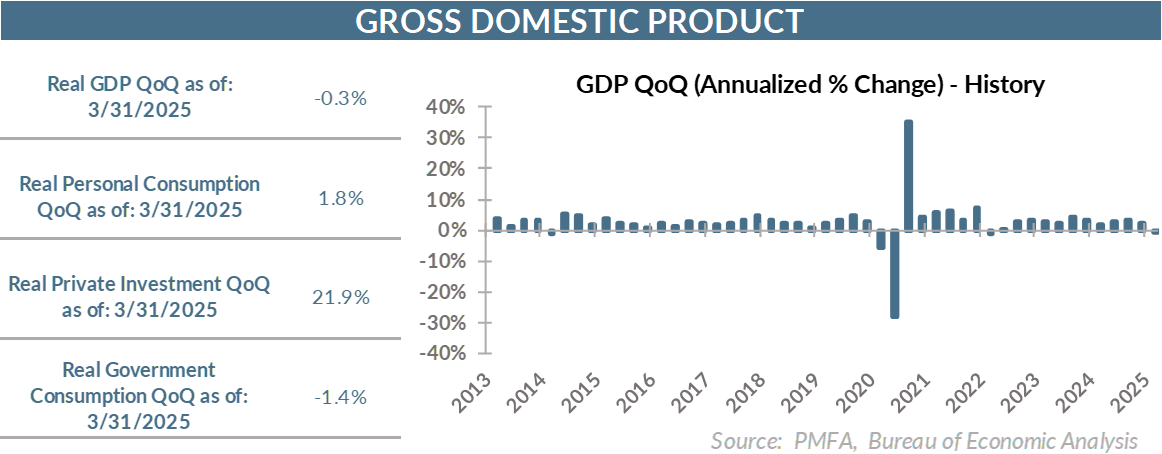

- The U.S. economy contracted modestly in Q1, with GDP slipping by 0.3% annualized — a result that was moderately softer than the consensus forecast but much better than some of the more dire predictions that surfaced in recent weeks.

- Underlying that relatively flat top-line growth was more pronounced volatility in a few key pieces of the puzzle.

- First, the good news: consumers continue to spend. As the foundation of the U.S. economy, solid consumption is critical. Consumers delivered 1.8% spending growth for the quarter — much softer than in Q4, but in line with the first three months of 2024.

- Private sales to domestic purchasers increased by 3.0% — a strong reading that suggests that the notable dimming in the consumer mood in recent months didn’t deter their willingness to spend.

- Other key factors paint a different picture. Imports swelled by over 9% annualized during Q1, as import-dependent businesses tried to front run anticipated tariffs by accelerating purchases. The resulting surge in the trade deficit slashed 4.8% off top-line growth for the quarter.

- A corresponding buildup in inventories offset about half the top-line effect of the trade gap, adding 2.25% back to top-line growth.

- On net, the mad dash to stock up on everything from raw materials to finished goods weighed heavily on growth in the first quarter.

- While not as impactful as the dramatic upswing in imports and inventory stockpiling, spending by the federal government contracted moderately in Q1, trimming top-line growth by 0.3%.

- Consumers will also take note of one other key aspect of the report. Price pressures continue to build, with the PCE index rising from 2.4% in Q4 2024 to 3.6% in Q1, its largest quarterly increase in two years.

Under the hood: Consumers became more pessimistic, but kept their wallets open

- Crosscurrents were abundant in the Q1 GDP data, reflective of the sea change in trade policy and the effect of businesses and consumers trying to get out in front of higher prices for a range of imported goods.

- The silver lining in an otherwise soft report was that consumers, for now, remain relatively resilient in their spending habits despite their increasingly pessimistic outlook.

- The question is where the economy is headed next. While the trade and inventory numbers should normalize in Q2, a resurgence in inflation could create a greater headwind to household spending.

- There are indications that policy uncertainty may be receding. Getting a few trade deals across the finish line, particularly with America’s largest trade partners, would help to solidify the rules of the game for businesses, allowing for a little more clarity in decision-making. At this point though, it’s unclear where negotiations stand with China, which may present the biggest challenge.

- Despite the sharp decline in the soft data on business and consumer sentiment, much of the hard data has held up better to this point. Even if sentiment stabilizes, it’s the near-term path for data on production, consumption, labor conditions, and inflation that should be monitored closely for signs of deterioration.

- To that end, the divergence between soft and hard data could close over the next few months, as the impact of tariffs and potential shortages of imported goods becomes apparent.

- In terms of sentiment, firmly establishing a new framework for expectations will be critical for businesses to move forward and for consumers to feel comfortable. Whether that arrives in time to avoid a more pronounced slowdown or a recession remains to be seen.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.