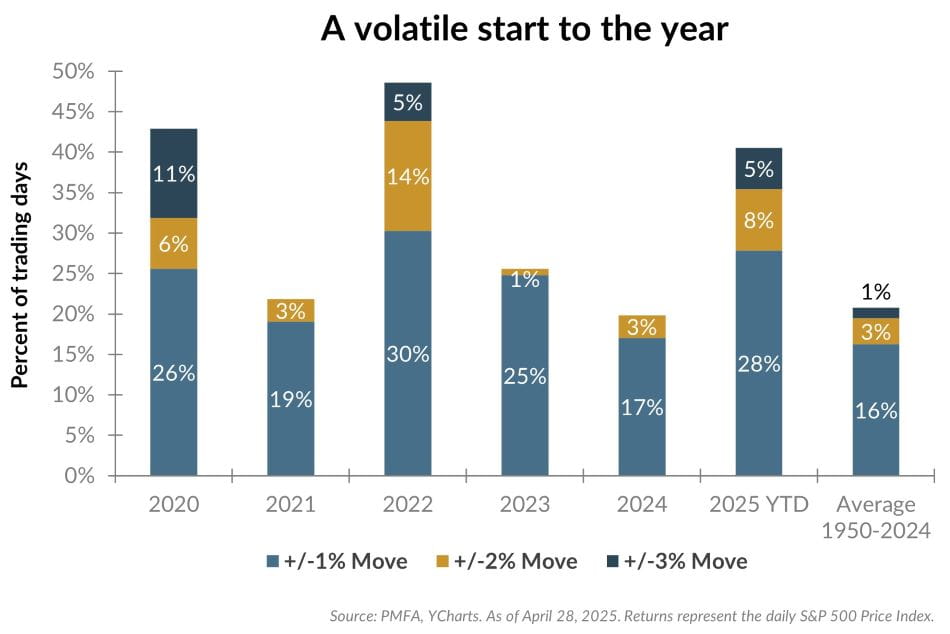

The first four months of the year have been marked by elevated volatility amid heightened policy uncertainty. Through the first four months of the year, the daily price change in the S&P 500 has topped 1% on about 40% of the trading days. This is on par with 2020, a year characterized by a global health crisis and economic shutdown that pummeled the stock market in March before it roared back to a solidly positive return for the year. In 2022, daily moves in the S&P 500 topped 1% on nearly half of all trading days. Yet notably, the respective returns of each of those two years (2020 & 2022) were materially different. In 2020, the S&P 500 returned over 18%; in 2022, it finished down more than 18%. The vastly different results clearly illustrate the two-sided nature of market volatility.

The more pronounced bear markets that occurred in 2020 and 2022 were accompanied by 2% or greater moves nearly 20% of the time. Year to date, these daily swings have occurred about 13% of the time, with over half of those days being negative. The most severe swings of >3% daily moves came last month, as investors grappled with the potential fallout from higher-than-expected tariffs announced by the Trump administration and subsequent implementation delays and refinement of those tariffs, creating a whipsaw in market sentiment and momentum.

Despite that volatility, equities ended April down less than 1%, an outcome that may have seemed highly unlikely just a few weeks prior. While it's unclear whether 2025 is on track for performance closer to 2020, 2022, or somewhere in between, staying anchored to a long-term plan, remaining disciplined, and rebalancing as appropriate has proven its mettle as an effective strategy to weathering the inevitable market storms.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.

© 2025 YCharts, Inc. All rights reserved, The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided “AS IS” with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.