By the numbers: Initial claims down, but continuing claims increased again

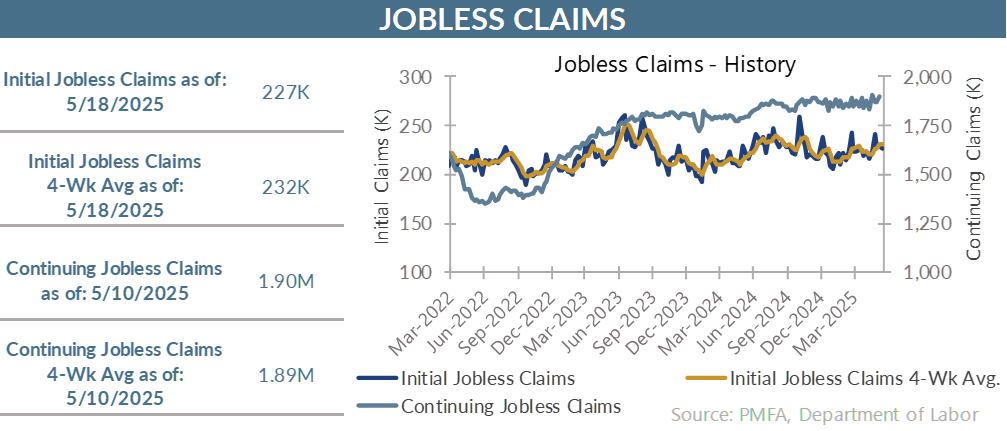

Initial jobless claims edged lower last week, easing to 227,000 from an unchanged 229,000 for the week ended May 17.

The four-week moving average rose modestly to 231,500, reflecting just a modest nudge upward from 230,500 the preceding week.

Continuing claims posted a more notable increase, topping 1.9 million for the week ended May 10, a 36,000 increase from the preceding week’s 1.867 million. Over the past year, continuing claims have risen by 110,000.

Fewer job openings and measured hiring, but limited layoffs

Labor conditions have eased by some measures, but first-time jobless claims have held relatively firm this year. That was evident again in last week’s data.

The combination of DOGE-related federal government job cuts and the announcement of unexpectedly significant tariffs was a gut punch to business, consumer, and investor sentiment in recent months, creating significant concerns about the near-term economic outlook.

That tide has turned a bit, as implementation delays and tangible progress in trade negotiations have alleviated those concerns since mid-April, lifting some of the cloud that had hung over the stock market and dimmed growth expectations.

Job openings have declined, and hiring has slowed, but there’s still little indication that employers are slashing jobs.

Bottom line? Labor market supportive, but higher prices remain a near-term growth risk

The economy isn’t out of the woods by any means, but the resiliency of labor data remains a comparative bright spot. Job creation is a critical underpinning to household consumption, one that has proven to be enough to support solid results since the beginning of the year.

That doesn’t mean that household spending growth in real terms will be sustained, as the early impact of tariffs on a range of imported goods becomes increasingly apparent.

Real consumption faces a stiff headwind from higher prices; that reality will challenge consumers in both their willingness and ability to spend in the coming months.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.