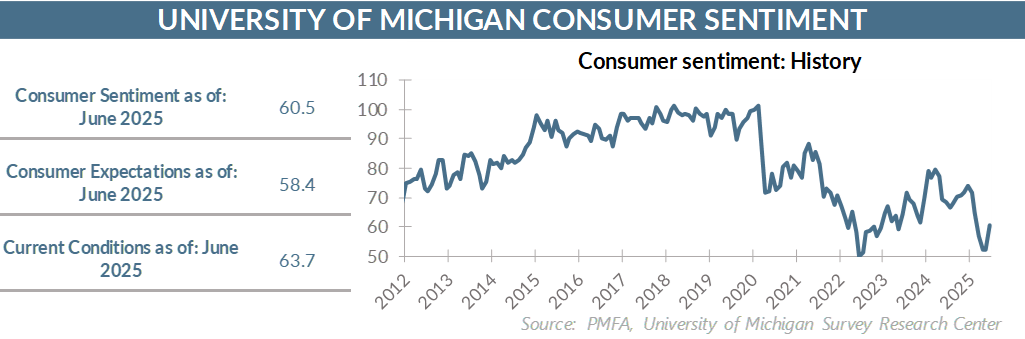

- The surge in the initial June reading of the University of Michigan survey on consumer sentiment suggests that consumers have turned the corner from the period of peak anxiety and uncertainty concerning trade policy. The index soared to 60.5 in June from 52.2 in May — the first improvement in six months and one that easily topped expectations.

- Respondents were more upbeat in their assessment of both current conditions and their expectations for the near-term outlook.

- The fact that the tangible impact of tariffs thus far has been much less than feared certainly helps. Prices on select products have risen; however, the impact hasn’t been anywhere close to the level that households feared to this point. That was confirmed by two very tame reports on May consumer and producer price inflation earlier this week.

- More importantly, the delay in implementation and ongoing trade negotiations have made it clear that the worst-case tariff scenario is off the table.

- That doesn’t mean that consumers aren’t still cautious; they are. Inflation expectations of 5.1% over the next year are still quite high, signaling that consumers are still bracing for higher prices. Even so, the decline in year-out inflation expectations from 6.6 to 5.1% in just a month is a significant move that mirrors the ratcheting down of overall anxiety.

- Falling inflation expectations suggest that consumers are coming to terms with the near-term lack of clarity around trade policy and the belief that the ultimate impact on their household spending budget won’t be as severe as they feared a month ago.

- However, the survey was completed well before yesterday’s events in Iran that will have near-term repercussions. Initial market reaction to the events in Iran have largely been as one might expect. Crude oil prices spiked overnight, although early reports suggest that Iran’s oil production capacity wasn’t directly impacted. Understandably, there’s a moderate risk-off mood today in global equities, with gold getting a lift as a crisis hedge.

- Much will depend on how Iran responds in the coming days and whether these developments evolve into a more widespread conflict that draws in other parties in the Middle East. Geopolitical developments such as this don’t tend to have a lasting economic impact globally; the immediate impact tends to be the hit to sentiment that’s usually absorbed by global capital markets relatively quickly.

- The wild card is oil; a sustained increase in oil prices — particularly against the existing backdrop of uncertainty — could become an additional hurdle for the economy to overcome. The events of the past day increase that risk, but a sustained increase in oil prices still doesn’t look like the base-case scenario. It’s possible that oil prices could recede if conditions don’t escalate considerably in the coming days and if the conflict is largely contained between Israel and Iran. Conversely, if the conflict were to expand or draw in additional parties across the region, the risk of a more sustained increase in oil prices — and a more notable impact on an already slowing global economy — would increase.

- For now, trade policy and tariff-related inflation fears are fading, with geopolitical risks coming to the forefront. For the average American who’s looking at their credit card bills, grocery store receipts, and checking account balances, higher prices on their doorstep are a much greater concern. An expansion of the Middle East conflict is a near-term risk; but absent a sustained rise in gasoline prices or a return to the market volatility of April weighing on their retirement portfolios, consumer sentiment could continue to recover in the coming months.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.