A recent U.S. Senate report reveals how Medicare Advantage insurers’ prior authorization practices are denying seniors post-acute care, creating barriers to care and financial challenges for patients and senior care providers. Here’s what you need to know.

A recent report from the U.S. Senate Permanent Subcommittee on Investigations, “Refusal of Recovery: How Medicare Advantage Insurers Have Denied Patients Access to Post-Acute Care,” focuses on the issue of prior authorization in Medicare Advantage and the significant concern, especially for seniors recovering from serious health events. The recent inquiry by the Permanent Subcommittee on Investigations (PSI) highlights how this process can create barriers to necessary care, potentially jeopardizing the health and well-being of vulnerable individuals. Four key themes emerged in the inquiry.

- Prior authorization process and how the system requires healthcare providers to obtain approval from insurers before delivering certain services. While intended to manage costs, it can delay critical care for seniors.

- The impact on seniors indicates that denials for post-acute care can force seniors into tough decisions about their health and finances, particularly right after hospital discharge when they are most vulnerable.

- Insurer practices and how major insurers like UnitedHealthcare, Humana, and CVS may be using prior authorization as a strategy to increase profits, raising concerns about patient care versus financial incentives.

- The need for reform to make the prior authorization process more transparent and less burdensome, ensuring that seniors receive timely and necessary care without unnecessary hurdles.

The findings from the subcommittee highlight a troubling trend in the Medicare Advantage system and the importance of advocating for policies that prioritize patient health over profit.

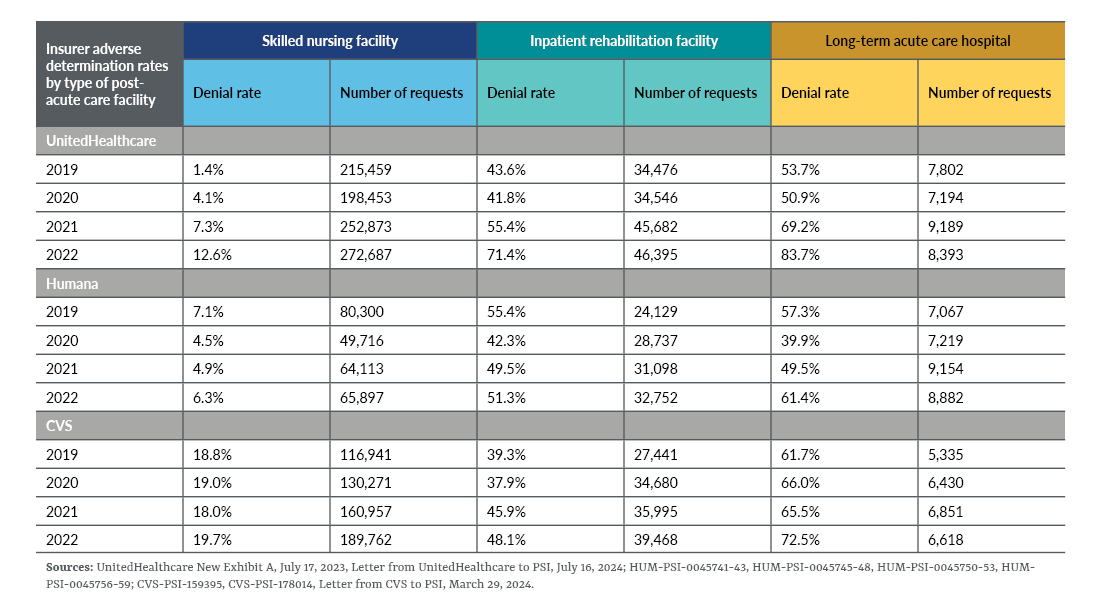

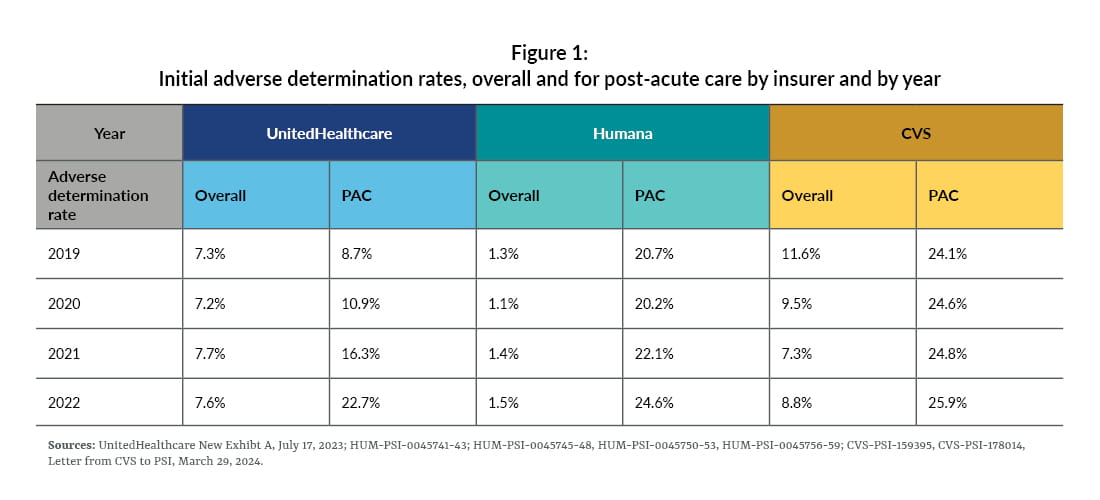

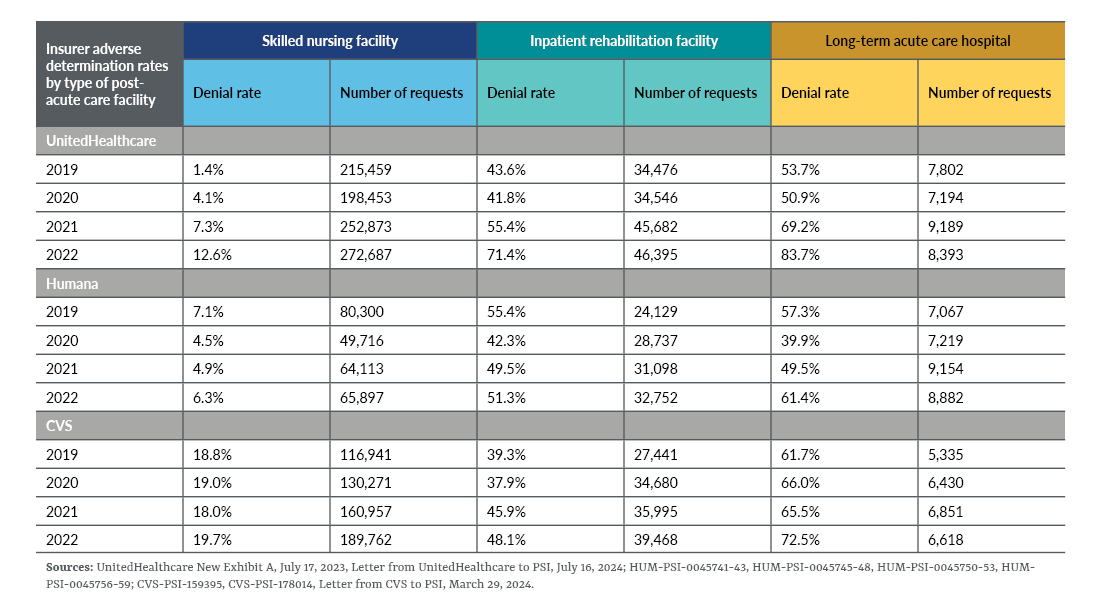

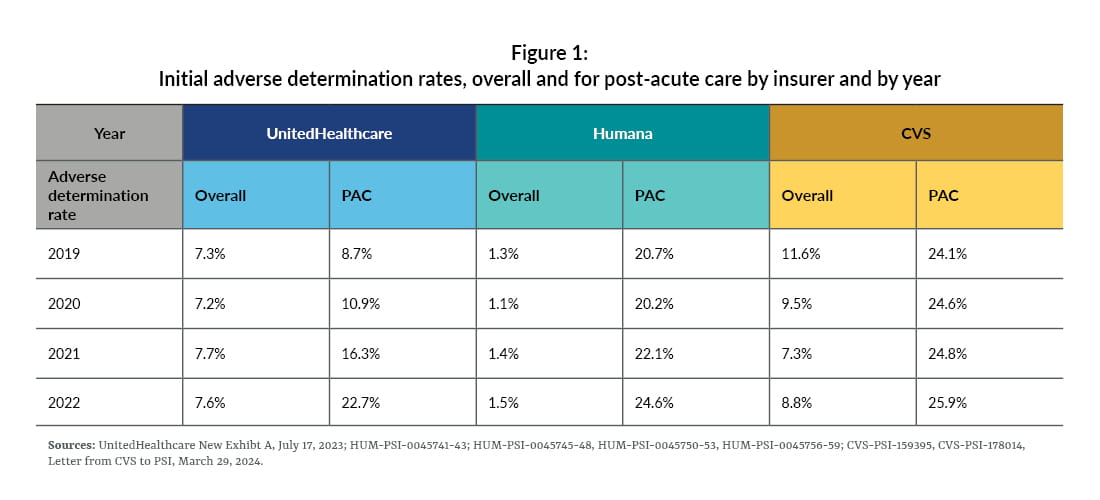

- Higher denial rates: The significant increase in denial rates for post-acute care requests compared to other types of care indicates a systematic issue. For instance, in 2022, both UnitedHealthcare and CVS denied these requests at rates about three times higher than their overall denial rates. Humana’s situation is even more concerning, with a denial rate for post-acute care over 16 times higher than its overall denial rate.

- Impact on access to care: The increased denial rates can severely limit access to essential post-acute care services, which are crucial for recovery after hospital stays. This can lead to longer recovery times, increased health risks, and added financial burdens for seniors and their families.

- Need for transparency and accountability: The findings suggest a need for greater transparency in how these decisions are made and for accountability from the insurers. It raises questions about whether the focus is on patient care or profit margins.

- Potential for reform: The current situation underscores the urgency for reforms in the prior authorization process to ensure that it serves patients’ needs rather than creating barriers to care.

By addressing these issues, the healthcare experience for Medicare Advantage beneficiaries could significantly improve.

UnitedHealthcare

The findings from the PSI regarding UnitedHealthcare’s use of automation and predictive technologies in the prior authorization process raise several important concerns.

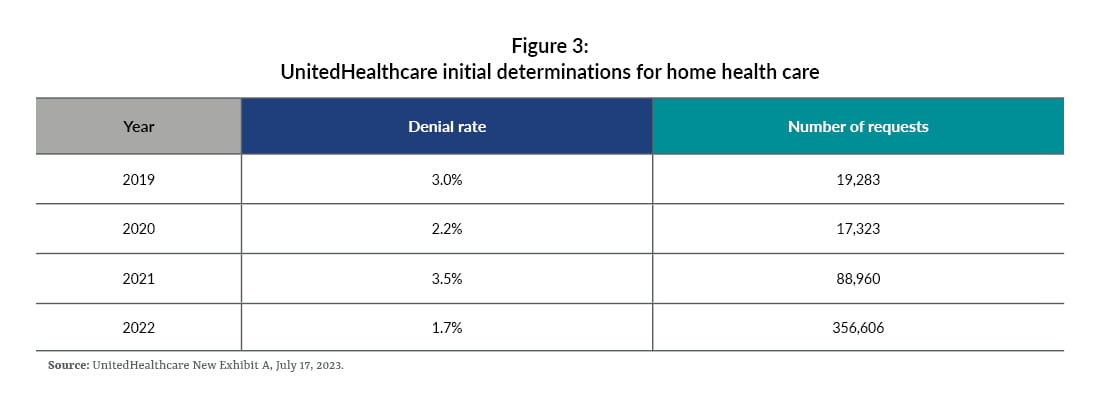

- Rising denial rates: UnitedHealthcare’s denial rate for post-acute care has significantly increased from 10.9% in 2020 to 22.7% in 2022. This trend suggests a growing reliance on automated systems that may prioritize efficiency over patient care.

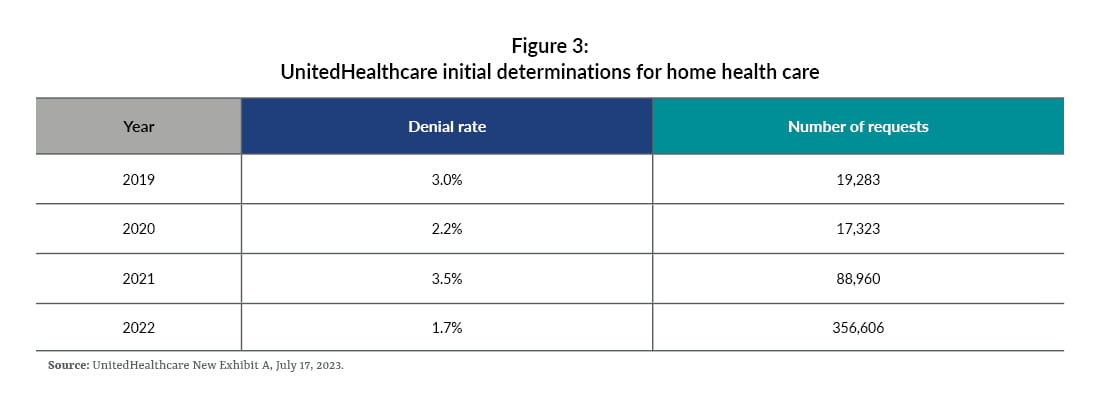

- Automation initiatives: The implementation of AI or “Machine Assisted Prior Authorization” are aimed to streamline the review process, reducing the time needed for approvals. However, this efficiency may come at the cost of thoroughness, as indicated by the increase in denial rates.

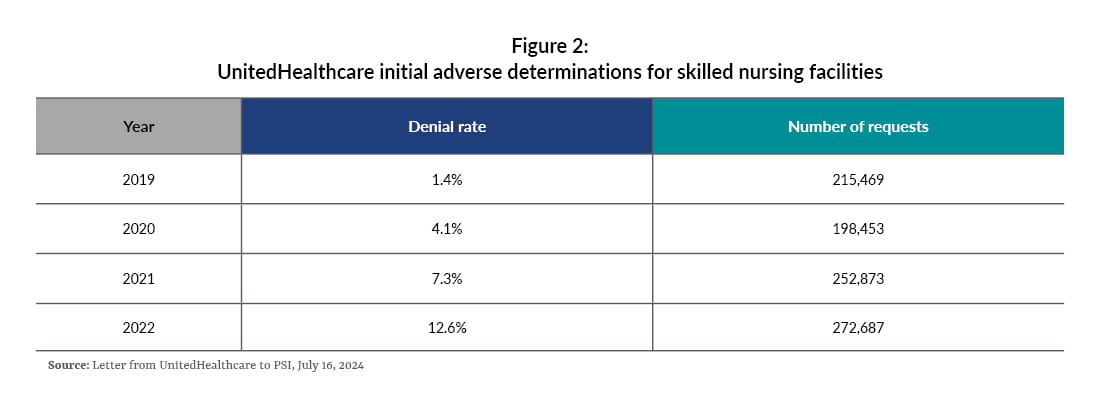

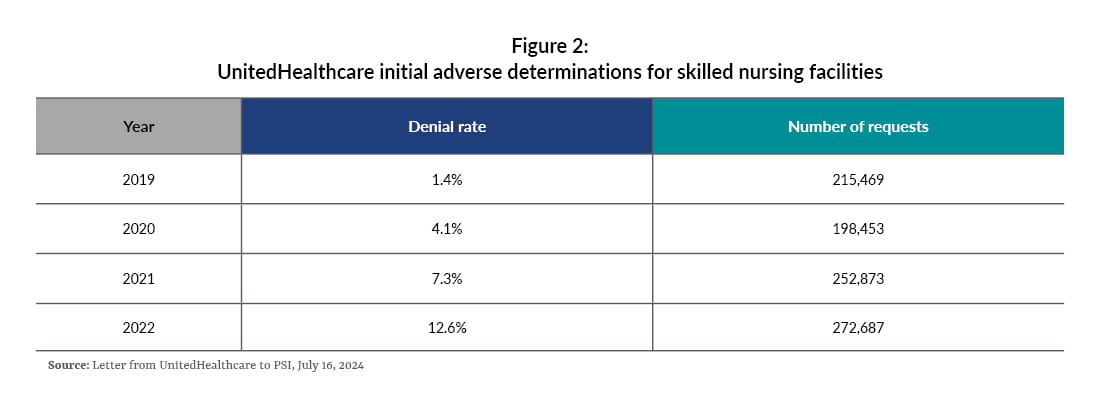

- Impact on skilled nursing facilities: The dramatic rise in denial rates for skilled nursing facilities — nine times higher in 2022 compared to 2019 — highlights a troubling shift. This suggests that insurers may be favoring less costly home health services over necessary post-acute care, potentially compromising patient recovery.

- Use of predictive algorithms: The introduction of algorithms like nH Predict to determine optimal care placements raises ethical questions. While these tools can enhance decision-making, they may also lead to denials based on data-driven models that don’t fully account for individual patient needs.

- Lack of guidance for providers: The directive to naviHealth employees not to guide providers during the authorization process can create confusion and hinder effective communication, further complicating access to necessary care.

These findings highlight the need for greater oversight and reform in the prior authorization process, ensuring that it prioritizes patient health rather than operational efficiency. Advocating for transparency and accountability in these practices could help protect seniors’ access to essential care.

CVS

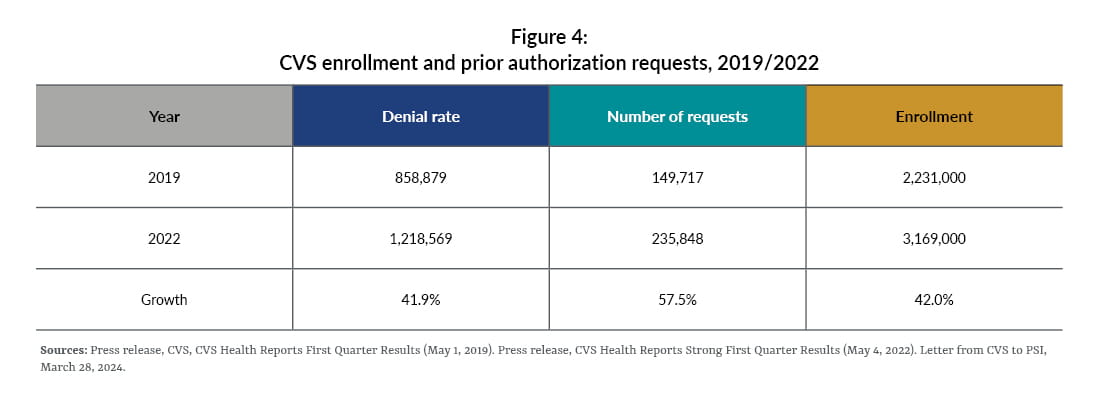

The PSI findings regarding CVS highlight stable denial rates amid an increase in service requests and streamlining of the authorization process.

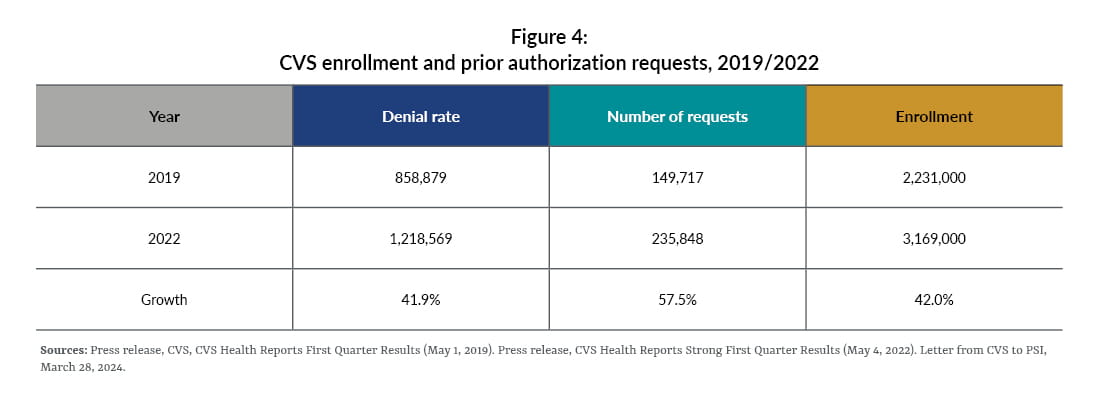

- Stable denial rate: The fact that the denial rate remained stable despite a significant increase in service requests (57.5%) suggests that CVS may be becoming more efficient in managing these requests or that the criteria for approval haven’t changed drastically.

- Enrollment growth: The enrollment growth of about 40% indicates that while more patients are being covered, the increase in prior authorization requests is outpacing this growth. This could imply a tightening of controls or a shift in how services are being utilized.

- Focus on high-risk cases: The program that suggests focusing on cases with a “significant probability to be denied” could be a strategic move to streamline the authorization process. By identifying and addressing these cases proactively, CVS might reduce unnecessary delays and improve patient care.

The insights from CVS’ approach to prior authorizations and cost management in its Medicare Advantage division are quite revealing.

- Significant savings: CVS reported saving over $660 million in 2018 by denying prior authorization requests for inpatient facilities, primarily from denied admissions. This highlights the financial impact of their prior authorization strategy.

- Predictive modeling challenges: The testing of a predictive model aimed at maximizing approvals revealed that it led to a high rate of “mistake” approvals for post-acute care — 10 times higher than for acute hospital admissions. This suggests that while the intention was to streamline approvals, it inadvertently jeopardized profitability.

- AI implementation: In April 2021, CVS launched its partnership with the Post-Acute Analytics tool, leveraging AI to manage costs associated with skilled nursing facilities. Initially projected to save $4 million annually, the expanded initiative is now expected to save over $77 million in three years. This indicates a successful pivot toward data-driven decision-making.

- Correlation between authorization and savings: CVS found a consistent link between increasing prior authorization requirements and enhanced savings. Its decision to deprioritize reducing the volume of prior authorizations reflects a strategic choice to maintain financial benefits over potentially improving patient access.

These developments illustrate the complex balance between cost management and patient care in healthcare systems.

Humana

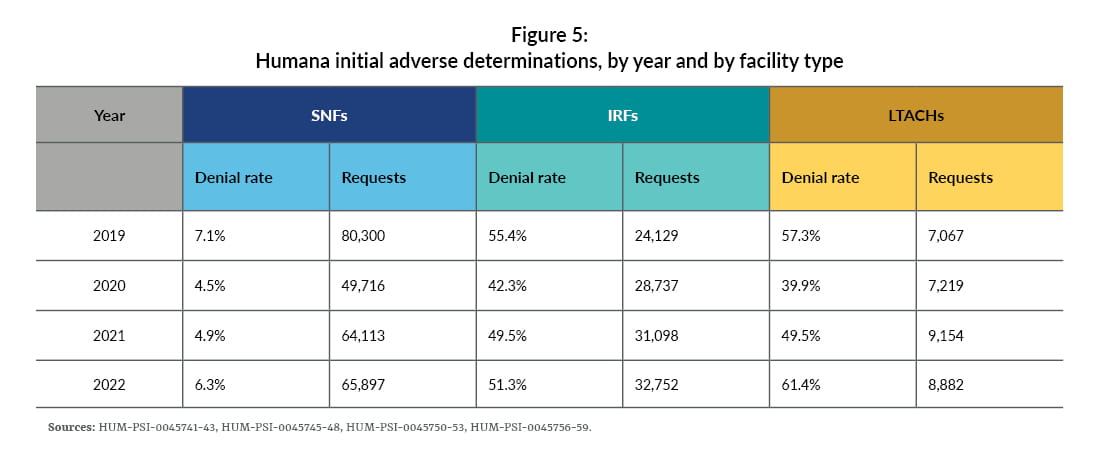

The information about Humana’s approach to prior authorization for long-term acute care hospitals also reveals several important trends and strategies.

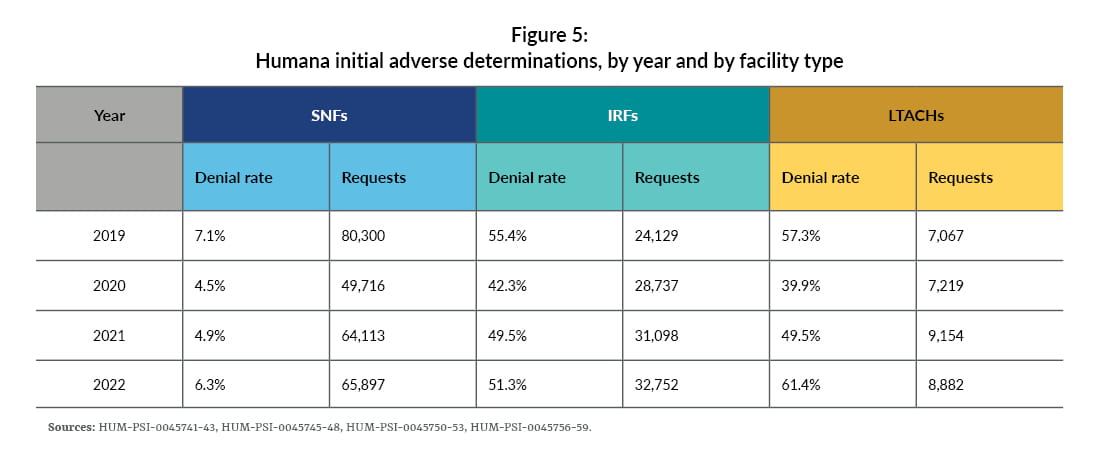

- Increased denial rate: Humana’s denial rate for long-term acute care hospitals rose by 54% from 2020 to 2022, following targeted training sessions for reviewers. This suggests that enhanced training may have led to stricter adherence to denial criteria.

- Template modifications: In 2019, Humana updated its communication templates for prior authorization decisions, emphasizing the importance of these changes for maintaining denials on appeal. This indicates a strategic focus on improving the clarity and justification of denial decisions.

- Impact of COVID-19: During the pandemic, Humana temporarily relaxed some prior authorization requirements, resulting in a lower denial rate for long-term acute care hospitals in 2021 compared to 2019. This reflects a responsive approach to the public health crisis while balancing cost management.

- Training and evaluation: The company conducted extensive training for reviewers on evaluating long-term acute care requests, emphasizing the high costs associated with these interventions. The use of “surprise questions” as a strategy for reviewers suggests a proactive approach to ensure thorough evaluations.

- Controversial alternatives: After feedback from medical reviewers, Humana removed references to hospice as an alternative to long-term acute care in response letters, although some training materials still mentioned it. This highlights the complexities and sensitivities involved in discussing care alternatives.

- Use of technology: While there is limited evidence on Humana’s use of automation or predictive technologies for denials, their partnership with naviHealth since 2017 suggests an interest in leveraging technology for decision-making. The distinction between “augmented intelligence” and “artificial intelligence” indicates a nuanced approach to integrating technology into their processes.

Overall, Humana’s strategies reflect a balancing act between cost control and ensuring appropriate patient care.

Overall key concerns

The report highlights the apparent conflict between financial gain versus medical necessity in prior authorization decisions. The data suggests that insurers may be prioritizing financial considerations over clinical judgment, particularly in high-cost areas of care. This shift could undermine patient care and access to necessary services. The findings from the subcommittee’s investigation into Medicare Advantage insurers raise significant concerns about the intersection of financial incentives and medical necessity, and makes recommendations in three key areas.

- Data collection by CMS: The recommendation for CMS to collect prior authorization data categorized by service type is crucial. This would provide clearer insights into whether insurers are disproportionately targeting specific types of care, allowing for better oversight.

- Targeted audits: Conducting audits based on notable increases in denial rates would enable CMS to focus its resources more effectively. By identifying insurers with significant spikes in adverse determinations, CMS can address potential abuses in the prior authorization process.

- Regulation of predictive technologies: Expanding regulations for utilization management committees is essential to ensure that predictive technologies don’t unduly influence human reviewers. This is vital to maintain the integrity of clinical decision-making and prevent algorithmic bias from overshadowing professional judgment.

These recommendations aim to enhance transparency and accountability in the prior authorization process, ensuring that patient care remains the priority. The balance between cost management and quality care is delicate, and these steps could help safeguard against potential pitfalls.

Impact on senior care providers

The report highlights the challenges Medicare Advantage plans have created for beneficiaries as well as senior care providers. Specifically, the denial of authorization or reauthorization for services for beneficiaries has contributed to occupancy challenges and much shorter lengths of stay.

An analysis of payments to providers as compared to the Medicare program wasn’t contained in this report; however, we typically see Medicare Advantage plans paying post-acute providers significantly later than traditional Medicare payments, resulting in negative margins for providers. We’re hopeful that the focus on Medicare Advantage plans will result in positive changes for beneficiaries and post-acute care providers.

To discuss how Medicare Advantage plans impact your organization’s financial stability, contact us.