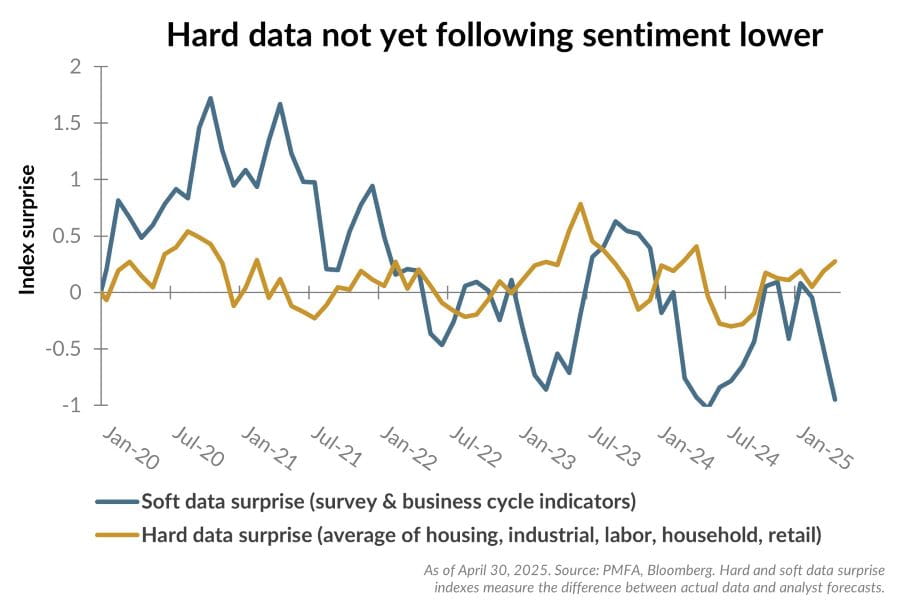

Since the start of the year, we have seen a divergence emerge between various closely watched indicators that are tracked for signals on the directional path for the economy. The “soft” (or survey) data gauges how individuals and businesses feel qualitatively about current economic conditions. In contrast, “hard” data consists of quantitative measures such as jobless claims, nonfarm payrolls, inflation indexes, or retail sales — all of which tell the story of what’s actually happening in the economy.

As shown in the chart above, surveys have recently been much worse than analysts expected, reflecting their susceptibility to economic uncertainty, market volatility, or negative headlines. Meanwhile, hard data has held in better than expected, surprising to the upside, as jobs data has remained solid and consumers have continued to spend.

This isn’t the first time we’ve seen contradiction between soft and hard data, having occurred most recently in 2023 and again in 2024. Despite elevated inflation and interest rates at the time, which raised recession fears and dampened the consumer mood, hard data remained resilient. How this divergence will resolve itself this time is still in question. Sentiment could ultimately rebound if economic growth stays resilient and greater clarity around trade policy is achieved in the near term. Conversely, should negative sentiment persist, it’s likely to weigh more heavily on consumer spending, hiring, and business investment, causing economic momentum to stall.

For now, uncertainty remains elevated, contributing to a wide range of potential outcomes. Against that backdrop, investors should remain broadly diversified, ensure sufficient cash for near-term spending, and adhere to an investment plan that aligns with your investment goals and tolerance for risk.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.