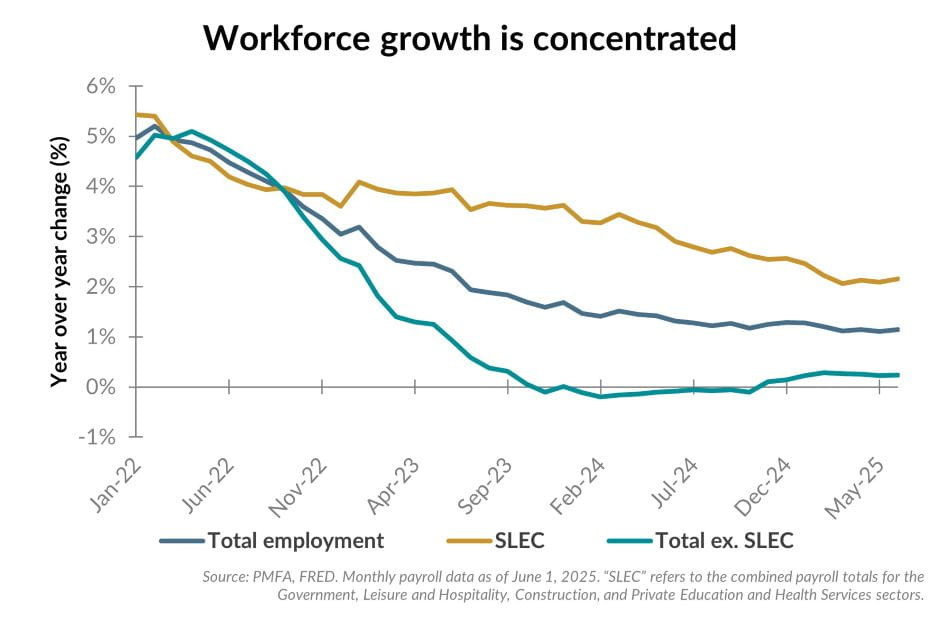

The U.S. labor market continues to see steady, though slower, growth, even as sentiment around job availability has softened, as noted in our accompanying piece. However, hiring activity has become increasingly concentrated in a handful of sectors.

As shown in the chart, hiring in a handful of sectors including state and local government, leisure and hospitality, construction, private education, and health services account for a disproportionate share of recent job gains. These sectors are benefiting from structural tailwinds — demographic shifts, infrastructure investment, and post-pandemic normalization of demand for services. They also highlight the comparative narrowness of recent job creation.

This concentration raises important questions about the breadth of labor market strength. Sectors such as manufacturing, construction, technology, and finance have seen more muted hiring or net job losses of late. Against that backdrop, it’s not surprising that the perception among those seeking work in those fields is that jobs have become harder to find. In certain industries, that’s certainly the case.

For investors and policymakers alike, the key takeaway is that while the labor market remains fairly tight, it’s being heavily supported by a few notable pockets of strength. Understanding where job creation is occurring — and where it’s not — provides additional context for the current state of the economy, labor market dynamics, and the practical implications for workers and potential workers seeking their next opportunity.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.