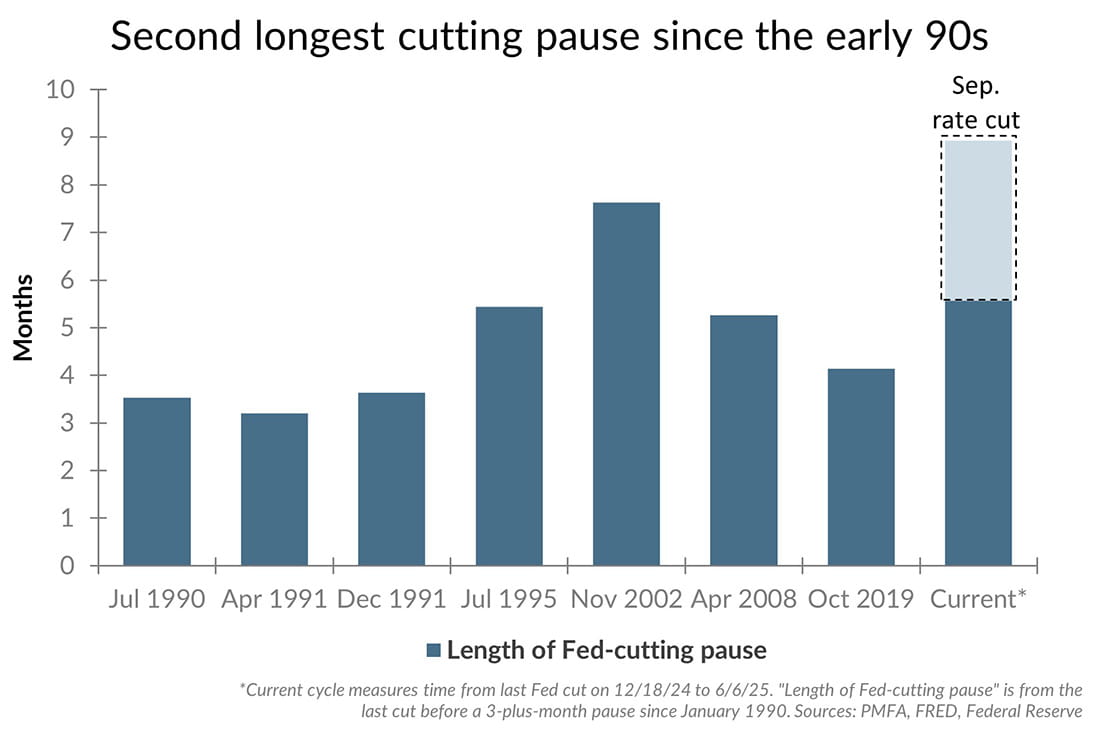

Starting in September last year, the Federal Reserve trimmed its policy rate by 100 basis points (1%) over three successive meetings. Following the December announcement however, the Fed paused its cutting cycle, holding its policy rate steady in the 4.25–4.5% range. Post-FOMC meeting comments and the Fed’s updated market projections suggest that the next cut is unlikely until at least their September policy meeting. If that turns out to be the case, a nine-month pause between consecutive Fed cuts would be the longest pause in recent history, as shown in the chart above.

Rising inflation and falling employment require different policy responses, and so far, this year, the data has been less than conclusive regarding which risk the Fed should be more focused on today. Unemployment has risen incrementally since the end of last year alongside other signs that labor conditions have weakened. Trade policy uncertainty has negatively impacted sentiment, but economic growth remains decent; and while inflation remains above the Fed’s 2% target, it has continued to tick downward.

Additional softening of the labor market could lead the Fed to begin cutting rates again, but policymakers remain cognizant of the near-term inflation risk posed by tariffs. Until one side of the scale tips into more conclusive territory, the Fed will likely remain on hold, with rates remaining higher for longer. Bottom line: A return to the ultra-low-rate environment of the post-financial crisis/pre-COVID-19 era anytime soon is unlikely