The emergence of fintech, or financial technology, and its transformative effect on the financial sector is no secret. Fintech refers to a nonbank company employing technology to deliver innovative financial products, services, and solutions. Over the past decade, exponential advancements in technology, rapid digitization, and evolving customer preferences, supported by strong growth in the banking sector, have propelled fintech to the forefront. Institutions are afraid to miss out on the exciting opportunities and potential benefits of fintech, but it’s important to be informed and strategic in making the decision to get involved with fintech. There are various fintech relationships to consider, each comes with their own unique benefits, challenges, and, of course, accounting implications.

Indirect investment: Limited partnership interest in fintech funds

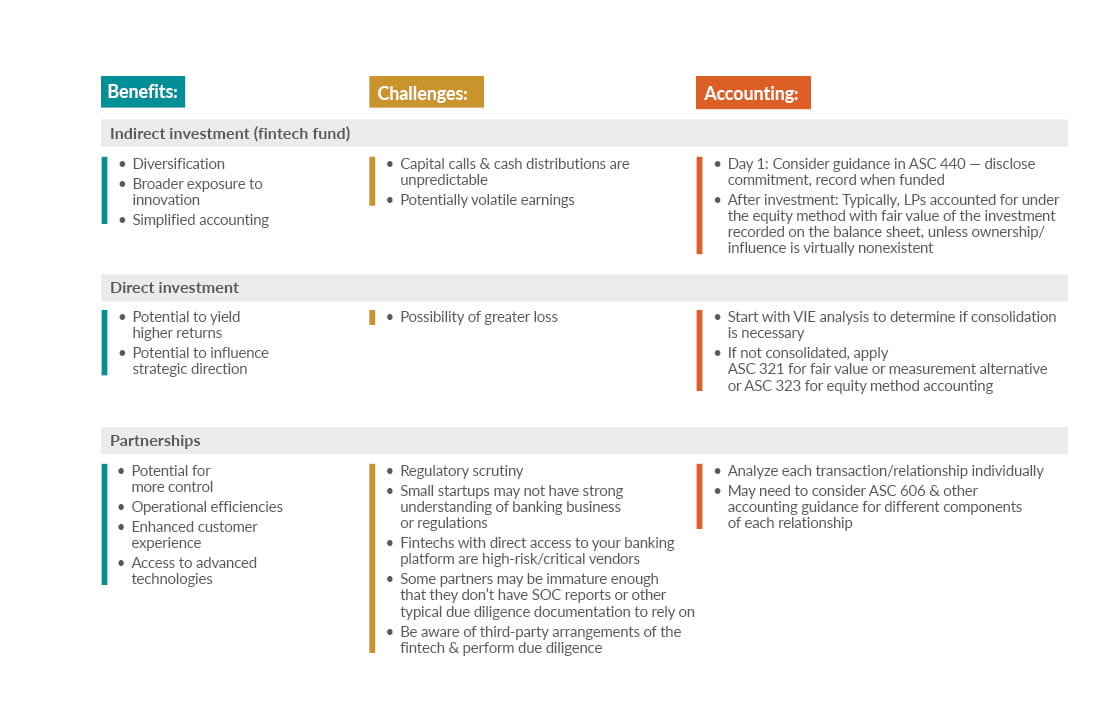

A fintech fund is a financial product that pools money from investors to invest in fintech companies. As with any fund investment, the core benefits to a fintech fund are diversification and broader exposure — in this case, broader exposure to innovation. A fintech fund provides the opportunity to monetarily capitalize on the growth of the fintech industry while limiting downside risk, but there’s more to consider than just investment risk. Be aware of the unpredictability of capital calls and distributions and the relative illiquidity of the investment during the life of the fund.

When an initial commitment is made to invest in a fund, no accounting entry is recorded. As capital is called, the limited partnership (LP) interest is generally carried at fair value with changes in value included in current period net income. Generally, the fund advisor will provide periodic reports, including current fair value estimates. This makes the ongoing accounting relatively simple from a mechanical standpoint; however, you should be prepared for some earnings volatility as it’s common for these funds to experience relatively large fluctuations in value from period to period.

Direct investment: Equity ownership of fintech company

Another option for fintech investment is to invest directly in a fintech company. This allows an investor to specifically identify the companies to invest in and has the potential for higher returns by giving more control over the investment. The obvious implication to this is that direct investments also carry a higher risk due to the potential for individual company failure compared to the diversification of a fund. Another potential benefit to direct investment is that the size of the investment may provide influence over the strategic direction of the fintech, which can help ensure alignment of objectives between your organization and the fintech and promote customizations that will allow you to integrate the technology into your existing operations framework down the road.

Just as the relative size of your investment and influence over the company impacts the strategy of your investment, it also impacts how you account for your investment. Significant levels of influence and control could result in consolidation of the entity. Lower levels of influence and control could result in accounting for the investment as an equity method investment at initial cost adjusted for earnings or losses of the fintech, accounting as an equity investment at fair value or the measurement alternative.

Fintech partnerships

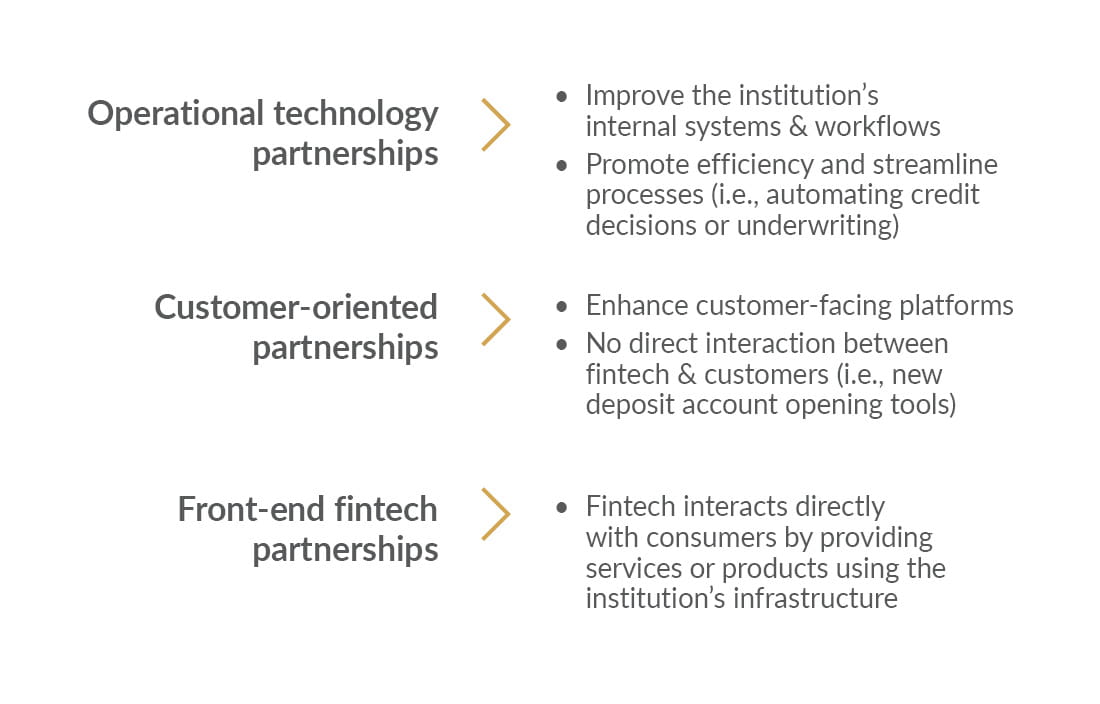

Fintech partnerships are more complex than investments. Partnership refers to the collaboration between an institution and a fintech to improve banking products and services. There are numerous types of fintech partnerships with different objectives, but in general, the benefits of fintech partnerships include some combination of operational efficiencies, enhanced customer experience, and access to advanced technologies that an institution may not be able to develop in-house.

Common types of fintech partnerships

Similar to any partnership, there is the risk of operational or strategic misalignment between the institution and fintech. This risk is enhanced with the complexity of integrating fintech solutions with existing banking systems, which can be difficult and time-consuming. These integrations need to be carefully planned and executed to avoid disruptions to service. Less obvious, but equally important, is regulatory risk. Fintech partnerships have been the focus of heightened regulatory scrutiny, and it’s important to understand your responsibilities.

Often, fintech companies are small startups that may not have a strong understanding of banking operations or regulations. Fintechs with direct access to your banking platform are a high-risk or critical vendor, and you’re expected to perform the appropriate due diligence for a vendor of this risk profile. Data security is one of the biggest risks associated with fintech partnerships. Institutions must ensure that their fintech partners have robust security measures in place to protect sensitive customer information from cyberthreats. Performing due diligence may be more difficult for some of the less mature companies that haven’t had the time or resources to complete the activities and reporting that you would typically rely on in your third-party risk management program.

You’re also required to understand the ecosystem of the fintech, including all third-party arrangements they have with other vendors, and perform the necessary due diligence on these vendors. For example, you may like everything about the specific fintech’s culture and alignment and how they are going to bring you products and services, but in assessing the larger ecosystem, you may find that they’re relying on a third party that you aren’t familiar with and that doesn’t have sufficient due diligence documentation to support an assessment. Alternatively, you may find that the fintech is relying on a third party that’s a startup, which may cause contingency plan concerns if that third party experiences issues or goes out of business. This is why it’s important that your diligence continues all the way through the expanded chain of dependencies and not end with the identified partner. This is being referred to by regulatory agencies as “Nth Party Risk.”

The accounting for a fintech partnership is also more complex, as each relationship is unique, and the appropriate accounting requires analysis of each transaction or relationship individually. It’s common that these relationships will require consideration of revenue recognition guidance in combination with other relevant guidance for the various components of the arrangement.

Do your homework first

Fintech offers great opportunity to financial institutions, but with any relationship, it’s important to be calculated and intentional. Understand and weigh the benefits, challenges, and accounting implications of your fintech relationships.