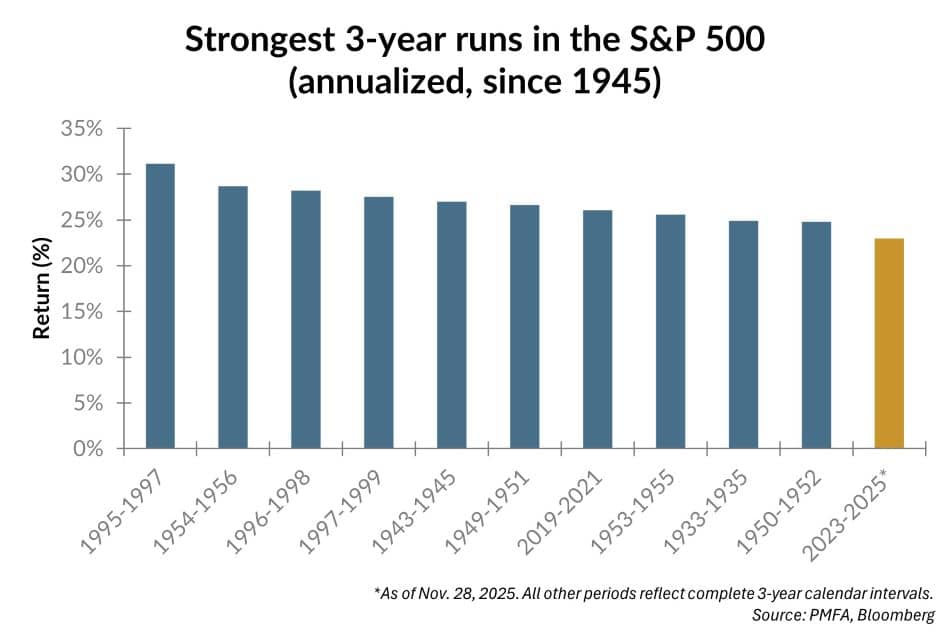

With just a few weeks to go before 2026, the S&P 500 is poised to end the year once again with an impressive double-digit gain. This follows 2024 (+25%) and 2023 (+26%) for an annualized 3-year return of 23%, assuming no material market move before the end of the year. If that holds, the period will rank just outside the 10 strongest three-calendar-year runs for the index since 1945. When compared to five‑year periods though, the return since January 2021 is still solid but much less remarkable, ranking only moderately better than the average five-year run in the post-World War II era.

Context is important because equity markets have experienced solid multiyear rallies before, and bull markets tend to be of a much longer duration than bear markets. Periods of strong performance can persist at times for longer than one might expect — even when valuations appear elevated as they do today.

This cycle’s strength has been narrowly led by high‑growth names in the mega-cap technology sector in which a game-changing technology (AI) is in the early phases of adoption, with far-reaching expectations for its impact. (It’s a pattern that’s been replayed many times over stock market history.) Periodic bouts of volatility over time have reflected a recalibration of expectations, but stocks have largely continued to deliver on earnings growth expectations sufficiently to support the market’s solid run.

Equity valuations are undeniably stretched, yet they could expand further. While the economic theme associated with this emerging technology is in the early stages, the market often runs ahead of fundamentals as investors price in future earnings potential. That broader context — beyond the chart alone — is essential to consider.

Valuations matter, as do macro themes that drive investment opportunities over time. Both should be factored into investor decisions around risk-taking and portfolio construction, balancing risk and return within a diversified allocation framework.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.