The implementation date for the new Financial Accounting Standards Board (FASB) lease standard may seem far off, but it will be here before you know it. To complicate matters, implementation of the new revenue recognition standard lurks around the corner, too.

While full implementation of the lease standard isn't required until 2019 for public business entities and 2020 for nonpublic business entities, entities should be taking some important steps right now to prepare for the adoption of the new standard and its successful implementation.

Inventory lease contracts.

The first step in successful implementation is to inventory all of your lease contracts. The number — and complexity — of an entity’s lease contracts will be the most significant factor in determining the amount of effort and the size of the team needed to implement the new leasing standard.For entities with few lease contracts, and where there’s a centralized process for negotiating leases, this exercise may be relatively straightforward. However, obtaining a complete inventory of all lease contracts may be more difficult when leasing is a significant asset financing strategy, or when operations are decentralized and lease contracts reside in multiple locations, such as for entities with significant international operations.

While real estate and major equipment leases tend to be the most significant leases, companies must also consider other lease arrangements. These might include contracts for office equipment, automobiles, or contracts with embedded leases, among others. While these leases may not be significant individually, they may be significant collectively if entities have a large number of them.

Assess technology needs.

The new lease standard will require all leases to be recorded on the balance sheet, and entities will need to assess how they want to track and account for their leases. Three potential options to consider include:Spreadsheets

Spreadsheets may be an attractive option for entities that have relatively few leases and terms that aren't overly complex. The primary advantages of spreadsheets are ease of use and cost-effectiveness.

The downsides to spreadsheets are that they're likely the most time-consuming method. They may be difficult to use with leases that have complex terms. And, there's a risk of error due to the manual input of information and formulas.

Standalone lease accounting software

Specialized lease accounting software can handle more complex lease terms and can be set-up to address differences between the income statement and subsequent measurement of operating leases and finance leases. Lease accounting software can also be used as a leased asset management system, and it alleviates the risk of manual error.

However, using a separate software package can add cost and require additional configuration to interact directly with your company’s enterprise resource planning (ERP) system or general ledger.

Lease accounting module for your ERP system

This solution has the advantage of being integrated directly with your ERP system, which will likely provide the most efficient approach to accounting for and managing a lease portfolio.

However, integrated leasing modules may not be as flexible as standalone lease accounting software and may be more complex to use. Entities will need to check with their ERP provider to determine what capabilities the module has and whether it's been updated to accommodate the new lease guidance.

Clearly, each solution has advantages and disadvantages. The decision you make should depend on your company's particular needs and resources.

Understand accounting implications.

The new standard raises several considerations for entities:Assessing policy elections

The new lease standard has several accounting policy elections that entities will be required to make when they adopt. The elections may affect the amount of time it takes to implement the new standard, so they should be considered during the gap- and impact-analysis stage. Some of the more significant policy elections that entities will need to make related to the new lease standard include:

Separating lease and non-lease components

The new lease standard requires entities to analyze lease contracts to separate lease components from non-lease components based on their relative standalone values.

Currently, some common types of non-lease components include common area maintenance charges in real estate leases or maintenance services in equipment leases. While the existing lease rules require the separation of lease and non-lease components, this is not often an area of focus since the treatment of lease and non-lease components is consistent.

Under the new standard, only lease components are included in the calculation of the right-to-use asset and lease liability. The new standard includes an accounting policy election so an entity can opt not to separate lease and non-lease components. This results in the full amount of the payment being treated as part of the lease component.

While this policy election offers the benefit of saving time by not having to separate the lease and non-lease components of an arrangement, it will result in larger right-to-use asset and lease liability amounts being recorded on the balance sheet.

Short-term leases

The most significant change resulting from the new lease standard is that operating leases will now need to be recorded on the balance sheet. However, the FASB does allow one exception to this general rule: Entities can make a policy election not to apply the recognition and measurement guidance to short-term leases. Short-term leases are defined as leases where the term is less than 12 months, including any periods covered by renewal options that the lessee is reasonably certain to exercise.

If an entity makes this election, it would not be required to calculate and record a right-to-use asset or lease liability for leases that qualify as short-term.

Sale-leaseback arrangements

The new standard makes changes to the accounting for sale-leaseback arrangements that generally simplify the accounting for these transactions. Under the new lease standard, entities need to follow the guidance in the new revenue recognition standard to determine if a sale has occurred. If the transaction meets the requirements for a sale, the leaseback will be accounted for under the new lease standard; if it does not meet the requirements for a sale, the transaction is treated as a financing.

There are likely to be differences in how these transactions are accounted for under the new rules compared with the current rules. In particular, it's likely that more sale-leaseback transactions involving real estate will qualify as a sale under the new standard, which many believe will allow the accounting to better reflect the underlying economics.

Another important factor to consider is that under the new standard, operating leases will be recorded on the balance sheet, so sale-leaseback transactions won't be a means of achieving off-balance-sheet financing.

Related-party leases

The new standard significantly changes the accounting for related-party leases by requiring these leases to be accounted for based on the legally enforceable rights in the contract. This differs from current GAAP, which often requires entities to account for leases based on the economic substance of the transaction. As many related-party leasing arrangements are informal, the new standard may significantly change the way these leases have been treated.

Leasehold improvements

There may be instances when the treatment of leasehold improvements might change under the new standard, most notably in situations where an entity has short-term real estate leases, often with related parties, with significant leasehold improvements. Given the significance of the leasehold improvements, the entity may have presumed the lease would be renewed (even if there are no renewal options in the lease) and depreciated the leasehold improvements over the extended lease term, including the renewal periods.

The new lease standard is explicit that leasehold improvements must be depreciated over the shorter of the useful life of the assets or the lease term, with the lease term limited to only those renewal periods in the lease contract that are reasonably certain to be exercised. This will result in entities recognizing the full amount of amortization expense for leasehold improvements over the lease term, which may be shorter than the useful life of the assets.

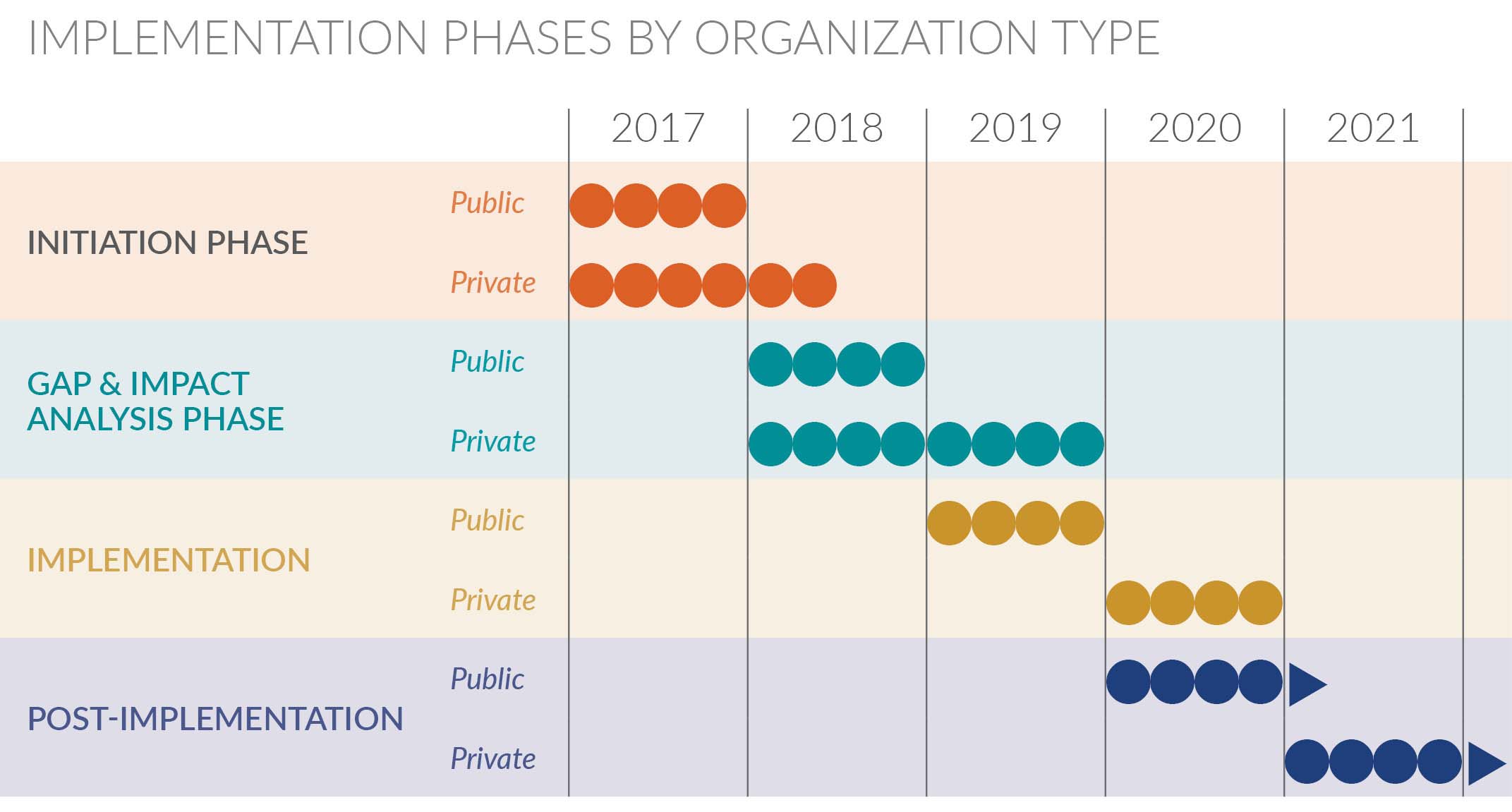

Timeline and implementation steps

The new lease standard is scheduled to become effective for public company financial statements in 2019 and all other entities in 2020. It’s easy to dismiss this deadline as “years away,” but the work needed to prepare for this change is significant. It's important to get started early.

The implementation can be broken down into four phases:

Initiation phase

2017 for public companies 2017 - early 2018 for private organizations- Assign staff to become your experts. They'll take the lead on understanding and implementing the new lease standard.

Note: Be mindful that the standard may impact operational personnel involved in negotiating leases as well as the accounting/finance department. - Read the standard or a summary of the standard.

- Determine area of judgments in the standard and practical expedients/policy elections to be applied to your leases.

- Inventory leases and terms. Develop an internal plan, if needed.

- Understand current processes and system capabilities related to initiation, storing, and accounting for leases.

- Determine project management tools

- Evaluate any new long-term leases.

Gap & impact analysis phase

2018 for public companies

2018 - 2019 for private organizations

- Determine what interim disclosures will need to be made before the standard is effective.

- Apply the new standard to significant leases to determine the potential balance sheet impact.

- Evaluate necessary changes to business processes, IT systems, and internal controls.

- Educate key stakeholders (audit committee, board of directors, investors, lenders, and others) on the impact of the changes to your organization.

Implementation

January 1, 2019 for public companiesJanuary 1, 2020 for private organizations

- Apply the transition methodology to all leases in place.

- Apply the new standard to leases entered into after the implementation date.

- Execute changes to business processes, IT systems, and internal controls.

- Execute changes required in other areas of your organization.

Post-implementation

- Establish processes to evaluate instituted business processes, IT systems, internals controls, and other changes.

Planning opportunities

Since the standard applies to all leases in effect at the time of adoption, entities should consider the impact of the new standard when entering into negotiations for long-term leases now.

While leasing decisions should not be driven by accounting considerations, it is important for management and key stakeholders to be aware of how financial statements will be affected by the new lease guidance. Also, since operating leases will be required to be recorded on the balance sheet, entities should take this into account when they evaluate lease-buy decisions for new assets.

Entities should also begin to assess how the lease standard will impact key ratios and whether it may have an impact on any debt covenants. While the adoption of the new lease standard will not change the underlying economics of the lease arrangements, it can have a significant impact on key ratios, especially those related to leverage and equity. Entities should consider proactively engaging with their lenders to determine if covenants need to be modified when the new standard becomes effective.

The new lease standard is going to have broad accounting implications, including a significant impact on companies' balance sheets, key ratios, and on lease-buy decision-making. It's critical to understand those implications and take advantage of the opportunities early planning offers.

As always, if you have any questions, feel free to give us a call.