The COVID-19 pandemic has dismantled financial markets across the globe. We’re still not clear on the magnitude of the economic fallout, but when it comes to estate and gift planning, there’s a silver lining. The tax implications of transferring assets are greatly reduced while values are depressed and interest rates are low. If you want to take advantage of the opportunities, you’ll have to act fast — rebounding markets can close your window of opportunity. Here’s what to do now.

Fair market value and the importance of valuation

For best results, partner with an expert who can help you value your assets before a transfer. A well-supported valuation analysis performed by a qualified, objective valuation expert is critical to an effective gift or estate tax filing. The “fair market value” of your assets is what determines how much you owe in taxes after a transfer of wealth. That’s why it’s so important to involve a valuation expert right away.

The concept of fair market value is complex, nuanced, and relies on multiple factors, including various discounts and premiums. It also depends on the values of the underlying assets being gifted, whether those assets are marketable securities, real estate, business interests, or any number of other assets. Right now, the values of business enterprises and other assets are depressed, meaning that you can transfer wealth at a much lower tax cost than what was possible just a few months ago, although we don’t know how long that will last.

Benefits of gifting equity interests

For asset-holding companies, the impact of depressed asset values on gift and estate tax liabilities is relatively straightforward — we can simply look at current stock prices and real estate assets. The same logic holds true for the transfer of a business interest. The benefits from gifting stock interests in a closely held business can be even more compelling in uncertain economic times.

While business valuation purports to be a forward-looking activity, it also focuses on the recent historical financial performance, the current financial markets, the access and cost of capital, and the short- and midterm financial outlooks. Businesses impacted in the short term by the economic downturn (in the form of decreased revenues, reduced margins, capital constraints, etc.) are likely to be valued lower, even if the long-term outlook is favorable. It’s also important to remember, no matter the current business cycle, a qualified valuation will also consider the applicable discounts for lack of control and lack of liquidity and marketability, which can further amplify the tax savings.

In the context of fair market value, a hypothetical buyer wouldn’t be willing to pay as much for a business operating under volatile market conditions as they would be for a business operating during stable or boom times. Today’s market conditions have created a unique opportunity to transfer business interests at meaningfully reduced values.

Estate tax reduction opportunities

Many estate tax reduction techniques are more attractive when asset values are depressed, as this provides more potential for future appreciation, which may be shifted outside of the taxable estate. In addition, the interest rates tied to several wealth transfer strategies are at historical lows. For those whose estates may be subject to estate tax on passing, this is an ideal time to consider techniques like intrafamily loans, grantor retained annuity trusts (GRATs), sales to intentionally defective irrevocable trusts (IDITs), or charitable lead annuity trusts (CLATs).

Take advantage of federal exemptions and depressed values before they go away

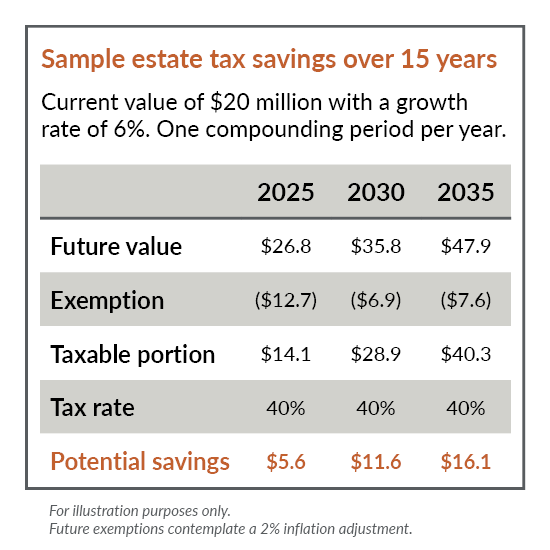

The Tax Cuts and Jobs Act of 2017 raised the federal exemptions for estate, gift, and generation-skipping transfer tax exemptions to an all-time high. With 2020 exemptions of $11.58 million for individuals or $23.16 million for married couples (reduced by prior lifetime gifts), now is a good time to execute any estate and family business transitions you’ve been considering.Waiting to act could put your planning at risk, as these current exemptions are reduced to 2011 levels of $5 million (indexed for inflation) after Dec. 31, 2025. Of course, there is a more immediate risk of reduction as part of any fiscal policy changes as a result of this year’s presidential election. As illustrated in the chart below, by taking steps today, you can lock in the benefits and plan ahead with more certainty.

Business owners or individuals with significant assets are likely more focused on hanging on and managing their exposure as best they can, as opposed to planning for the future. It’s understandable to prioritize the short term right now, but if you believe that our economy will rebound and grow over the long term, then you’ll need to consider the future, too. One of the few tactical opportunities in this economy is transferring wealth with substantial reductions in your tax liability. We hope you’ll give your valuation partner a call as soon as possible.