Delays for major new accounting standards

In November, the FASB approved the delay of several major accounting standards: CECL (Topic 326), Leases (Topic 842), and Derivatives and Hedging (Topic 815). This change is the first indication of the Board’s shift in mindset to an environment where large public companies adopt new standards multiple years before smaller institutions. An additional delay for Leases was approved in May 2020.

A summary of revised effective dates for December 31 fiscal year-end companies is below.

- CECL (Topic 326)

2020 — SEC filers, excluding smaller reporting companies as defined by the SEC

2023 — All other entities

- Leases (Topic 842)

2019 — Public business entities, employee benefit plans, not-for-profit conduit bond obligors

2022 — All other entities

- Derivatives and Hedging (Topic 815)

2019 — Public business entities

2021 — All other entities

Libor phaseout

With the anticipated discontinuation of Libor in 2021, institutions with significant borrowing, lending, or hedging transactions indexed to Libor are beginning to analyze contracts to identify where amendments are needed and searching for a replacement index rate.

A group convened by the Federal Reserve Board and Federal Reserve Bank of New York has identified the Secured Overnight Financing Rate (SOFR), a measure of the cost of overnight borrowing collateralized by U.S. Treasury securities, as a possible alternative rate for Libor.

Additionally, to offer relief for accounting for contract amendments executed to update the reference rate, the FASB has issued 2018-16. Under this update, modifications of loan, lease, or debt contracts to reference a new index rate are treated as a continuation of the initial contract and don’t need to be analyzed to determine if they qualify as a new agreement. The standard expands circumstances under which hedge accounting will be preserved when agreements are modified, and is effective for contract modifications completed through Dec. 31, 2022.

Credit unions

2019 supervisory priorities

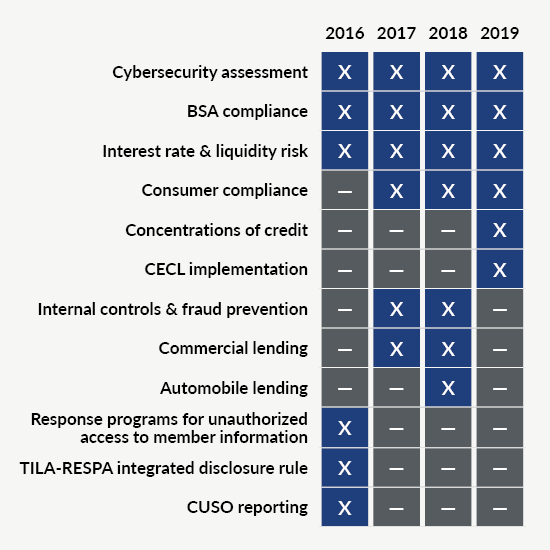

As we await the release of the NCUA’s 2020 supervisory priorities, we reviewed trends in the regulator’s focus noting cybersecurity, BSA compliance, interest rate and liquidity risk, and consumer compliance have appeared on the list of priorities consistently over the last three to four years.

Cybersecurity and IT appear to continue to be points of emphasis, including the introduction of new information security examination procedures, which will be piloted through 2020 preceding full implementation scheduled for 2021. The NCUA intends to provide additional resources to credit unions in this area through the publication of monthly cybersecurity articles, enhancements to its cybersecurity website, and cybersecurity forums.

Banks

CBLR

Regulators approved simpler capital requirements for community banks, effective Jan. 1, 2020. Under the new rule, often referred to as the Community Bank Leverage Ratio (CBLR), banks that meet certain criteria can reduce capital reporting to only the Tier 1 ratio, eliminating several ratios currently required under Basel III.

Criteria to qualify for CBLR

- Leverage ratio 9% or higher

- Total consolidated assets: Less than $10 billion

- Trading assets and liabilities as a percent of consolidated assets: Less than 5%

- Off-balance sheet exposure as a percent of consolidated assets: Less than 25%

Banks that have adopted the rule but subsequently fall below the 9% minimum have a two-quarter grace period during which they could remedy compliance with the qualifying criteria. There is no grace period if the leverage ratio falls below 8% or if an institution no longer meets the qualifying criteria due to a merger or acquisition.

Although the majority of banks under $10 billion in assets qualify for the CBLR, many community banks are hesitant to adopt due to future expansion or acquisition plans and hesitancy to see how state regulatory bodies respond to the federal rule.

FDIC credits

The Dodd-Frank Act raised the FDIC’s minimum Deposit Insurance Fund (DIF) reserve ratio to 1.35% of insured deposits. As of June 30, 2019, this ratio has been achieved, and the FDIC announced they’ll be awarding credits, beginning on the second-quarter assessments. The credits will be automatically applied to each quarter’s assessment as long as the DIF ratio stays above the threshold.

Brokered CDs and reciprocal deposits

The FDIC took action to reduce restrictions imposed on brokered deposits held by certain institutions. In a final rule adopted in early 2019, certain reciprocal deposits (such as deposits sourced through the CDAR’s network) are exempt from being considered brokered deposits for certain insurance institutions. Under this exemption, well-capitalized and well-rated institutions aren’t required to treat reciprocal deposits as brokered deposits, with a cap on the amount of deposits subject to the exemption.

Public companies

Changes to the auditor’s report

A new section related to critical audit matters (CAMs) is being phased in to the auditor’s report for public companies to provide investors with additional information on significant matters in the audit and how they were addressed. This addition to the auditor’s report will require auditors to identify and provide additional disclosures around matters that are critical to the audit.

The criteria used to identify CAMs and additional disclosure requirements for each CAM identified are summarized below.

CAM identification

- The matter is communicated or required to be communicated to the audit committee.

- The matter relates to material accounts or disclosures that are material to the financial statements.

- The matter involves especially challenging, subjective, or complex auditor judgment.

CAM Disclosures

- Identification of the CAM

- Description of the main considerations that led the auditor to identify the matter as a CAM

- Description of how the audit addressed the CAM

- A reference to the relevant financial statement accounts or disclosures related to the CAM

This addition to the auditor’s report isn’t expected to significantly change communications with the audit committee, as all CAMs are already required to be communicated.

Auditors were required to include disclosures related to CAMs beginning with June 30, 2019, audits for large accelerated filers. This requirement will be phased in for all other public companies for year-ends on or after Dec. 15, 2020.

SEC’s review of accelerated filer definition

In May 2019, the SEC issued a proposal to exclude all smaller reporting companies (SRCs) with less than $100 million of revenue from the definition of an accelerated filer. This follows a change in 2018 that increased the SRC threshold to $250 million of public float (or public float under $700 million and revenue under $100 million) without changing the accelerated filer definition, resulting in many companies that are both SRCs and accelerated filers.

If the May proposal passes, SRCs wouldn’t be required to obtain an auditor’s attestation on the effectiveness of internal control over financial reporting (ICFR) and would follow later filing dates. This wouldn’t, however, modify the FDICIA requirement for banks over $1 billion in assets to obtain an independent auditor’s opinion on the effectiveness of ICFR.

The proposed change is highly anticipated in the industry as there are more financial institutions than any other type of company that would no longer be considered accelerated filers.